Designed by Freepik

The MENA (Middle East and North Africa) region has experienced the highest rate of population growth of any region in the world over the past 100 years. Today, the countries of MENA boast more than 380 million people or 6% of the world’s population. And as leaders in the region respond to this population growth, developing a financial infrastructure capable of serving those who live in the Middle East and North Africa – from the underbanked to the ultra high net worth individual – is a massive challenge.

Much of what is driving change in the MENA region is taking place in partnership with some of the world’s biggest financial institutions. But as the foreword to EY’s World Islamic Banking Competitiveness Report 2016 cautions,

Participation banks are still attempting to transform their rather generalist business models to more direct integration with priority sectors of the Islamic economy. There is increasing pressure on these banks to demonstrate the purpose of existence – specifically their role in enabling important sectors such as transportation, retail, telecommunications, and SMEs to name a few – that have the greatest impact on the economy and on creating employment alternatives.

So how does financial technology make it possible for the people of the MENA countries to have the tools necessary to manage their finances efficiently and securely in the context of an emerging, increasingly mobile, increasingly social, and yet exceptionally diverse Islamic world? Fintech authority Chris Skinner observed last spring:

The net:net is that you have a rapidly growing economy, with a mix of young migrant workers who need remittance services; another group of professionals who expect mass affluent services; and a small group of High Net Worth and Ultra High Net Worth individuals who take exceptional service for granted.

An interesting place to be a bank.

Fintechs

Or a fintech? Looking at a map of the MENA region – which consists of more than 20 countries from Algeria to Yemen – the first observation to make is that a majority of MENA fintechs come from a handful of countries. According to a recent study by Wamda Research Lab (WRL) and Payfort and published in their Spring 2016 report, State of Fintech, three out of four fintech companies in the MENA are based in just four countries: UAE, Egypt, Jordan, and Lebanon. And four out of 12 countries host 73% of all MENA fintech startups. A second observation is that, as is the case with fintech in most areas of the world, payments and lending are the areas with the greatest number of fintechs in the Middle East and North Africa. Per Wamda, payments-based companies represent 84% of all MENA fintech startups.

Who are these companies? Among payments companies, Jordan’s MadfooatCom (founded in 2011), UAE’s Beam Wallet (founded in 2012), and PayMob and Fawry of Egypt (founded in 2015 and 2008, respectively) are some of the more notable fintechs in this space. MadfooatCom is a online real-time bill presentment and payment system. Beam Wallet is the leading mobile wallet in the UAE with more than 500,000 users. PayMob builds white label mobile wallet solutions for MNOs and FIs. And Fawry is an electronic payment network that provides billpay, mobile wallet, and other services.

Given Islamic sanctions against usury, or charging interest, there is ample space for companies specializing in Sharia-compliant lending practices. In the MENA region, this includes companies like Moneyfellows of Egypt (founded in 2014) , Zoomaal of Lebanon (founded in 2012), Jordan’s Liwwa (founded in 2013), and companies like YallaCompare (formerly Compareit4me) and Durise from the UAE (founded in 2011 and 2014, respectively). Moneyfellows is a social savings and lending service. Zoomaal is a crowdfunding platform. Liwwa caters to small business borrowers. YallaCompare is an insurance, credit card, personal loan comparison shopping site. Durise specializes in real estate crowdfunding.

It’s also worth pointing out that many companies headquartered outside the MENA region have nevertheless made major commitments to bringing fintech innovation to communities in the Middle East. Among Finovate alums recently making major MENA-related headlines are ACI Worldwide, Fidor Bank, NCR, NetGuardians and Thomson Reuters.

That said, behind every great fintech startup is not just a great idea, but also significant guidance and support. In the MENA region both accelerators and incubators as well as leadership from the public sector play major roles in helping area entrepreneurs turn their technologies into solutions that can be brought successfully to market.

The role of accelerators

With regard to accelerators, a recent look by Forbes shared 15 Middle East Accelerators to Watch, and a number of the organizations featured in the Forbes article have made significant recent commitments to supporting fintech innovation. Flat6Labs, founded in Egypt, partnered with Barclays to launch a fintech accelerator, 1864 Accelerator, in the fall of 2016. Last month, Jordan’s Oasis500 announced its latest round of investments including support for fintechs like Akaryana.com (global platform for marketing real estate properties), Amwal.com (comparison shopping for financial products), and DareebaTech (online tax return filing and payment facilitator). Lebanon’s Berytech includes interactive retail banking portal Bnooki.com, mobile payments solutions provider Via Mobile, and the Bank of Baghdad among its fintech alums.

But no discussion of the development of fintech in the MENA region is possible without a discussion of the sizable degree of support from the leaders of countries in the area. Last month the Bahrain Economic Development Board partnered with fintech accelerator FinTech Consortium to launch Bahrain FinTech Bay. The goal is to help support MENA-area fintechs and guide Bahrain toward becoming a regional fintech hub. In the UAE, the Abu Dhabi Global Market (ADGM), which launched in 2015, will play a major role in helping build a 21st century financial services sector and, by extension, stimulate development of vibrant fintech innovation, as well. Back in October, ADGM announced a pair of new initiatives – launching the ADGM FinTech Innovation Centre and a partnership with Plug and Play – as part of its first FinTech Abu Dhabi Summit.

The blockchain

Sophisticated technologies such as bitcoin and blockchain are being studied by governments and central banks in the MENA region. This is particularly the case in the UAE, but is also true for institutions in Saudi Arabia, Qatar, Kuwait, and Bahrain. In a post called “GulfTech is the Next Big Thing,” Skinner underscored the area’s fascination with the blockchain in a subsection titled “Everything on a blockchain.” Skinner discusses how blockchain technology might be used to help turn the region into an international leader in Islamic finance:

IslamTech is an opportunity for the GCC, and one they need to grasp, You would think that the GCC countries would lead in Islamic Finance, but they don’t. Kuala Lumpur and London take those honors. However, as a FinTech opportunity, building their presence as an Islamic FinTech center, or IslamTech as I like to call it, makes sense. In particular, because Dubai wants to build everything on a blockchain, and transparency of products through a shared ledger service for Islamic investments makes absolute sense.

Skinner also links to an article from CoinDesk that discusses Dubai’s strategic partnership with IBM for a city-wide blockchain pilot project run by Dubai’s innovation arm, Smart Dubai.

Partnerships

Partnerships are also developing between MENA countries as well as within them. In December, the central bank of UAE announced a joint project with the Saudi Arabian Monetary Authority (Sama) to use blockchain technology to issue a digital currency that would be accepted for cross-border transactions between the UAE and KSA. Individual companies in the MENA region that are innovating with blockchain technology include firms like ArabianChain, a UAE-based startup founded in 2016 that is building a public blockchain for Islamic banking and government services-related apps.

There are many aspects of fintech in the MENA region that make it easy to be optimistic about the industry’s future. According to Wamda, MENA-area fintech startups have raised more than $100 million in the last 10 years. And the opportunity is clear: 86% of the adult population in the MENA is unbanked, and SME lending by regional banks is significantly below the average for middle income countries. Combine this with (1) the growing appetite for mobile-based solutions driven in part by the disproportionately large under 30-population, (2) the emergence of increasingly-diversified sources of wealth and investment, and (3) the clear commitment of leaders in the region to leverage fintech to help modernize their societies and provide better life outcomes for their citizens, and you have one of the world’s most worthwhile fintech industries to watch.

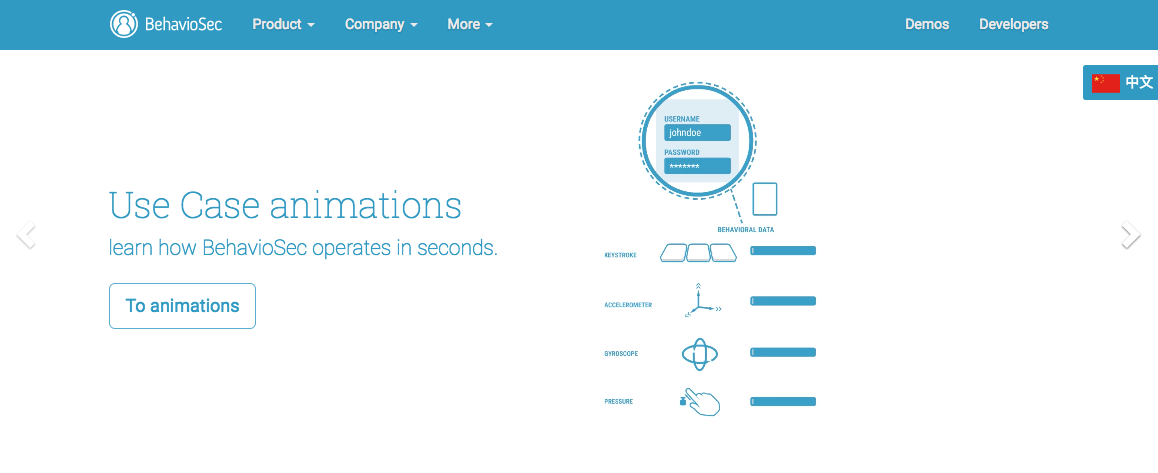

A look at the companies demoing live at FinovateEurope on the 6 through 9 of March 2018 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 6 through 9 of March 2018 in London. Pick up your tickets today and save your spot.

LinkedIn

LinkedIn

Gary Singh, VP of Marketing

Gary Singh, VP of Marketing

Presenters

Presenters Ozan Vakar, CTO

Ozan Vakar, CTO

Presenter

Presenter

Presenter

Presenter