Here’s a look at the press coverage from

FinovateFall 2012 held September 12 and 13 in New York:

ABA Banking Journal

Bank Technologists Meet American Idol

by John Ginovsky

AdvisorOne

Stock Picking Goes Social as Stockr, aSpark Debut

by Joyce Hanson

American Banker

Apple Effect Evident at Innovator Gathering

by Mary Wisniewski

Dynamics Adds Another Option for Its High-Tech Cards

by Daniel Wolfe

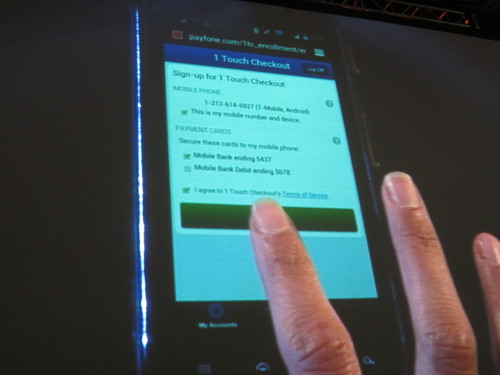

Payfone Aims to Make Mobile Payments Pain-Free

by John Adams

PreCash to Debut Mobile Wallet for the Underbanked

by Daniel Wolfe

Reporter’s Notebook: Day 1 FinovateFall Favorites

by Mary Wisniewski

The Top 10 Tweets of Finovate

Andera blog

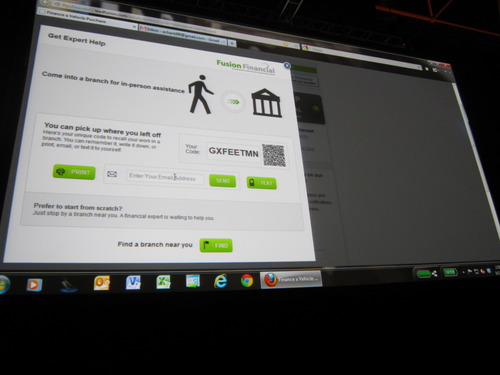

Finovate Takeaway: User Experience in Retail Transactions

by Andrea Hunter

Bank Innovation

Finovate Fall 2012: Demo Performance Scores and Reviews

by JJ Hornblass

Wade Arnold, CEO of Banno, Presents Grip

by Phillip Ryan

Bank Systems & Technology

5 Hot Bank Technologies From FinovateFall 2012

by Bryan Yurcan

Banno Releases Updated Grip Product

by Bryan Yurcan

MasterCard Forms New Rewards Program Partnership with Linkables Networks

by Jonathan Camhi

Mobile Commerce Company Payfone Debuts Checkout Solution

by Bryan Yurcan

Business Insider

Financial Planning Startup LearnVest Already Has Millionaire Clients

by Alyson Shontell

The Business Review

To save or buy is ImpulseSave’s question

Celent

FinovateFall 2012 Recap

by Jacob Jegher

Consumer Reports

Finovate Fall 2012: A solution to the mortgage crisis?

by Tobie Stanger

Finovate Fall 2012: Help with students’ loans and seniors’ bills

by Tobie Stanger

Finovate Fall 2012: Making, managing and keeping money

by Tobie Stanger

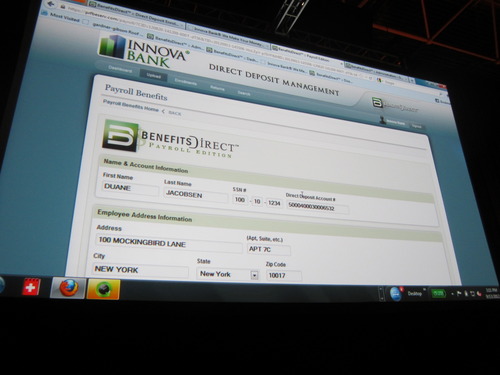

Finovate Fall 2012: Now maybe you’ll switch banks

by Tobie Stanger

Contactless News

Dynamics unveils Triple Interface, battery-powered payment card

Credit Sesame Blog

Check Out the Newest Way to Measure Your Credit and Loan Health!

by Erin Renzas

CreditUnions.com

Finovate Dispenses Inspiring Ideas (Part 1)

by Aaron Pugh

Finovate Dispenses Inspiring Ideas (Part 2)

by Aaron Pugh

The Currency Cloud blog

Finovate NY – Video & Photo Diary

by Nasir Zubairi

CU Soapbox

GUEST POST: Innovation Unveiled In The Big Apple

Alix Patterson

Daily Finance

A Digital Wallet for the Unbanked: Mobile Finance Goes Downmarket

by Ross Kenneth Urken

The Digital Mailer Blog

FinovateFall 2012: A Recap

Discerning Technologist

Best of Show Locked Up? @MoneyDesktop Demo At #Finovate

by Bradley Leimer

Dough Roller blog

The Best Way to Track Your Investments Online (and it’s Free!)

by Rob Berger

Dwolla Blog

Dwolla at FinovateFall

by Caitlin

Financial Planning

LearnVest Becomes an RIA, Plans to Hire Advisors

by Elizabeth Wine

Finextra

EToro launches social trading index

PreCash introduces mobile wallet for underbanked

Fintech Marketing blog

William Mills III, CEO William Mills Agency Live Blog from Finovate Fall NYC 2012-DAY ONE

by William Mills III

William Mills III, CEO William Mills Agency Live Blog from Finovate Fall NYC 2012-DAY TWO

by William Mills III

FintechToday

TOP TEN AT FINOVATE 2012

by Walt Cox

Forbes blog

4 Great New Tools to Manage Your Money

by Richard Eisenberg

Gonzobanker Can Make FinTech Amusing

by Tom Groenfeldt

LearnVest Reinvests In Its Mission: Financial Planning For The 99%

by Meghan Casserly

If You Want to Really Raise Capital, Try This Company and Not KickStarter

by Mark Fidelman

The Problem with Finovate

by Helaine Olen

GigaOM

Forget Mint, LearnVest’s new platform takes aim at financial planning industry

by Ki Mae Heussner

Locaid bolsters location service with IP address data

by Ryan Kim

Gonzo Banker

Vendor Dirt: 2012 Finovate Fall

by Scott Hodgins

Huffington Post Money Blog

Online Financial Planning: The Chilling Thing I Found Out About My 70th Birthday

by Catherine New

JP Nicols Blog

Finovate Fall 2012 Best of Show Winners

by JP Nicols

Keeping Nickels

My Tweets from #Finovate

by Nichelle Stephens

Moment NYC blog

Finovate Fall 2012: Less tech, more desire.

by Alexa Curtis

MyBankTracker

Dashlane: Finally Something that Might Actually Make Online Shopping Easier

Dynamics Introduces Card Capable of Swipe, EMV, Contactless Payments

Finovate Wrap-Up: What Can FinTech Do for You? Really?

by Willy Staley

Ideon Choice Unveils Platform for Customer-Created Savings Products

ImpulseSave: Another App to Help You Save

LearnVest Gets SEC Certified, Announces Mobile App, Upgrades

by Willy Staley

Linkable Networks, MasterCard Expand Card-Linked Offers

by Simon Zhen

Locaid: Enter the Digital Panopticon!

MoneyDesktop Connects PFMs Across Multiple Devices

mShift’s AnyWhereMobile Wallet Actually Adds Value

by Willy Staley

New Technologies Are Coming for Unbanked, Underbanked

by Simon Zhen

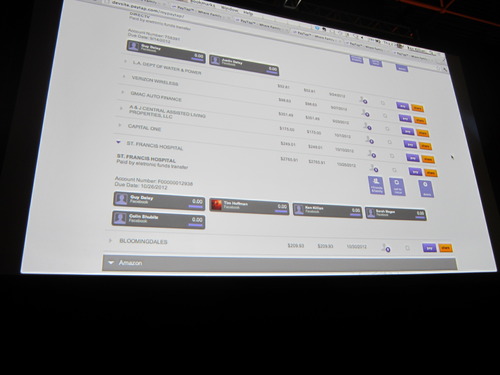

PayTap Debuts Shared Bill Payment Portal

PreCash Announces FlipMoney at Finovate: Mobile Money for the Underbanked

by Willy Staley

SwitchAgent: Bank-Switching Made Easy

by Simon Zhen

Tuition.io — It’s a Pun, Get It?

The New York Times Blog

LearnVest Dips Its Toes Into Investment Advice

by Ann Carrns

Next Avenue

4 Great New Tools to Manage Your Money

by Richard Eisenberg

NYConvergence

FINOVATE: Mobile and Social FinTech Innovations Dominate

by Lauren Keyson

PandoDaily

The Consumerization of Life’s Ickiest Chores Continues: LearnVest Injects Its Financial Planning Tools With Steroids

by Erin Griffith

PaymentEye

Payfone launches a mobile commerce checkout solution

PaymentsJournal

MasterCard Keeps Investing in Rewards, This Time With Linkable Networks

PaymentsNews

FinovateFall 2012 – Best of Show Winners

Payfone To Launch Mobile Commerce Checkout Solution

PayTap Launches Social Bill Pay Service

PreCash Introduces FlipMoney Mobile Wallet for Underbanked Consumers

The Paypers

Banno adds new features to Grip financial aggregation app

Payfone makes 1 Touch Checkout available, partners CardinalCommerce

PC World

New web apps tackle business finance problems

by Yardena Arar

PYMNTS

Banno Unveils New Features for Grip, Strengthens the Mobile Banking Standard with Pre-Transaction Insights

Silicon Prairie News

Banno unveils upgraded interface, new analysis tools for Grip

by Michael Stacy

Snarketing 2.0

SedUIced

by Ron Shevlin

Advice For Finovate Presenters

by Ron Shevlin

TechCrunch

Credit Sesame Adds Social Comparison Tools, Lets You See How Your Debt Compares With People Like You

by Sarah Perez

Dashlane’s Password Management Service Now Alerts Users When Their Accounts May Be Hacked

by Sarah Perez

It’s Not Just For Women Anymore: LearnVest Brings Financial – And Now Investment – Planning To Everyone

by Sarah Perez

Money Management Service Personal Capital Wants To Manage Your 401K

by Leena Rao

Telecompaper

Payfone launches m-commerce checkout service

Tier One blog

Finovate: Day One in Review

by Kathy Wilson

FinovateFall Part Two! All about Savings, Security and Slick New PFM Tools

by Sue Parente

The Next Web

eToro launches Social Trading Index for learning from other traders and sharing top techniques

by Jamillah Knowles

LearnVest launches redesigned tools, new financial plans and teases its upcoming iPhone app

by Harrison Weber

Thomson Reuters

EPAM Systems and Thomson Reuters announced a partnership to develop and host an App Store solution

Upstart Business Journal

Financial planning, iPad app among best at Finovate

by Kent Bernhard, Jr

Get a 401(k), win an iPhone5

by Kent Bernhard, Jr

LearnVest targets masses for professional financial advice

by Teresa Novellino

No need to wait for crowdfunding

by Kent Bernhard, Jr

Personal Capital aims to disrupt 401(k)

by Kent Bernhard, Jr

Sci-fi meets finance at Finovate

by Kent Bernhard, Jr

VentureBeat

Financial planning for all: LearnVest gets its biggest update yet

by Devindra Hardawar

Locaid launches Internet and mobile location-tracking service

by Dean Takahashi

Be sure to check back because we’ll add more coverage as it is published throughout the week.

Simple is the first (virtual) bank to go “open” by entertaining customers’ wants, needs, problems, and various crazy requests on its Twitter feed. The chatter exposes the ugly underbelly of transaction processing, points out the startup’s painful process of scaling up, eats up way too much staff time, and is just a royal pain in the you-know-where.

Simple is the first (virtual) bank to go “open” by entertaining customers’ wants, needs, problems, and various crazy requests on its Twitter feed. The chatter exposes the ugly underbelly of transaction processing, points out the startup’s painful process of scaling up, eats up way too much staff time, and is just a royal pain in the you-know-where.