“Everybody’s gotta have a little place for their stuff,” the late great George Carlin reminded us years ago. “That’s all life is about. Trying to find a place for your stuff.”

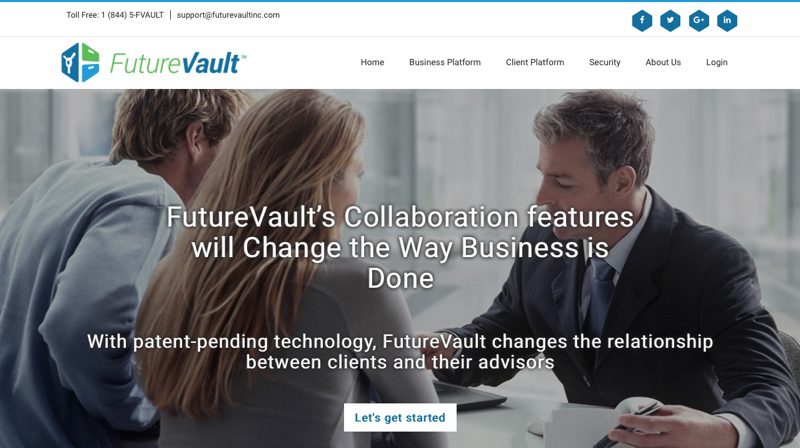

Digital safety deposit box developer FutureVault appears to agree. The company announced this week that it is partnering with BlueRock Wealth Management, providing the firm’s high net worth (HNW) clients with access to its secure digital filing technology and information management platform. BlueRock President Neal Owen highlighted the data management functionality of the new solution, BlueRock Vault, referring to it as the type of technology that is important in both storing and managing digital documents. He said the partnership would help his firm to safeguard information as well as it safeguards assets.

Pictured: FutureVault CEO and Executive Chairman G. Scott Paterson demonstrating the company’s digital safety deposit box at FinovateFall 2016.

In his comments on the news, FutureVault CEO and Executive Chairman G. Scott Paterson emphasized the “unique needs” of high net worth clients and their families. In addition to providing bank-grade security, optical character recognition (OCR), pre-configured digital filing cabinets, and sophisticated tagging, BlueRock Vault clients will have access to FutureVault’s Trusted Advisor service. This feature enables clients to allow a trusted fiduciary such as a financial advisor or attorney to enter and manage their information on their behalf.

The ability to serve HNW clients was demonstrated by Paterson’s own use of the technology as an “alpha” customer when he formally launched the technology at FinovateFall a year ago. He showed how the platform was easily able to accommodate clients with a complex set of data storage requirements (for example, a HNW family with multiple business concerns, a small trust, a foundation, etc.), noting that the platform scales downward as well “(these categories) could also be family members, parents, business divisions.”

Founded in 2015 and headquartered in Toronto, Ontario, Canada, FutureVault demoed its technology at FinovateFall 2016. Last month, the company announced a partnership with C-Suite Network, which will offer the C-Suite Vault as a premier value-added service to executive clients. FutureVault began the year by bolstering its own C-suite, adding three former TD Bank executives, Kevin Whyte, Tom Duane, and Rudy Sankovic to its ranks as president and COO, CTO, and CFO, respectively.

Mobile app development and omni-channel deployment company,

Mobile app development and omni-channel deployment company,