In a Series C round led by Benhamou Global Ventures and Eastern Link Capital, IdentityMind Global has secured $10 million in new funding. The investment, which also featured the participation of Hanna Ventures, Overstock.com, and Zanadu Capital Partners, will help support the digital identity specialist’s expansion within international markets and to grow its new business unit designed to provide KYC and AML solutions for ICO and cryptocurrency markets.

“We feel privileged to be working with an elite group of high quality investors who have a proven track record of success,” IdentityMind Global CEO Garrett Gafke said. “The market demand for digital identity-based solutions in today’s global digital economy is booming. IdentityMind, the pioneer in digital identities, with hundreds of customers spanning six continents, is uniquely positioned to meet growing global market demand.”

An alum of Finovate’s developer conference series, FinDEVr, IdentityMind Global is looking specifically to markets in Asia, Latin America, and Europe for expansion. And with regards to the new market of ICOs and cryptocurrencies, the company’s announcement comes only one week after unveiling its new business unit dedicated to providing anti-fraud solutions for ICOs.

Overstock.com CEO and IdentityMind investor Patrick Byrne referenced the rise of ICOs and their needs in the funding announcement. “ICOs and cryptocurrencies are going mainstream and IdentityMind is one of the key players in helping ensure transparency, legitimacy, security and compliance which will only lead to faster and greater marketplace adoption.”

In addition to new opportunities in the emerging ICO and cryptocurrency space, IdentityMind Global has also taken advantage of new trends in regtech more broadly – including the EU’s GDPR – that will increase demand for its AML, KYC, transaction monitoring, sanctions screening, and fraud prevention services. The company cited statistics from Frost & Sullivan that indicated that the global RegTech market could reach $6.45 billion by 2020.

“The ongoing growth of synthetic or stolen identities requires digital identity-based solutions to prevent identity fraud and maintain the integrity of the global digital economy,” Managing Partner for Eastern Link Capital Yodong Hou said. “IdentityMind has been identified as a ‘go to’ partner for those companies needing to implement an effective defense to identity thieves, online fraudsters, and money launderers worldwide.”

IdentityMind Global participated in Finovate’s developers conference in London in 2017, presenting its Entity Link API that helps businesses meet KYC and AML-related risk and compliance requirements. Last month, the company announced a partnership with fellow Finovate alum Mitek, integrating the two fintechs’ digital ID verification capacities. With this investment, the company’s total capital stands at more than $20 million.

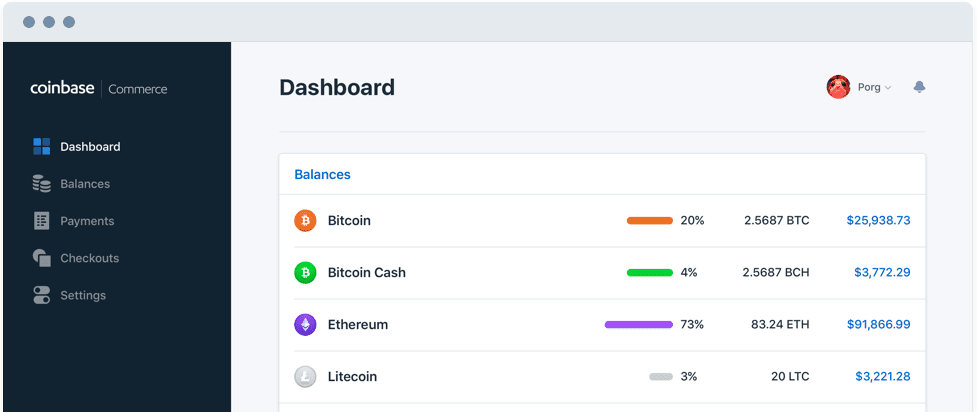

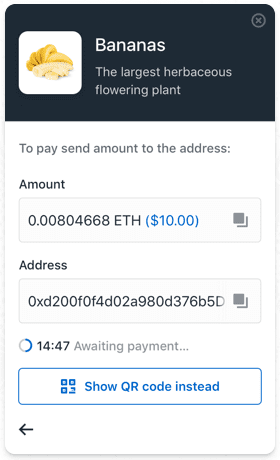

Digital currency wallet

Digital currency wallet