Canada-based payments platform nanopay unveiled its new B2B payments solution for international trading this week. The new platform, which is scheduled to be available to users in February and is currently in private beta, will initially support cross-border payments between the U.S. and Canada. nanopay expects to extend the service to India and China in the second quarter of 2018.

CEO and founder of nanopay Laurence Cooke pointed to the difficulty in paying and getting paid by international trading partners – as well as a lack of visibility – as the challenge the new platform solves. “Business relationships are founded on trust and the nanopay platform eliminates payment risk as an impediment to working together,” he said. “With UPS-like tracking you always know the status of your payment request.”

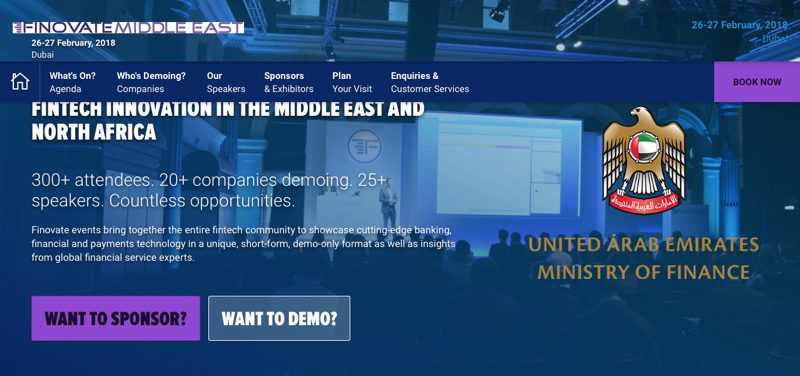

CEO and founder Laurence Cooke demonstrating nanopay Cross Border / B2B Portal at FinovateFall 2017.

“nanopay’s vision for simple and secure global B2B payments made it an easy choice to implement its platform,” s2H Business Information Systems CEO Sam Andary said. Crediting nanopay’s technology for helping his firm separate itself from its competition, he added, “Our customers will benefit from knowing where their money is at all times and trusting that it’ll be delivered securely – capabilities that customers are growing to expect in this digital age.”

nanopay’s B2B platform supports account-to-account payments, providing full visibility and payment context. This includes ISO 20022 metadata to provide for straight-through processing (STP), and avoids the need for transferring sensitive banking information back and forth. Payment originators will have full visibility of foreign exchange costs when invoices are paid in a different currency, and the platform will be accessible both via API as well as online as a web app.

Founded in 2013 and headquartered in Toronto, Ontario, nanopay demonstrated its nanopay Cross Border/B2B Portal at FinovateFall 2017. Last month, the company partnered with Interac e-Transfer, providing Canadians with another real-time payment option. Also this fall, nanopay announced a pair of C-level hires, adding new Chief Revenue Officer Nilesh Dusane and a new Chief Risk Officer Amir Sunderji. With more than $10 million in total funding, nanopay includes APAGM, Rohatton, Jarnac Capital Management, and Goldman Sachs among its investors.

Kabbage is also announcing today it has appointed Robert Sharpe (pictured) as Chief Operating Officer. Sharpe brings 20 years of executive leadership experience from North America, Europe and Asia, and 10 years of commercial banking and corporate finance experience. In a statement, Sharpe said that he is “excited to contribute the benefits of these experiences to Kabbage’s mission of driving small business success.”

Kabbage is also announcing today it has appointed Robert Sharpe (pictured) as Chief Operating Officer. Sharpe brings 20 years of executive leadership experience from North America, Europe and Asia, and 10 years of commercial banking and corporate finance experience. In a statement, Sharpe said that he is “excited to contribute the benefits of these experiences to Kabbage’s mission of driving small business success.”

Disney Company, and most recently, AutoGravity, to help further develop the company’s auto shopping platform.

Disney Company, and most recently, AutoGravity, to help further develop the company’s auto shopping platform.