I was pretty excited for my first ride in my nephew’s brand new Tesla. The car was a major upgrade from his previous vehicle: a Jeep with “character” that had both broken down and been broken into a few times too many. His visit – and the Tesla’s – also marked the first time my wife and I would have company over for dinner since the COVID-19 pandemic struck, so there was more than a little to look forward to.

And while the Greek burgers were good and the tzatziki and baklava even better, my ride in the brand new Tesla was … kinda underwhelming.

Admittedly the experience as a rider in a Tesla is not identical to the experience as a driver. But as I slowly emerged from my initial shock at the lack of ornamentation, the absence of anything even resembling a full service dashboard and began to appreciate the machine’s unnaturally silent acceleration, its “It’s-All-on-the-Tablet” functionality, and “front trunk,” it dawned on me just how dramatically Tesla had reduced the driving experience to its most essential features and then turned them up to eleven.

What does this have to do with banking?

My Tesla experience reminded me of the challenge of distilling customer experience into its most necessary aspects. This is what drives innovation in everything from PFM apps that provide account balances without requiring login to mobile brokerages that cut out the stock market’s most hated middle man – commissions. Yet what is a trifle to one customer can be a can’t-do-without attraction to another. In the same way that I found myself in my nephew’s Tesla actually missing the dials, buttons, and other dashboard gizmos that had once defined automotive technological sophistication, so will many consumers find the leanness of new digital banks, for example, and perhaps even the trend away from what might be called “the human touch” in financial services to be a less appealing customer experience rather than a more fulfilling one.

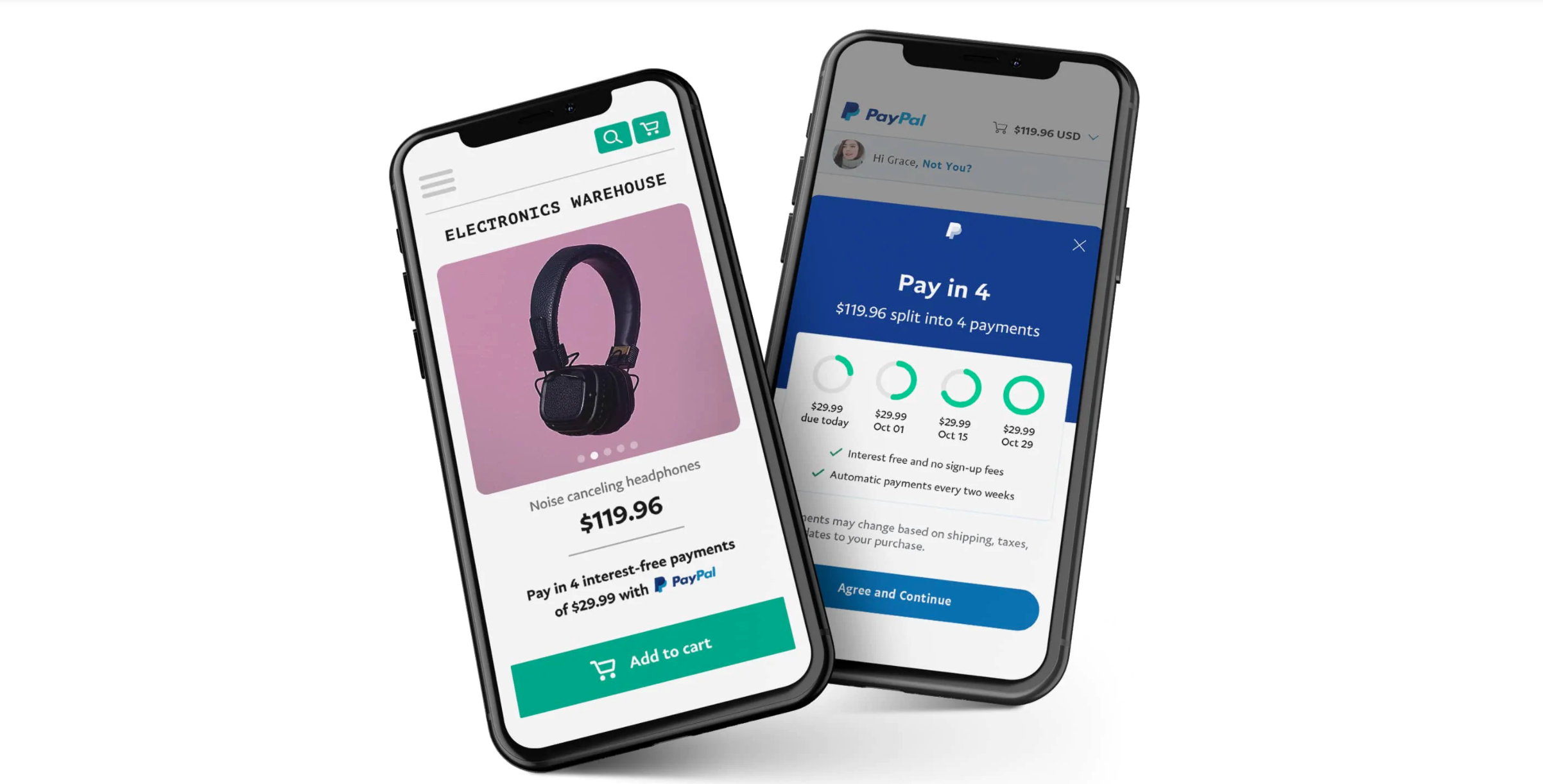

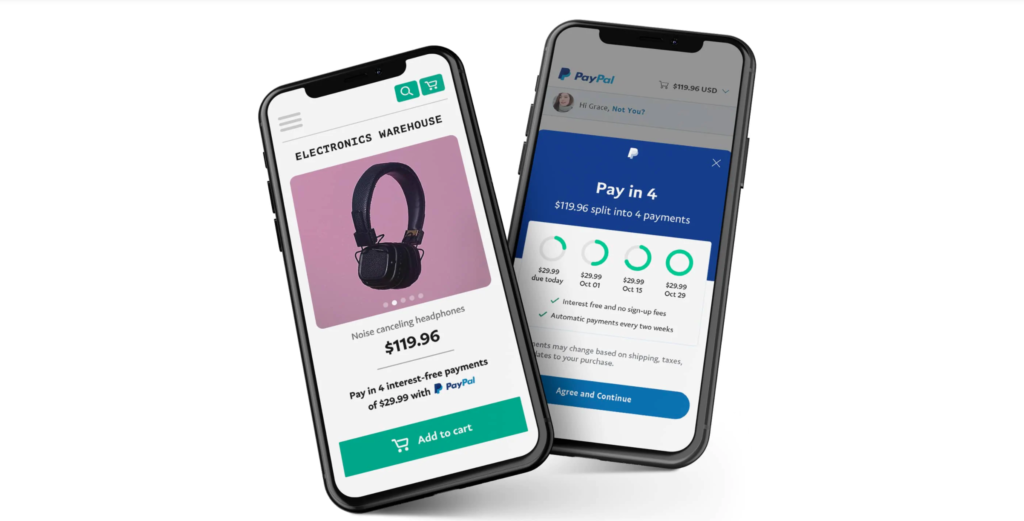

In this way, I wonder if it is helpful to think of two innovation tracks for banks and financial services. One track is the one we spend most of our time reading and thinking about in fintech circles: the digital-first if not digital-only mobile bank that caters to the young, the mobile and, ironically, to both the hyper social connected individual and the asocial consumer who believes that automated checkouts at the grocery store are the best thing since sliced bread. Here the innovations are mostly technological, leveraging AI, machine learning, Big Data, and other leading technologies to provide more data, more services, faster, with a premium on seamless, frictionless, no frills interactivity.

But there is – or at least could be – another bank. And while it is digital, as well, and provides many if not most of the same basic financial services as any other bank, this bank focuses more on responding to the personal and social worlds of its customers. This bank puts financial inclusion and wellness at the center of its mission, sponsoring and providing educational opportunities for members of the local community – including their children who are likely getting precious little financial education in school. In-person credit counseling and financial planning would also be a good fit for an institution like this, which would play a role in the private sphere of a community that is similar to the role a local library or post office plays in the public sphere. At more advanced levels, coursework and training for individuals looking for careers in financial services could be offered, as well.

Not necessarily 100% or exclusively brick and mortar, this truly community-based financial institution would provide a customer experience that would be very different from its all-digital cousin, but one that could be just as innovative by using technology to make finance and financial services easier to understand and easier to incorporate constructively in the average working and middle class person’s life.

Photo by Chad Russell from Pexels