FinovateMiddleEast is just one day away. For the first time, Finovate is bringing its fintech conference of live demos and insightful keynotes and panel discussions to Dubai, the largest city in the UAE., to explore and learn about some of the exciting developments in fintech that are taking place in the Middle East and North Africa.

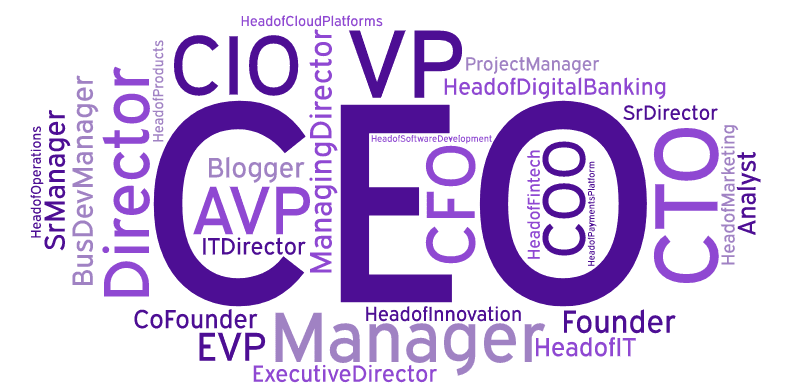

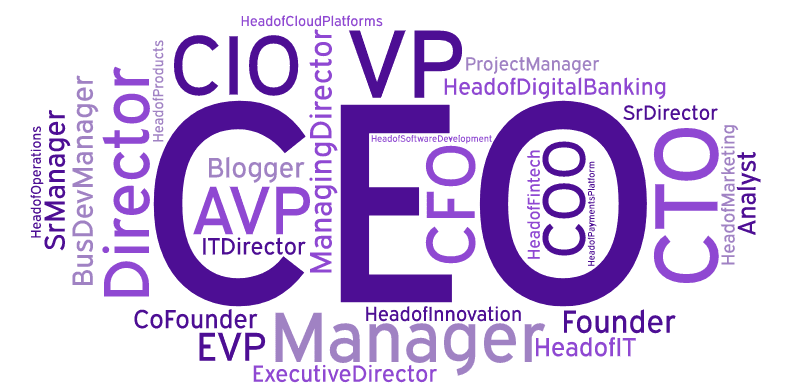

The presenters on stage are only part of what makes Finovate events special. Our conference attendees – hailing from all over the world – are a diverse collection of professionals from finance, technology, the investment world, and the fintech media. And it is often the case that the introductions made and business cards exchanged between attendees during our networking opportunities prove to be as valuable as the fintech demos and keynote addresses on stage. Take a look, for example, at the titles of our attendees for FinovateMiddleEast that we’ve aggregated into a word cloud below:

From C-level executives like CEOs, CTOs, and CIOs to heads of digital banking, cloud platforms, software development and more, Finovate audiences are a great source of fintech experience and insight in and of themselves. This is one of the reasons why we ensure that our attendees have ample opportunity to mix, mingle, and network both at the beginning and end of each conference day.

So with FinovateMiddleEast kicking off tomorrow, here are a few last minute, need-to-knows to help you make the most of your Finovate experience.

The What

FinovateMiddleEast is a two-day conference of live fintech demonstrations, keynote addresses, panel discussions, and peer networking opportunities. The event is Finovate’s first in the Middle East, and is being produced with the exclusive strategic partnership of the UAE Ministry of Finance.

The When

FinovateMiddleEast takes place on Monday, the 26th of February, and Tuesday, the 27th. Registration begins at 8am on both days. The program on Monday morning will start at 8:30 am. On Tuesday, the program will begin at 9am.

The Where

FinovateMiddleEast will be held at the Madinat Jumeirah Conference and Events Centre in Dubai, UAE. The conference and events centre is part of the Madinat Jumeirah Resort which consists of a trio of grand hotels: Jumeirah Al Qasr, Jumeirah Mina A’Salam, and Jumeirah Al Naseem.

The How

Join us in Dubai for FinovateMiddleEast by visiting our registration page and picking up your ticket. There are group discounts available, as well as discounts for members of government and regulatory entities. Check out our registration page for more information.

Also be sure to download the Finovate app – available at both the Apple Store and at Google Play. Search for “Finovate” and use the same email you used to register for FinovateMiddleEast as your login. If you are a first-time user of our app, the password is “finovate”. In the app you will find more information about our presenters, partners, and sponsors; network with your fellow FinovateMiddleEast attendees, and – importantly – vote for your favorite fintech demos in our Best of Show competition.

There is also a desktop version of the event app available at finovatemiddleeast2018.zerista.com.

The Why

FinovateMiddleEast is a great way to learn about the growing fintech scene in the Middle East and North Africa. Our live fintech demos provide an insight into the kind of challenges fintech companies operating in MENA are solving every day. Our keynote speakers and panel discussions provide the context to understand how these solutions are improving the financial lives of the more than 380 million people living in the region. For more background on fintech in MENA, a few of our thought pieces are listed below:

We are very excited to bring our fintech conference to the UAE and hope you will join us – either live here in Dubai or by following along online via our coverage on Twitter @Finovate.

The United Arab Emirates Ministry of Finance is the Exclusive Strategic Partner of FinovateMiddleEast

FinovateMiddleEast sponsors also include UAE Exchange, Profile Software, simility, Temenos, Block Gemini, Loxon Solutions, Ortec Finance, Plug and Play Abu Dhabi Global Market

Dubai International Financial Centre is a supporting partner of FinovateMiddleEast

FinovateMiddleEast partners also include AstroLabs, Byte Academy, European Fintech Alliance, Femtech Leaders, FINOLAB, Fintech Connector, Fintech Galaxy, Fintech Professionals Association, Holland Fintech, Plug and Play Abu Dhabi Global Market, SME Finance Forum, Startupbootcamp, Startupbootcamp Fintech, Swiss Finance + Technology Association, Women Who Code

FinovateMiddleEast media partners include Aite Group, Arabnet, BankersHub, Banking Technology, BeFast.TV, Big Data Made Simple, Blockchain in Europe, BlockExplorer, Breaking Banks, Middle East Business Review, Crowdfund Insider, Financial IT, Fintech Finance, Fintechtime, Forrester, Gigabit, Headcount, IBS Intelligence, Innovate Finance, Islamic Finance News, Mercator Advisory Group, Ovum, Oxford Business Group, Plus Journal, Rainmaking Colab, RFI Group, The Fintech Times, The Nilson Report, The Paypers, Unlock Blockchain

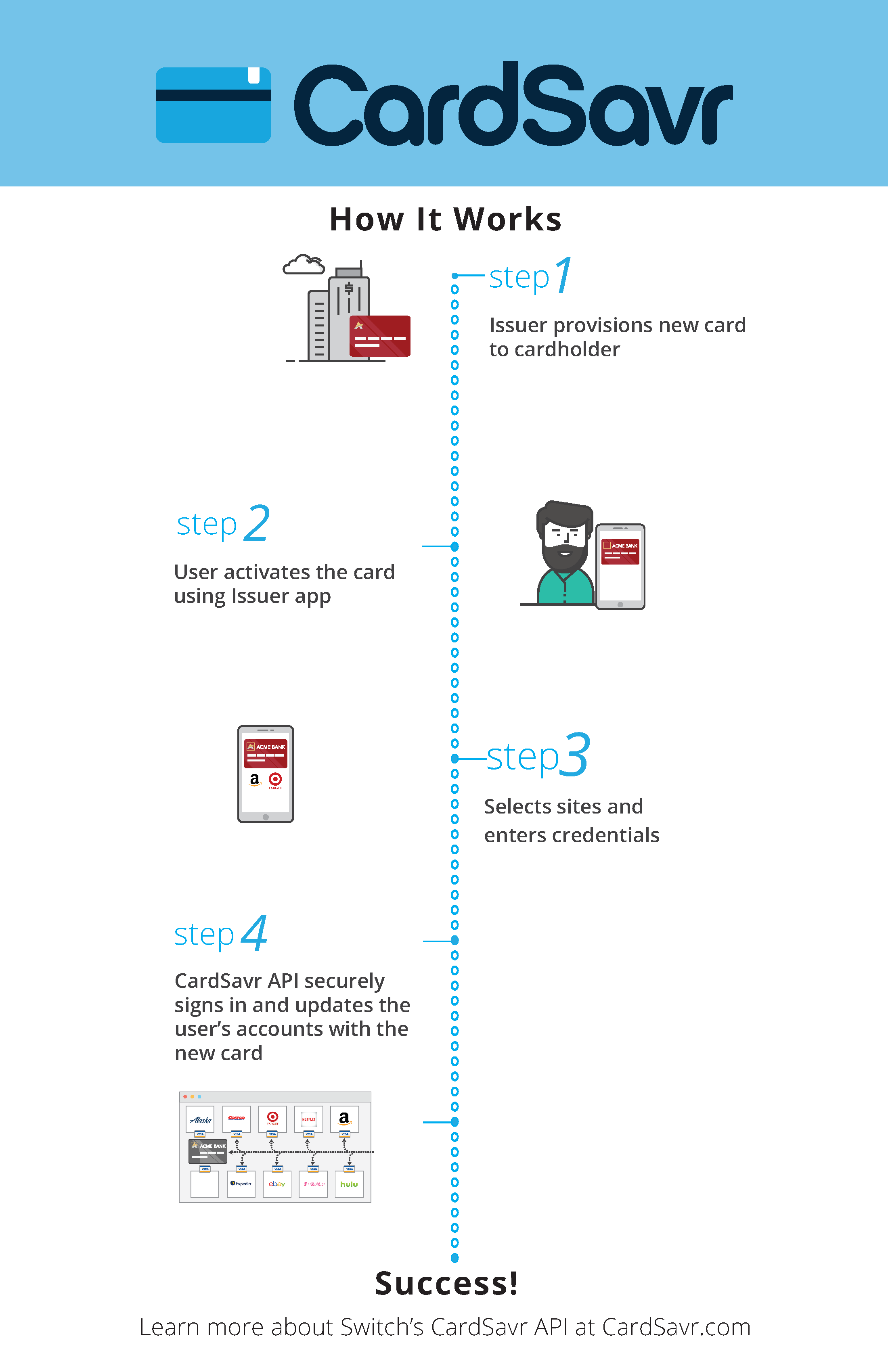

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”