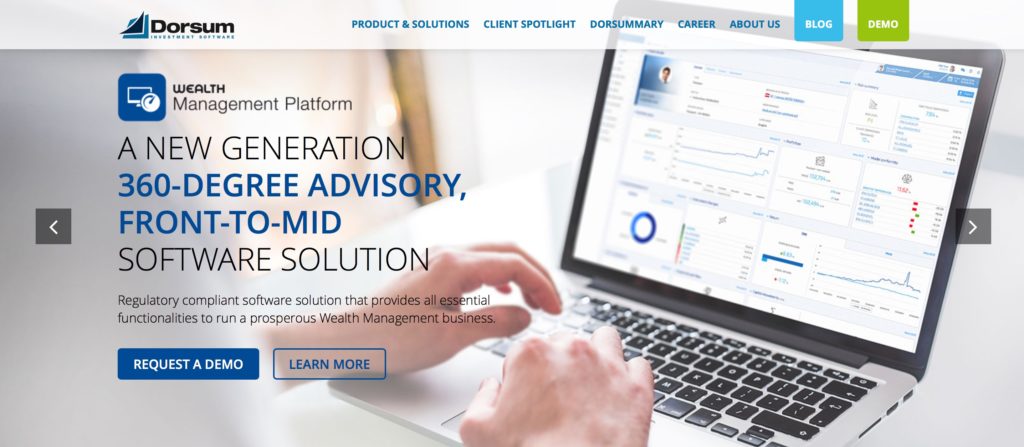

With FinovateEurope kicking off this week in Berlin, Germany, we thought it would be fun to check in with FinovateEurope Best of Show winner and Central and Eastern European fintech innovator Dorsum.

How are the social and technological changes in Europe influencing the way fintechs and financial services companies build, pilot, and market their solutions? We reached out to Dorsum’s Senior Innovation Expert, Greg Csorba, to find out how the company is meeting these challenges and more.

Finovate: As a European fintech, what is the most exciting thing about fintech in Europe right now, and how is Dorsum taking advantage of this opportunity?

Greg Csorba: In the next 10 to 15 years a significant amount of wealth will pass from the Baby Boomer generation to the Y (Millennial) and Z generations. This will, among other things, change the service model expected of investment service providers. This multigenerational wealth transfer will present a real challenge for every player in the market to adapt to the digital expectations of the new generation, which could bring significant business benefits in the coming years.

Finovate: Dorsum won Best of Show at FinovateEurope last year. What does that accomplishment mean for the company on the eve of your return to FinovateEurope?

Csorba: We were very honored to have won the award last year at FinovateEurope. It confirms that our solutions represent what the industry demands. Every year we are working on understanding our clients better to create new, innovative products, answering their needs. This mindset lead us to create the subject of this year’s show as well, our Wealth Management Communication HUB. We do hope that it will win over the audience as well.

Finovate: For those unfamiliar with Dorsum, can you tell us a little bit about the company and the work it does?

Csorba: Dorsum is an investment software provider company, based in Hungary with two other subsidiaries in Romania and Bulgaria. Since our foundation in 1996, we became a leading software company in the CEE region. Our investment software family offers versatile solutions to players in the capital and wealth management markets. We are especially proud of our innovation team who always keeps one step ahead of the market for the company to continue creating industry-leading solutions.

Finovate: What are some of the key enabling technologies used by your platform? Do machine learning, AI, and other new technologies play a major role in powering your offerings?

Csorba: Yes, we always looking at new technologies and new ways to empower our customers. AI and machine learning are used in our Botboarding chatbot engine, our client-facing investment app My Wealth, and the new Communication HUB. As for the future, we are looking into innovative ways of using and applying information from Big Data databases, which has yet to make a notable change in the lives of wealth managers and investors. For example, we are excited to work on a project aiming to profile users based on their everyday interactions with other digital services – which could reflect their attitude towards risk taking and provide personalized product recommendations.

Finovate: Dorsum is known for its work in the Central and Eastern European markets. How is the company’s growth in this region going and are there any significant plans for expansion beyond the CEE?

Csorba: This year one of our greatest achievements was to win BNP Paribas and their Polish subsidiary as one of our customers and we are working on new deals to continue this growth in the future. In 2020 we are mainly focusing on the CEE market as our main target group. To this end, it’s important for us to have a constant presence in the most prestigious Europe-wide conferences such as Finovate.

Finovate: Dorsum uses a hybrid model combining traditional and digital advisory processes. Why do you think this is a winning strategy for you and your clients?

Csorba: We see that new digital technologies in wealth management and the private banking industry are always welcome, but clients still need and rely on the advice of their advisor. This type of advice however can be managed in innovative ways on digital platforms. This is why we created a hybrid advisory model where digital meets the personal touch. Clients can manage their portfolio on their own, but if they need, they can learn from an AI-driven chatbot or reach their personal advisor through an app and real-time chat.

Finovate: What does Dorsum have in store for 2020? Can you give us a little preview of what you’ll be presenting at FinovateEurope next week?

Csorba: We are presenting new communication features for our wealth management applications, referred to collectively as the Wealth Management Communication HUB. The HUB connects advisors and clients through notification sending and real-time chat. This GDPR- compliant, secure communication module is superior to non-binding e-mail chains, and includes automated notification sending, paperless document underwriting and even an integrated educational chatbot. The HUB represents our hybrid advisory vision, as it allows banks to reach the mass affluent and well as the private banking segments with digital products, saving time and money through efficiency.

Watch Dorsum demonstrate its latest technology live at FinovateEurope in Berlin, Germany, February 11 through 13. Tickets are still available.

Here is our weekly look at fintech around the world

Sub-Saharan Africa

- Nigerian fintech Wallets Africa unveils its new Wallets for Developers offering.

- ITWeb’s Samuel Mungadze looks at how a pair of South African fintechs – Meerkat and Spoon Money – are “redesigning financial services.”

- Nigeria’s The Guardian profiles African fintech pioneer, Segun Aina, on his 65th birthday.

Central and Eastern Europe

- Hamburg, Germany-based digital debt servicing platform Receeve raises 4 million euros in seed funding.

- Analysis from Sberbank shows that for the first time, Russian made more digital payments than cash payments in the fourth quarter of 2019.

- Varengold Bank announces plans to open a fintech hub in Berlin.

Middle East and Northern Africa

- Morocco’s Bank Assafa goes live on Path Solutions’ iMAL core banking system.

- National Bank of Kuwait announces availability of Fitbit Pay.

- Entrepreneur.com lists “4 Things to Know About the Middle East Fintech Industry.”

Central and Southern Asia

- Freelance Wallet, the product of a new partnership between Paystand and JS Bank, enables freelancers in Pakistan to receive payments via smartphone.

- PayU co-founder Shailaz Nag raises $8 million in seed funding for his finech startup, Dot.

- State Bank of India partners with BEP Systems for mortgage origination.

Latin America and the Caribbean

- The Mexico City-based Startupbootcamp Fintech accelerator run by Finnovista reports that four of the 20 fintechs in its latest graduating cohort have female leadership.

- Born2Invest examines the state of Chile’s fintech sector.

- Mexican digital banking startup Stori locks in $10 million in funding.

Asia-Pacific

- Jumio teams up with CIMB Bank Phillippines to bring its digital onboarding and AI-enabled identity verification to Filipino customers.

- Singapore-based ridesharing firm turned fintech giant Grab acquires robo-advisor Bento Invest.

- Fiserv partners with Hong Kong digtal bank pioneer ZA Bank.

As Finovate goes increasingly global, so does our coverage of financial technology. Finovate Global is our weekly look at fintech innovation in developing economies in Asia, Africa, the Middle East, Latin America, and Central and Eastern Europe.