The fintech space is filled with new players bringing to market new innovations and solutions to old business and consumer problems, as well as traditional businesses looking to develop in-house innovation teams and partner with start-ups. But what they both have in common is a desire to meet and exceed changing customer demands, make financial services more accessible and user-friendly, and keep up with the fast-paced technological advances. During FinovateFall, we sat down with the experts on the ground to ask them about what’s driving the fintech ecosystem where they work.

Finovate Alumni News

On Finovate.com

- Wealthfront’s New Freemium Model.

- DoubleNet Pay Acquired by Benefits Provider Purchasing Power.

Around the web

- Moxtra partners with Virtusa to help banks with client engagement.

- Daon announces partnership with Avtex to improve contact center experience.

- Envestnet | Yodlee launches risk insight for pre-qualification.

- BCFocus highlights Crypterium.

- Benzinga features Kabbage growth stats.

- CNBC: Coinbase and Circle form joint venture to boost adoption of dollar-backed digital coins

- City A.M. reports Azimo and CurrencyCloud to open offices in Amsterdam.

- First Data launches Clover in Canada.

- Temenos announces new Hybrid Pooling cash management solution for corporate banking.

- ClearBank selects Featurespace for real-time fraud and AML detection.

- Insuritas partners with Northwest Bank to launch bank-owned digital insurance agency platform.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Moven Enterprise Goes Global

Smart banking solutions provider Moven Enterprise, a division of Movencorp, is leveraging its success with banks in Canada and New Zealand to help more FIs globally improve customer engagement and build new revenue streams. The company announced this week that it will be bringing its AI-powered digital banking platform to banks in Latin America, APAC, Africa, the Middle East, and Europe – buoyed by a $10 million investment from SBI Group and the establishment of SBI Moven Asia earlier this year.

“Moven has a proven model for success. Several of our client banks’ results tell the story – from significantly reduced attrition rates, positive customer engagement and increased savings behaviors and reduction in spending, Moven is well-positioned to roll-out our enterprise offering to banks around the world,” Moven CEO Marek Forysiak said.

Moven founder Brett King underscored SBI Group’s role in accelerating the company’s opportunities overseas. “SBI’s partnerships with more than 60 banks across Asia give us the opportunity to deploy our solutions quickly and efficiently, offering our Asian customers tailored and localized support and attention,” King said.

Moven Enterprise offers a customizable digital banking platform that enables FIs to boost engagement with solutions to better help their customers manage their spending and savings. Available as a white-label, software-as-a-service offering, the technology supports instant mobile signup to make new customer acquisition less costly and more efficient, as well as a customer engagement engine that provides real-time spending and savings insights. Moven Enterprise demonstrated new capabilities of the platform – including a wishlist that uses behavioral gamification, a chatbot feature called ChatUI, and a new credit feature – at FinovateAsia 2017.

Founded in 2011, Moven is headquartered in New York City. The company has raised more than $35 million in capital over time, and includes TD Bank and Westpac among its partners.

Kony Bucks Status Quo by Acquiring Tech from Bank

In a fintech-techfin world, it is usually banks that acquire technology from fintech companies, and not the other way around. However, this week, enterprise application company Kony is changing that narrative. The Texas-based company announced it is acquiring the assets of Pivotus, the innovation subsidiary of Umpqua Bank parent company, Umpqua Holdings. The financial terms of the deal were not disclosed.

Umpqua launched Pivotus in 2015 to serve as an environment where it could quickly develop, test, and deploy new banking solutions for Umpqua. Cort O’Haver, Umpqua Holdings president and CEO, said, “As the speed of technological change continues to accelerate, it’s important that we’re able to make the most of our strategy and size by developing a network of partnerships that can accelerate our pace of differentiation. Finding a smart home for Pivotus—with the capital, technical expertise, and customer focus —is important for Umpqua moving forward, and Kony is a terrific partner.”

Kony anticipates the acquisition will augment its Kony DBX digital banking applications. The company launched Kony DBX earlier this summer to help banks with their digital strategies. The new digital banking platform and application suite offers pre-built apps and a digital banking platform to help banks and credit unions deliver digital experiences across all customer channels with less friction.

As a part of the deal, Umpqua will help Kony to continue developing the Pivotus Engage platform. Launched earlier this year, Engage helps banks offer a consistent user experience that maintains a human touch across multiple channels. After the acquisition is finalized, Kony will rename the tool Kony DBX Engage.

“Our partnership with Umpqua, combined with the talented Pivotus employees and the innovative technologies they’ve developed, is a landmark combination that will deliver high impact solutions for financial institutions around the globe,” said Thomas Hogan, chairman and CEO of Kony. “Umpqua is widely recognized for their innovative approach to leveraging digital to enhance and deepen the customer experience. The Pivotus team and assets will extend and accelerate Kony’s market leading portfolio for digital banking. We couldn’t be more proud or thrilled to join forces.”

Kony’s CTO, Bill Bodin and Product Marketing Manager, Antonio Sanchez, showcased the company’s digital banking platform at FinovateFall 2017. Earlier this fall, Kony integrated with Payveris’ cloud-based money movement technology. In October of last year, the company launched a new digital banking solution that leverages Daon’s biometric tools. Founded in 2007, Kony has raised more than $115 million.

Plaid Signs Open Banking Agreement with JPMorgan

After making its international debut earlier this year, Plaid, the provider of APIs for financial infrastructure, announced it has linked up with JPMorgan Chase to help the bank make a move toward open banking by enabling account holders to safely share their financial data with third party fintech applications.

Via a secure API, Plaid accesses consumers’ data to help them share their digital financial information with other fintech apps such as Robinhood, Acorns, and Venmo. The cooperation will also offer developers quality data they can use to build new products and services. To put clients in control, Chase has launched a new tool called Account Safe that brings users visibility into which applications are using their data and give them control over the use of their data.

In an announcement on its blog, Plaid stated that it believes today’s partnership “underscores the need for secure and reliable data in the fintech ecosystem.” It continued, “We firmly believe that collaboration with financial institutions is the best way to deliver on the promise to protect consumers and developers. We’re proud of the steps we are taking with Chase towards this reality.”

According to Business Insider, this news comes as Plaid is in talks with investors about a funding round that could raise the company’s valuation to $2 billion. To date, Plaid has raised $59.3 million from investors including Goldman Sachs Investment Partners and Spark Capital.

Plaid has 150+ employees and offers 6 products, including Auth, an account authentication tool; Balance, which pulls account balance information in real-time; Identity, which leverages bank data to verify consumer identity; Transactions, which pulls bank statement data across banks; Assets, a verification of assets tool; and Income, a tool that validates a consumer’s income and verifies direct deposit data. Since it was founded in 2012, Plaid has analyzed more than 10 billion transactions.

At FinDEVr San Fransisco 2014, the company’s founder Zach Perret gave a presentation about leveraging the Plaid API for financial infrastructure. Earlier this year, Plaid was featured by both CNBC and Forbes. At the start of 2018, the company was honored on Forbes’ Fintech 50.

Finn AI Closes $11 Million Series A

One of the big stars of last year’s FinovateAsia, Finn AI, continues to make big headlines. The company, whose AI-powered virtual assistant technology has earned it two Finovate Best of Show awards, has picked up $11 million in new funding (CAD $14 million). The Series A round was led by Yaletown Partners and Flying Fish Partners, and featured participation from BDC Capital’s Women in Technology Fund, 1843 Capital, and angel investors.

“We’ve seen great progress in our business over the last twelve months, doubling our team to over 50 across North America and acquiring a number of major new customers and partners,” co-founder and CEO of Finn AI Jake Tyler said. “As the market moves beyond early experiments into scale production deployments we are seeing greater demand for our proven enterprise-grade Conversational AI platform.”

Tyler added that the funding would support the company’s growth in North America and Europe. The investment will also enable Finn AI to innovate on its enterprise technology and extend its core solution to support additional banking and personal finance capabilities for its current customers.

As part of the investment, Eric Bukovinsky of Yaletown Partners and Frank Chang of Flying Fish Partners will join Finn AI’s board of directors.

At FinovateFall 2017 last September, Finn AI demonstrated how its virtual banking assistant, integrated with Facebook Messenger and Google Assistant, could be used to complete everyday banking and personal finance tasks. Leveraging bot technology and artificial intelligence, Finn AI’s solution supports payments, budgeting, and savings. And while the virtual assistant is capable of answering a wide range of support queries without any human intervention, the technology is also able to bring in human agents to respond to more complex requests.

“Banks around the world are rapidly adopting Conversational AI to deepen relationships with customers, drive sales, and migrate routine, high volume tasks and queries to digital self-serve channels,” Bukovinsky said. “Finn AI has proven it can deliver with major banks across North America, Europe, Africa, and Latin America. We’re excited to support them in this next stage of their growth.”

Finn AI was founded in 2014 and is headquartered in Vancouver, British Columbia, Canada. Earlier this year, the company announced a partnership with Visa Canada, leveraging the Visa Development Platform APIs to enhance its conversational AI technology. This spring, Finn AI teamed up with Bank of Montreal (BMO) to power the bank’s personal banking chatbot, BMO Bolt. The company also collaborated with Nicaragua’s biggest bank, Banpro, in March, to offer the company’s first Spanish-speaking virtual banking assistant.

The Best Bits of FinovateFall 2018

Finovate conferences showcase cutting-edge banking and financial technology through a unique blend of short-form demos and key insights from thought-leaders.

See the highlights from FinovateFall 2018, which took place September 24 through 26 in New York:

Finovate Alumni News

On Finovate.com

- Finn AI Closes $11 Million Series A.

- Plaid Signs Open Banking Agreement with JPMorgan.

- Moven Enterprise Goes Global.

Around the web

- Klarna pairs up with Rancourt to let shoppers pay over time.

- Credit Karma launches new personalized shopping experience.

- Temenos ramps up AI efforts to power its digital banking platform.

- Feedzai launches AI-powered Feedzai Genome to help users visualize and fight financial crime.

- Jumio stays ahead of fraudsters with certified 3D liveness detection.

- Clover announces additions to its Partner Portfolio with enhanced integrations with Nav, AP Intego Insurance Group, and Gusto.

- Ayondo forms white label agreement with Phnom Penh Derivative Exchange to provide TradeHub for derivative brokers trading CFDs for PPDE’s clients in Cambodia.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Experian, FICO, and Finicity Launch the UltraFICO Score

Three fintechs joined forces today to create a new credit scoring technology designed for thin-file customers. Experian, FICO, and Finicity are the triumvirate behind the new score, named the UltraFICO score.

The UltraFICO score leverages consumer-permissioned account data aggregated and distributed by Experian and Finicity. Unlike the traditional FICO score, which relies heavily on repayment data from users’ previous credit usage, UltraFICO looks at how responsibly consumers manage their finances. After gaining the user’s permission to access their bank statements, Finicity’s technology pulls consumer-contributed data from their checking, savings, and money market accounts, examining the length of time accounts have been open, frequency of activity, and saving data.

For its part, Experian pulls the consumer’s credit information and will integrate the new model into lenders’ existing operational workflow. Alex Lintner, president of Experian’s Consumer Information Services, said that this project has offered the company “a new way to use consumer-permissioned data that allows lenders to make better decisions and helps consumers gain access to credit.”

Accessing the additional data not only offers lenders a more complete picture of the prospective borrower’s ability to repay, it also improves access to credit for Americans who are typically below lenders’ preferred credit score threshold. This especially applies to thin-file borrowers and those working on rebuilding their score after a financial crisis.

Jim Wehmann, FICO EVP of Scores, said that UltraFICO “empowers consumers to have greater control over the information that is being used in making credit risk decisions.” He added, “It also enables a deeper dialogue between the consumer and lenders to help both parties make better financial decisions.”

UltraFICO will be piloted in 2019 to test the new model and determine consumers’ willingness to share their financial data. The group plans to make the new model generally available to lenders in mid-2019.

Headquartered in Dublin, Ireland, Experian most recently demoed its decisioning platform at FinovateFall 2018. The cloud-based platform enables organizations to combine data and analytics to improve the accuracy of their customer lending decisions. Earlier this year, Experian acquired U.K.-based ClearScore for $385 million.

Founded in 1956 as Fair Isaac Corporation, FICO presented “Rapidly Deliver Contextually-Powered Stream Processing” at FinDEVr New York 2016. Earlier this month, the company announced it will provide KYC and onboarding solutions for Belarus-based lender, Belgazprombank.

Utah-based Finicity demoed at FinovateFall 2017 where the company’s Co-founder and President of Data Services, Nick Thomas, showed how the company simplified access to its Verification of Income and Verification of Assets reports. Frequently in the headlines, Finicity announced last week it was selected as third-party service provider for Freddie Mac’s automated income and asset assessment solution, Loan Product Advisor. In September, the company aligned with intelligent process automation software provider Capsilon to modernize the mortgage origination process.

Ondot Lands Strategic Investment from Citi Ventures

A strategic investment from Citi Ventures announced today will help power international growth for mobile payment services specialist Ondot.

“As we steadily march toward high-frequency, invisible and autonomous payments, consumers increasingly expect detailed information about their transactions,” Ondot CEO Vaduvur Bharghavan said. “Bringing together details such as real-time transaction authorizations, proximity controls, merchant specifications, and applying machine learning on historical data helps consumers have more control over their cards and delivers a premium cardholder experience.”

The amount of the funding was not disclosed. Prior to today’s news, the company reportedly had raised $51 million in equity financing.

Ondot offers banks and credit unions technology that enables them to provide their customers with solutions to better manage and control their card payments. The company’s real-time, API-based platform and mobile app provide an end-to-end digital payment card services experience that ranges from bot-assisted digital acquisition and instant activation to geolocation-based contextual alerts and messaging. Ondot’s technology gives payment cards a “digital voice,” supported by a three-way interaction between the card issuer, the card holder, and the merchant.

“Consumers want to be able to manage their financial lives anywhere and at any time, and their expectations for a seamless experience will continue to evolve,” Citi Ventures’ co-head of venture investing Ramneek Gupta said. “Ondot meets this demand by providing innovative solutions that enable increased access and control of financial information, so we are thrilled to invest.”

Ondot’s strategic investment comes as the company announced a partnership with Mexico’s INVEX. The collaboration will enable INVEX to leverage Ondot’s digital acquisition and instant issuance technology to provide the country’s first “Instant Card.” Integrated with Ondot’s technology, INVEX’s Digital Card Services solution will also feature mobile product presentment and selection, as well as built-in card controls and alerts.

“Nowadays, credit card customers and digitally savvy generations, seek simplicity and immediate financial solutions through 100% digital channels,” Jean Marc Mercier, INVEX’s Managing Director for Consumer Banking and Payments, said. He added that INVEX was “committed to consolidate our position as a player at the forefront of the Mexican consumer and payments market, providing solutions that meet these expectations.”

Santa Clara, California-based Ondot Systems demonstrated its Digital Card mobile app at FinovateSpring 2018. The company also participated in our inaugural FinovateMiddleEast conference earlier this year, winning Best of Show honors for a live demo of its card control technology. More than 3,000 banks and credit unions around the world use Ondot’s white label apps, including the premier credit union services organization in the U.S., PSCU, which announced a partnership with Ondot in August.

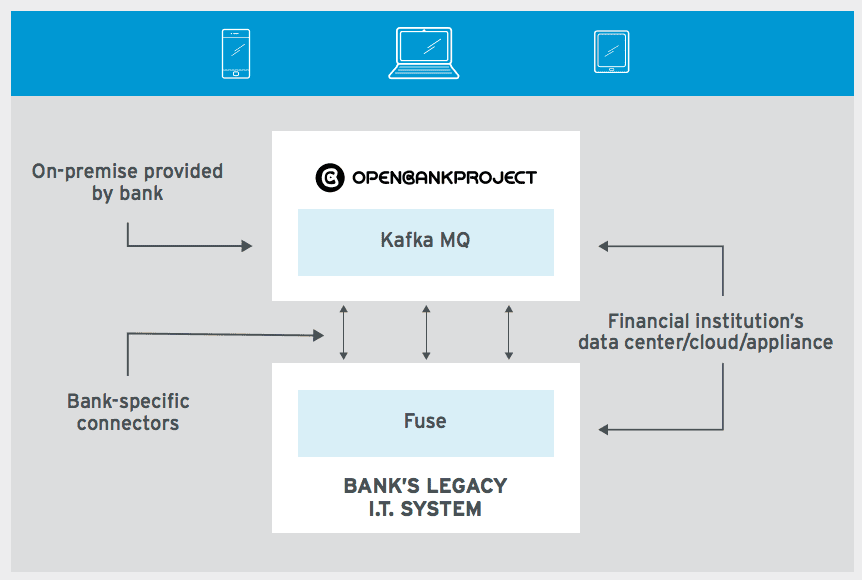

Open Bank Project Collaborates with Open Source Software Company Red Hat

Open source API innovator, TESOBE’s Open Bank Project, announced it has teamed up with Red Hat this week. The two are collaborating on a new API specifically designed for banking and financial services companies.

The Open Bank Project will leverage Red Hat’s Fuse along with the North Carolina-based company’s rule engines to connect banking systems and offer interoperability among a variety of sources of bank data. This combination of the Open Bank Project’s and Red Hat’s open source technologies facilitates banking system connections while delivering a wider range of applications to end users.

TESOBE CEO and Founder of the Open Bank Project, Simon Redfern, said, “Red Hat and TESOBE share a strong commitment to open source and I’m excited to see these technologies working together. The collaboration we have today can offer a valuable opportunity for banks to help reap the benefits of Open Banking.”

Founded in 2005, the Open Bank Project is a pioneer in open banking, an initiative wherein banks open up their architecture via APIs. In addition to allowing third party applications and services to leverage consumer data, open banking helps financial services companies comply with the EU’s recently revised payment services directive, which was implemented in January of this year. For this reason, as Rich Feldmann, global director of financial services for RedHat, noted, “As open source continues to be a part of the financial services and banking industry, it is important to have standards and projects in place to help enable it to be used properly and remain compliant. This is why we are happy to collaborate with TESOBE’s Open Bank Project to help provide technology tools and guidance to enable success in open source banking.”

In addition to today’s Red Hat announcement, the Open Bank Project also divulged it will be working with Australian challenger bank, 86 400. The neobank will leverage the Open Bank Project’s APIs to standardize and harmonize its API design for more than 10,000 fintech developers.

Headquartered in Germany, TESOBE’s Open Bank Project demoed at FinovateFall 2018 last month, where Redfern showcased how banks can leverage APIs to drive innovation. Earlier this summer, the Open Bank Project teamed up with Citizens Bank to power the bank’s hackathon.

Fiserv Partners with UK-Based Co-operative Bank

Fiserv announced that UK-based Co-operative Bank will implement its FinKit for Open Banking, “to provide more flexibility for customers to choose how they conduct their everyday banking in relation to the European Union’s Second Payment Services Directive (PSD2)”, reports Tanya Andreasyan of Fintech Futures (Finovate’s sister publication).

The two parties have a long-standing relationship.

The cloud-based managed service delivery model of FinKit for Open Banking appealed to the bank, Fiserv explained, because it will help facilitate the many aspects of open banking compliance, from secure customer authentication to management of trusted third parties (TPPs).

FinKit for Open Banking includes access to pre-built APIs and facilitates ongoing compliance through API version control and publishing. This positions the bank to respond efficiently and effectively to the rapid pace of regulatory and industry change, the vendor explains.

FinKit originates from a UK-based mobile paytech provider, Monitise, which was acquired by Fiserv last year.

“Open banking is an area of continual change, and Co-operative Bank is positioned to move ahead of the curve,” noted Lee Cameron, managing director, EMEA, Fiserv (and formerly CEO of Monitise).

Fiserv was founded in 1984 and is headquartered in Brookfield, Wisconsin. The company most recently demonstrated its technology at FinovateSpring 2018, partnering with Samsung SDS America to show new biometric authentication features for its digital banking experience, Fiserv Commercial Center.

With more than 12,000 clients and more than 24,000 associates around the world, Fiserv trades on the NASDAQ under the ticker “FISV”. The firm has a market capitalization of $32 billion. Jeffery Yabuki is president and CEO.