Startups are advised to find pain-points, then build businesses to profitably solve them. Despite the current wave of very bad publicity around banks, especially the big ones, everyday banking isn’t a huge pain-point for the 80% of households currently served by existing players.

Startups are advised to find pain-points, then build businesses to profitably solve them. Despite the current wave of very bad publicity around banks, especially the big ones, everyday banking isn’t a huge pain-point for the 80% of households currently served by existing players.

Sure, I’d like to have more security options, fewer unintelligible messages, and a Cash Tank. But most of these are feature/function improvements, not “must-have” issues that need to be solved.

What are the acute pain points in banking and personal finance?

- Debt management, especially credit card and student loans

- Home financing

- Small business financing

- Insurance

- Retirement planning/saving

Three of these five have to do with the debt side of the consumer’s balance sheet. Yet, much of the talk about online/mobile banking innovations centers around spending management, payments, checking and savings accounts, and account access technology.

So I get pretty excited about innovations on the debt front. And last week, there was an interesting launch on the student-loan-management front, SmarterBank from Finovate alum, SimpleTuition. Its tagline says it all:

It’s a truly free, full-featured checking account, with debit card, paper checks and all the usual (but no branches, of course). And it’s powered by The Bancorp Bank, which has its hands in many of the new direct banking initiates we are seeing, including (bank) Simple.

But the special sauce is a built-in rewards program tied directly into student loan payback.

___________________________________________________________

How it works

___________________________________________________________

It’s actually two separate accounts, rewards and checking. You don’t need to buy the checking account to participate in the rewards program. But you must be in the rewards program before you can get a SmarterBank checking account.

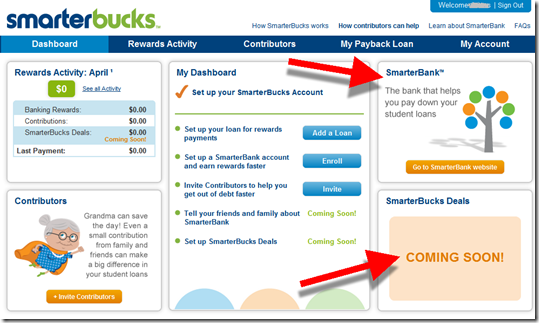

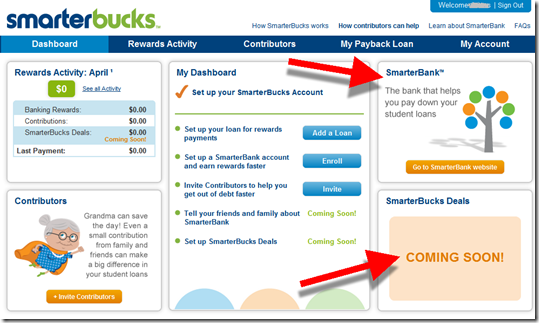

- SmarterBucks: rewards piece (see first two screenshots below)

- SmarterBank: the checking account

Users accumulate cash to accelerate student-loan payback in three ways:

- Deals/offers (note 2)

- Banking rewards (from linked SmarterBank checking account)

- Direct contributions from family and friends

SmarterBucks dashboard (8 April 2012)

Note: (1) Link to SmarterBank in upper right

(2)The deals piece is marked “coming soon”

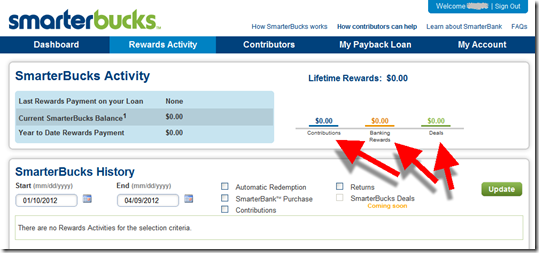

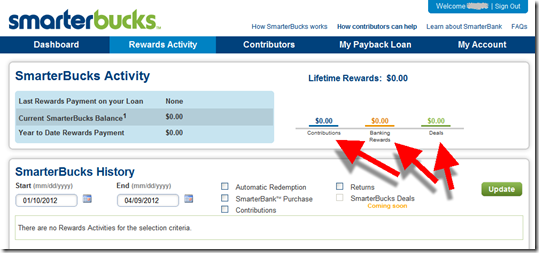

SmarterBucks reward activity

_________________________________________________________

Sign-up process

_________________________________________________________

1. Sign up for SmarterBucks, which as a non-financial account requires only name and email address

2. Add a student loan that SmarterBucks rewards are credited to

3. (Optional) Add a SmarterBank account so that non-PIN debit purchases earn SmarterBucks rewards

4. (Optional) Invite family to contribute money directly to the SmarterBucks account

SmarterBank application hosted by The Bancorp Bank (link)

______________________________________________________________

Analysis

________________________________________________________________

Marrying rewards, checking/debit, P2P family contributions, and student loan repayment is brilliant. It not only provides a tangible benefit for the 37 million Americans with student loan debt (see note 1), but also is a great customer-acquisition tool for a very important segment, recent college grads. Financial institutions looking for more twenty-something customers should consider building similar capabilities or partnering with SimpleTuition.

———-

Notes:

1. Figures are from the company. It also said that 10 million students owe more than $50,000, and 2 million owe more than $100,000.

2. Friends and family will also be able to link their own SmarterBucks account to the student’s.

3. We covered family/student banking nine months ago in our Online Banking Report (here).