Note: I wanted to call this post, Frid-AI Fun, but visually, “Frid-AI” (sound it out) doesn’t really work as well as I thought it would. So we’ll just skip the “clever” headline and get right to it.

Note: I wanted to call this post, Frid-AI Fun, but visually, “Frid-AI” (sound it out) doesn’t really work as well as I thought it would. So we’ll just skip the “clever” headline and get right to it.

As a semi-active analyst, full-time fintech advisor, and dormant engineer, I could not be happier with the rise of the term artificial intelligence or AI as it is mostly written these days. And the term is not as new as you might think. Spielberg released a movie with the name 16 years ago (see inset). And the term is at least 62 years old, having been studied at Dartmouth in 1955/1956. But it went mainstream this century, especially the past few years (see search activity below).

It is a clever rebrand of a fairly mainstream process, the creation of computerized algorithms. It’s one of the hottest phrases in fintech history, second only to Big Data. For what it’s worth, the Internet still gives “big data” the nod ahead of “artificial intelligence,” 68 million Google results to 44 million, but I’m guessing AI pulls ahead soon. Banks are creating AI teams, fintech bloggers are using it headlines (Finovate, Financial Brand), and conference organizers are creating keynote sessions around it.

Google trends for the search term AI (16 June 2017)

Google trends for the search term AI (16 June 2017)

Bottom line: I predict a long, long run for the phrase AI, so you might as well come to terms with it. Add it to your website, job description, or your team’s mission. You’ll be glad you did when the robot overlords come to evaluate your organizational value.

Author: Jim Bruene is Founder & Senior Advisor to Finovate as well as

Principal of BUX Advisors, a financial services user-experience consultancy.

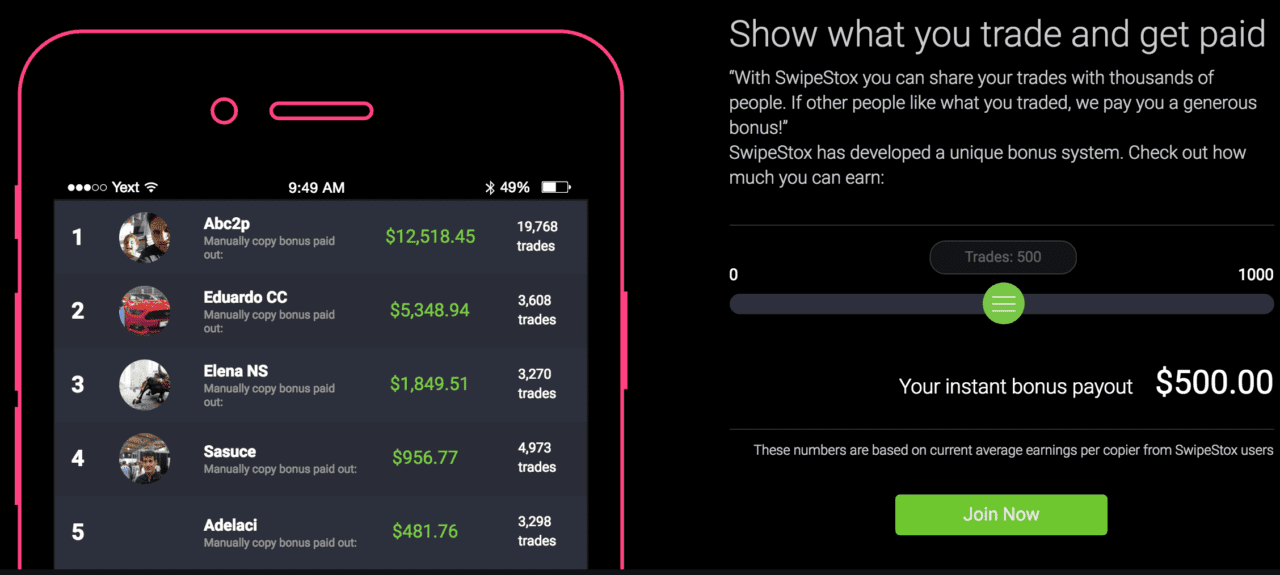

they’re the best, really (these guys, not the pics).”

they’re the best, really (these guys, not the pics).”