“The new feature to the existing service allows senders to simply convert an AcceptEmail into an AcceptSMS. A short URL sends the recipient via mobile internet to the secured AcceptEmail transaction page. From this landing page the payment can be done, choosing one of the many available payment methods. The outstanding amount is safely paid via credit card, debit card or online banking and soon also via mobile banking.”

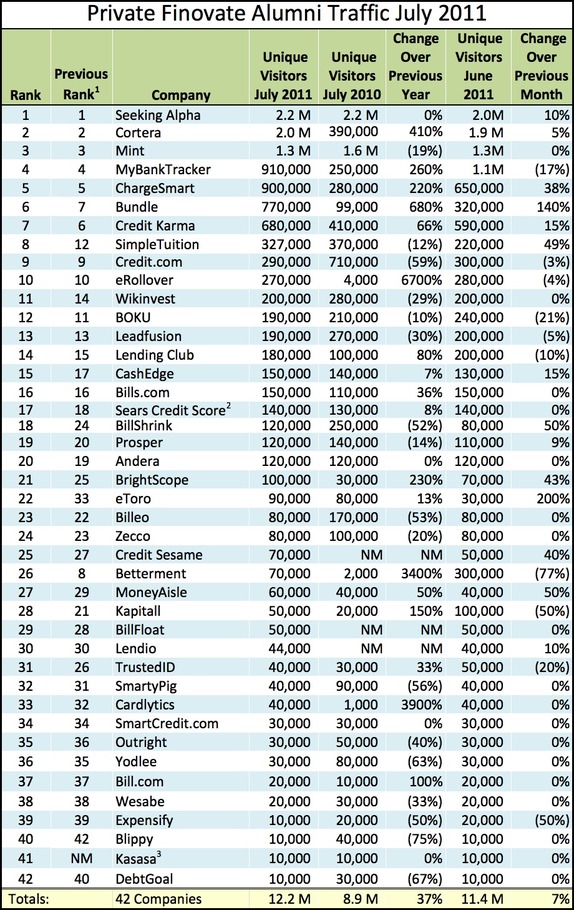

Finovate Alumni Website Traffic in July

- Seeking Alpha had the most traffic in July with more than 2 million unique visitors.

- eToro saw the highest monthly growth percentage with 3 times the number of unique visitors in July compared to June.

- Bundle had the highest increase in number of unique month-over-month visits, with 450,000 more visitors in July than in June.

- eRollover had the highest percent year-over-year traffic increase, with 260,000 more visitors from last July.

- PayPal had the highest number of U.S. visitors in July, with more than 30 million visitors.

- Jack Henry & Associates saw the highest monthly growth with twice as many visitors in July than June.

- Wipro Technologies had the highest year-over-year growth, with 3 times as many visitors this year compared to last year.

- FIS Global and Online Resources also doubled their traffic compared to last year.

Capital Access Network’s Risk Determination Method

“Took the ‘overall most innovative’ category in Barlow Research Associates’ Monarch Innovation Awards, which recognizes financial industry innovation. One of the judges, Robert Seiwert of the American Bankers Association, says the concept takes valuable information that used to be considered the proprietary information of analytics firms and makes it available to any bank that wants to pay for it.”

“What Capital Access has come up with is a third way,” Seiwert says. “Instead of waiting 30, 60, 90 days after a quarter is over to get the financial statements, we can get data daily and get into the heartbeat of a business to figure out how it’s doing.”

BOKU Forms Direct Carrier Billing Agreement with Two French Mobile Carriers

“These deals give BOKU nearly 100% coverage of the French mobile market, which is nearly 50 million mobile subscribers total. Bouygues Telecom and SFR are actually launching a new service, called Internet + Mobile, allowing consumers to purchase goods online and use BOKU to pay with their mobile phone number. BOKU says the purchase process only requires two-clicks and gives online merchants access to a full range of price points of up to 10 Euros.”

Mint.com Helps Users Keep Track of What’s Ahead with New Bill Timeline & Reminders

It’s hard to believe that Mint turns four next month. It made its financial industry debut at our first Finovate conference (demo here, Oct. 2, 2007) after having launched to the general public a few weeks earlier.

It’s hard to believe that Mint turns four next month. It made its financial industry debut at our first Finovate conference (demo here, Oct. 2, 2007) after having launched to the general public a few weeks earlier.

With 5 million registered users, and public ownership (Intuit), it’s now “the establishment” that dozens of startups look to unseat.

Mint made a large stride forward this week with the addition of a bill-due-date timeline to its Overview page, the page that users land on after login (see inset and first screenshot below).

The company also expanded its text and email bill-due-date reminder system. A wizard launched from a promotion on Mint’s main page (screenshot 2, 3) prompts users to establish reminders for regular household bills.

Bottom line: Mint’s billing timeline is a good example of the forward-looking approach that’s much needed in online and mobile banking.

—————————————–

A timeline of upcoming bills has been added to the Mint.com’s main Overview page (25 Aug. 2011)

Mint promotes the new feature with a huge interactive banner on the main Overview page

In this pop-up box, Mint gathers together likely bills and asks if you want a reminder

A timeline of upcoming bills has been added to the main overview page

——

Note: For more on online personal financial management (OFM), see Online Banking Report (published May 2010).

FinovateFall 2011 Sneak Peek: Part 2

![]() More than 60 leading fintech innovators, both startups and established companies, are gearing up to present at the biggest Finovate ever, Sept. 20/21 in NYC.

More than 60 leading fintech innovators, both startups and established companies, are gearing up to present at the biggest Finovate ever, Sept. 20/21 in NYC.

ti-media content directly to your clients’ Apple, Android, BlackBerry, or Microsoft smartphones and tablets.

the support center. IND Mobile banking is more than just the extension of online banking features, unique ergonomic design, user experience, security and the fact that it is always-online.

o create missions.

Betterment Expands Portfolio Options by Adding International Investments

“As of last month, Betterment’s portfolio includes international exposure through the addition of two new exchange-traded funds: Vanguard Europe Pacific and Vanguard Emerging Markets.”

Dwolla Announces New Proxi Service

“The new tech will allow users to convert their Dwolla enabled devices into movable Spots to seamlessly take payments without additional hardware, like NFC or dongles.”

What Online Banking and the Weather Have in Common

I’ve always been a bit obsessive about the weather. I blame it on my Iowa roots, where the economy ebbs and flows depending on the rain and sunshine, and where you have just about every type of weather condition, sometimes in the same day.

I’ve always been a bit obsessive about the weather. I blame it on my Iowa roots, where the economy ebbs and flows depending on the rain and sunshine, and where you have just about every type of weather condition, sometimes in the same day.

One of the main reasons I wanted an iPhone back in 2007 (in the days before the App Store and mobile banking), was to get a weather button in my pocket 24/7. But it wasn’t until today I realized that weather info is a decent metaphor for where remote banking is headed.

Think about the weather displayed on your mobile or PC. You get some pretty good info about what’s going to happen today, plus decent estimates on the next few days, followed by a SWAG on what might happen a week or two out. This is helpful for planning your clothes, weekend activities, and as a last resort, for making conversation (sorry family).

This is exactly what’s needed in online banking, a FORECAST of your finances. You need to know exactly where you stand today, plus you need an accurate prediction of your cash flows for the rest of the week based on pre-scheduled payments, followed by reasonable estimates of how things stand for the next month based on historical income and expenses.

Most of the major PFMs are incorporating forward-looking views into their interfaces. It’s probably THE most important missing element in today’s online banking. A financial forecast should be shown right next to the current balance on the main account page.

Most of the major PFMs are incorporating forward-looking views into their interfaces. It’s probably THE most important missing element in today’s online banking. A financial forecast should be shown right next to the current balance on the main account page.

Bottom line: It’s not a perfect analogy. It’s still important to track historical spending to look for waste, fraud, and opportunities to save (note 1). But consumers need help understanding their financial position going forward. So crunch the numbers for them and let your customers get back to their mobile entertainment, even if it’s checking the weather in Yakutsk (notes 2, 3).

———

Notes:

1. And you can help with that too; see BillGuard post.

2. Yakutsk, Russia, is the coldest city you can track on the iPhone (hat tip to my nephew Marcus).

3. And yes, that’s an actual image stored on my iPhone. I don’t make these things up.

4. For more on online personal financial management (OFM), see Online Banking Report (published May 2010).

Bill.com Launches Invoice Mailing Service

California-based Bill.com launched a billing feature that allows small businesses and accountants to invoice their customers via snail mail.

“Bill.com’s Accounts Receivable (AR) update enables users to send printed bills to their customers via U.S. mail at below the cost of what a typical company would spend printing, stuffing and mailing invoices.”

This new service will benefit those who prefer paperless billing methods by allowing them to send invoices to customers who still use paper invoices.

It also includes new features such as:

- The addition of a Quick Response (QR) code on the invoice that allows the recipient to scan the code and link directly to their Bill.com Payment Portal.

- The ability to integrate with QuickBooks and Peachtree accounting software

To learn more about Bill.com, watch its FinovateSpring 2011 demo here.

Mint.com Adds Bill Payment Reminder Feature

Mint.com launched a new bill payment reminder feature today that provides one place where users can track upcoming bills. This timeline format lets users see their bills over time and allows them to set customized due date reminders.

Mint.com launched a new bill payment reminder feature today that provides one place where users can track upcoming bills. This timeline format lets users see their bills over time and allows them to set customized due date reminders.

“‘Juggling due dates and amounts owed, and jumping from websites to paper statements, is tedious and confusing. Busy people have better ways to spend their time and money, such as saving toward a goal,’ said Aaron Forth, VP and GM of Intuit’s Personal Finance Group”

Mint.com will automatically recognize user’s bills based on prior bank statements and monthly patterns.

To learn more about Mint.com, check out its FinovateSpring 2011 demo here.

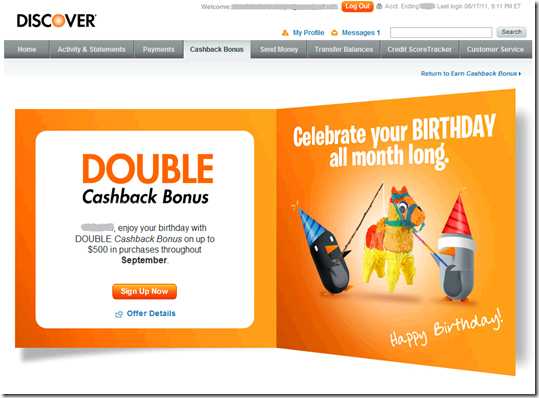

Out of the Inbox: Discover Card’s Birthday Present

Although worth only $5 at most, Discover Card’s month-long Double Cashback Bonus (on the first $500 spent) sure sounds impressive. And combined with the cute penguin visuals, it’s an effective birthday greeting. And probably the first one you’ll get since it’s sent two weeks in advance of the first day of the month of your birthday.

Recipients must register to receive the bonus, a common technique to keep costs down. The card issuer continues to display dazzling graphics throughout and even sends a confirmation email (below). Great attention to detail.

It would be nice if you didn’t have to do a full login to register. But for extra reward points, most users will put up with the hassle.

Grade = A-

Discover Card birthday email (18 Aug. 2011, 2 weeks in advance of the birthday month)

First landing page: Log in (link)

Second landing page: Register (link, must be logged in to your Discover account)

Confirmation screen

Confirmation email

-thumb-150x65-3844.jpg)