Third up,

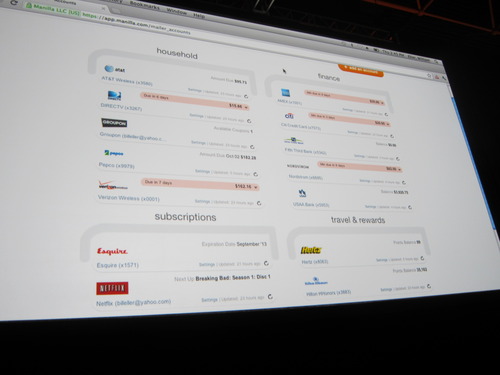

Euronovate launched its paperless technology:

“Existing companies are focused on only one key element, creating a fragmentation of competence and making it difficult for customers to realize a successful paperless project. Euronovate owns all the expertise and the best product to deliver a turnkey paperless program (using partner resources).

ENSIGN 10 + ENSOFT are innovative tablet and software for advanced electronic signature and instant marketing, with a unique concept that assures maximum customer experience and level of security. Features include: 10″ wide screen, biometric data-capture including special on-the-air movement and 1.024 pressure level, one single shell impossible to open, encryption 3DES in communication, USB cable for power and data transmission, avoiding any tentative sniffing, tempered glass.”

Product Launched: September 2012

HQ Location: Lugano, Switzerland

Company Founded: February 2012

Metrics (as of July 31, 2012): 1.3M € in revenues, 15M € in pipeline closing by end of 2012, 6 internal employees, 250 resources available through industrial stakeholders, in due-diligence with Atlante Ventures for raising 1.5M €

Introducing Alberto Guidotti (President & CEO) and Nicola Ruggiero (Director)