Alternative payments specialist Sezzle has raised $5.6 million in funding in advance of its debut on the Australian Securities Exchange (ASX) later this year. The financing was led by Continental Investors of Chicago, and featured participation from a total of 10 investors. Sezzle plans to raise $6 million in the current round, which was described as a “pre-IPO” round by the Australian Financial Review.

Sezzle hopes to raise between $20 million and $30 million via initial public offering on the ASX. The company admits that it has no plans to begin operations in Australia, and that the listing on the ASX was to take advantage of the investment interest that Afterpay, a Sezzle rival based in Melbourne, has enjoyed since its own arrival on the ASX. Sezzle CEO Charlie Youakim noted that investors in Australia have been quicker than investors in the U.S. to embrace what he called “the potential of the payment method.”

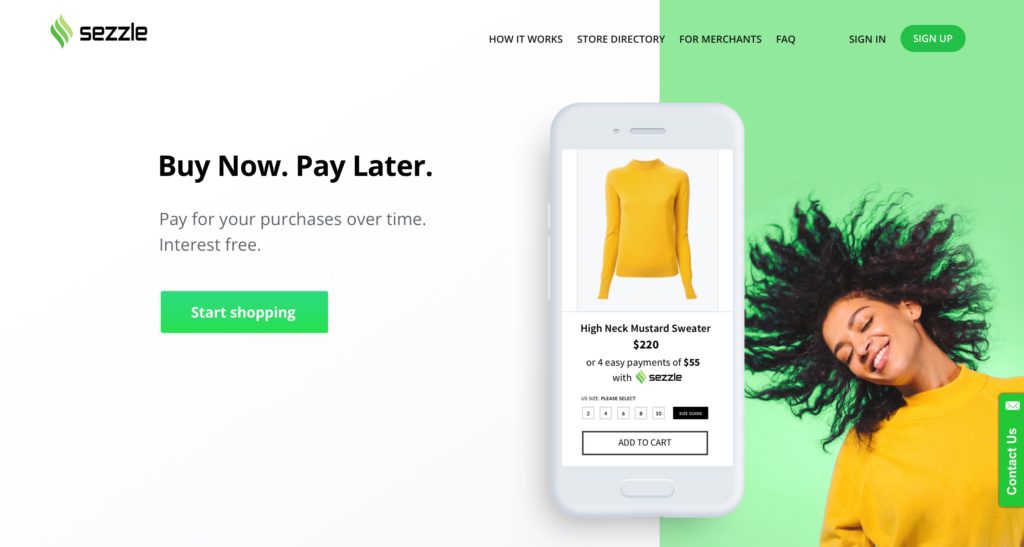

Sezzle empowers consumers by enabling them to make purchases and pay for them in four, interest-free installments, payable every two weeks. The company’s merchant partners have recorded higher average order value and higher conversion rates since adding Sezzle to their checkout systems. More than 3,500 stores currently offer Sezzle as an option.

Sezzle’s funding comes just a few months after the company announced that its Shop Now Pay Later option would be available on the 3dcart ecommerce platform. Founded in 1997, the Florida-based, Inc. 5,000 company has more than 22,000 merchants using its technology to build and manage online stores and shopping carts, and engage in content marketing.

“By providing our merchants with an easy way to allow customers to finance their purchases, we open up possibilities for both retailers and customers,” 3dcart founder and CEO Gonzalo Gil said.

Sezzle demonstrated its technology at FinovateFall 2018. Founded in 2016 and headquartered in Minneapolis, Minnesota, the company was named to American Inno’s Top Minnesota Startup Fundings of 2018 in December, the same month the company announced the hiring of new Chief Risk Officer Jamie Kirkpatrick.

Also late last year, Sezzle picked up a $100 million line of credit from Connecticut-based investment firm, Bastion. The financing helped Sezzle promote its pay-in-2019 initiative with online retailer Tobi during last year’s holiday season. Sezzle also partnered with Priority Payment Systems last fall, which began offering Sezzle’s alternative payment option to the 174,000+ merchants on its network.

Presenter

Presenter