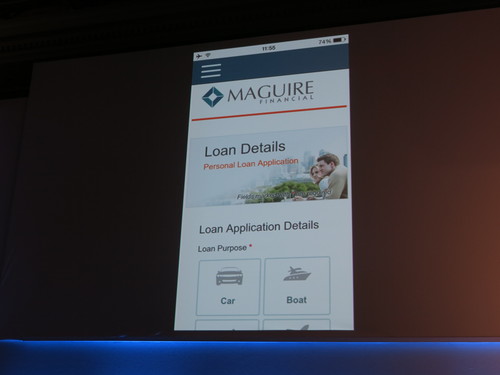

The 3-Minute Loan Application: Fastest Onboarding Experience in the World

Product and pricing are not differentiators in financial services—customer experience is. In particular, frictionless customer experiences have proven effective for attracting and retaining customers. Avoka helped a client go from 36% conversion rate for personal loan applications to 51% in just 4 weeks by focusing on delivering a frictionless experience for the customer. Because online, seconds matter.

We are demonstrating how combining social, cloud services, and crowd sourcing streamlines account opening, and how credit origination minimizes customer effort and takes the friction out of customer acquisition.

Author: Julie Muhn (@julieschicktanz)

VATBox Takes the Headache Out of Tracking VAT

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

VATBox is demoing a first-of-its-kind, cloud-based, truly automated solution. The automated VAT recovery solution and dashboard enable customers to build one global process that tracks and manages VAT spend with ease. Automation guarantees reduce risk, simplicity, and ease of use by eliminating human error and reducing the inefficiencies of manual processes. But, automation and transparency isn’t only about the money, it’s about data integrity. Qualified and validated data delivers visibility, control, and compliance.

VATBox empowers companies like Teva, PPG, and Broadcom by maximizing returns while enabling transparency. Deployment is simple; all it takes is a few simple steps.

With Wipro’s ngGenie myAdvisor, Users Receive Personalized Banking Assistance

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Wipro ngGenie™ myAdvisor truly provides the ‘Next Generation Banking Experience’ for customers. The Wipro ngGenie™ myAdvisor can have an interactive conversation with you in natural language using voice and gestures. Wipro ngGenie™ myAdvisor learns from your spend patterns, banking transactions, retail transactions, and your social transactions and provides personalized assistance.

It is able to adapt to the user, understand context, and provide the right kind of assistance. It learns from the user’s actions and is able to predict user action as well as provide timely help. Wipro ngGenie™ myAdvisor covers a broad range of functionalities across branch, call center, and web, and provides omnichannel experience.

Strands Launches Loop to Combine PFM and Card-Linked Offers

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Strands Loop is a combination of three solutions: Business Financial Management (BFM), Card-Linked Offers (CLO) and Personal Financial Management (PFM). Strands BFM is a white-label product that helps SMEs make better financial decisions. With this intuitive tool, business owners can analyze and forecast future financial needs.

Thanks to the tight integration with Strands CLO and Strands PFM, SMEs are also empowered to influence their future cash flow. With predefined marketing strategies and PFM data insights, SMEs can easily set up campaigns and target highly relevant deals to the card holders. With Strands Loop, financial institutions can create a more seamless and personal banking experience and build better relationships with their SME clients.

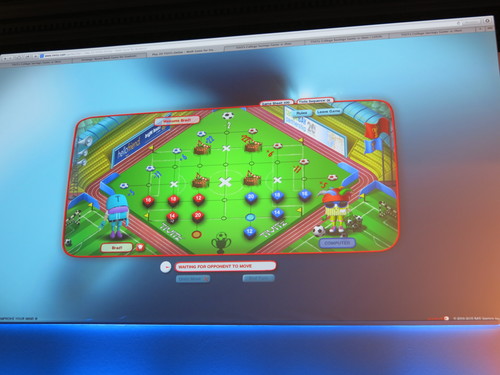

TiViTz College $avings Game-a-thon Helps Kids Save for College

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

The TiViTz College $avings Game-a-thon is a market-disruptive tool that complements existing financial savings vehicles and provides a solution for families to offset potential student-loan debt and to help cover the cost of higher education.

The Game-a-thon—where students solicit pledges online from friends and family for playing TiViTz games—is similar to a Walk-a-thon, only fully automated from pledge solicitation to fund deposit into a savings vehicle. The Game-a-thon can fundamentally change the way families think about affording college and significantly empower children to take responsibility for, and contribute to, their own advanced education, all while improving their math skills and financial literacy.

ebankIT’s Solution Brings Contextual Banking to Multiple Channels

ebankIT aims to materialize in a solution that is much more than a banking application, maximizing the interaction of financial institutions and clients by extending the concept of omnichannel and social banking. In the world of omnichannel banking, customers are in control of the channels they wish to use.For example, they can begin an interaction using one channel, such as mobile, while at home, and end it in another, such as SmartTV or Internet banking. Omnichannel banking brings the industry closer to the promise of true contextual banking in which financial services become seamlessly embedded into the lives of individual and business customers.

Quantitative Credit Research’s RiskAware Forecasts Corporate Defaults

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

RiskAware was developed based on the lessons learned from the financial crises. RiskAware can analyze and measure corporate credit risk quicker and better than existing practices.

RiskAware forecasts corporate defaults on a one-year term with close to 90% accuracy rate. New methodology includes the introduction of the macro environment into credit risk analysis and the simulation of 32 macro scenarios for each loan and borrower.

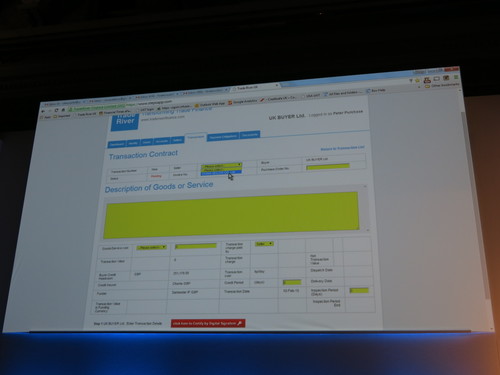

TradeRiver Finance’s Cross-Border Trade Platform Allows Buyers to Pay Suppliers in Local Currency

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

The TradeRiver platform provides a business-funding and transaction-execution solution, which completely changes the nature and operation of cross-border trade finance.

TradeRiver provides the online tool and the finance for trade buyers of goods and services to pay their global suppliers in cash and in local currency at any point in their supply chain using a facility much like an online credit card.

AdviceGames Raises $570,000 from Ibuildings

AdviceGames, the Netherlands-based company that gamifies personal financial management, announced last week it raised $570,000.

The investment comes from Ibuildings, a creator of software that facilitates online communication between businesses and customers. The funding will be used to increase the speed of its machine learning technology and build a solid foundation for international growth.

Since launching in 2013, AdviceGames has invested over $1.1 million to develop and build its machine learning platform.

Tom Schenkenberg, founder of Ibuildings, will join AdviceGames as CTO.

AdviceGames will debut its newest technology this week at FinovateEurope 2015.

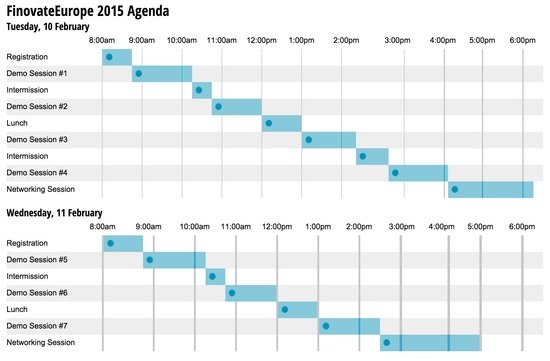

FinovateEurope Lands in London Tuesday

We are excited to be in London again for the fifth annual FinovateEurope 2015. The event begins at 8:00 AM Tuesday, 11 February, at Old Billingsgate Market Hall and continues through 5:00 PM Wednesday, 12 February. If you still don’t have your ticket, pick one up today, because they’re almost gone.

If you’re a registered attendee, download the mobile app to view the agenda, presenters, fellow attendees, and more:

Once you’ve downloaded it, search Finovate and select Join.

Have more questions? Check out our FAQ or email [email protected].

Funding for E.U.-based Finovate Alums Totals $377 Million in 2014

With FinovateEurope less than a week away, it’s a good time to review the results of 2014. In total, European-based alumni of Finovate raised $377 million. And 2015 is looking even better with two major fundings in January:

- $58 million to London-based Transferwise

- $200 million credit line to Hamburg-base Kreditech

Here are the 2014 fundings by quarter:

- Azimo

$10 million

- Birdback

$2.4 million

- Kantox

$9 million - Klarna

$135 million

- Red Zebra

“seven figure amount”** - Zopa

$22.5 million

Total: $21 Million

- Ayondo

$4 million - Tink

$4 million

- SumUp

$13 million

- BehavioSec

$6 million

- eToro

$27 million

- Nous

$0.6 million

- Qapital

$1.3 million

- Trustly

$30 million

- Vaamo

$3.2 million

- Xpenditure

$1.25 million

Note: This total does not reflect funding raised by the 44 new-to-Finovate companies that will demo next week at FinovateEurope 2015.

** We used $1 million for Red Zebra’s “seven figure amount”

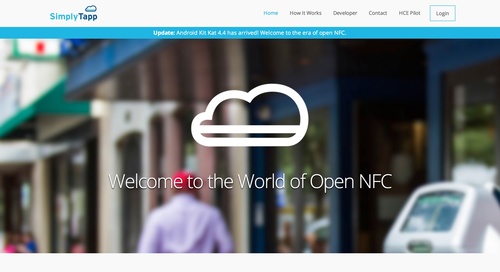

Payments Platform Mozido Adds $2.5 Million to SimplyTapp’s Series B Round

Host Card Emulation company, SimplyTapp, announced a $2.5 million addition to this week’s most recent round, bringing its Series B total to $8.5 million and total cumulative funding to $10.1 million.

The Austin-based company announced the first round, which was furnished by Blue Sky Capital and Lightspeed Venture Partners, last November.

The funding comes from mobile payments and rewards company, Mozido, which is also based in Texas.

SimplyTapp demonstrated at FinDEVr San Francisco 2014.