SayPay Technologies uses biometric authentication to give users an easy way to pay bills, check out online, and log into their online banking website.

Statistics:

- Headquartered in Pleasanton, California

- Founded in February 2014

- Millions of production users in 40+ countries

- Functions in English, Spanish, and Mandarin

At FinovateSpring 2015, the Pleasanton, Calif.-based startup announced a partnership with VoiceVault to leverage the biometric company’s ViGo product for voice authentication.

SayPay Technologies founder Steve Hoffman gave a personal demo of SayPay at FinovateSpring 2015 in San Jose

How it works

SayPay offers voice-based authentication for three main use-cases: bill pay, e-commerce checkout, and online banking login. For all use cases, SayPay identifies the user’s phone, authenticates their voice, and provides authorization for the interaction.

SayPay authentication works on more mobile devices than a fingerprint, which requires the user to have a fingerprint scanner on their device.

Use cases

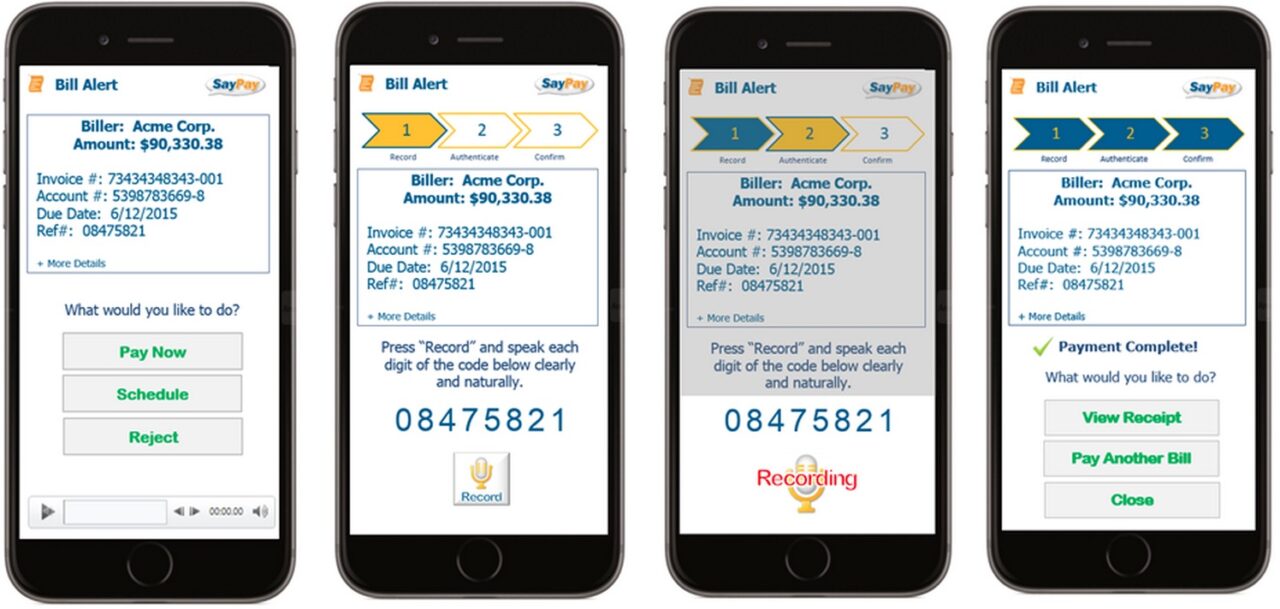

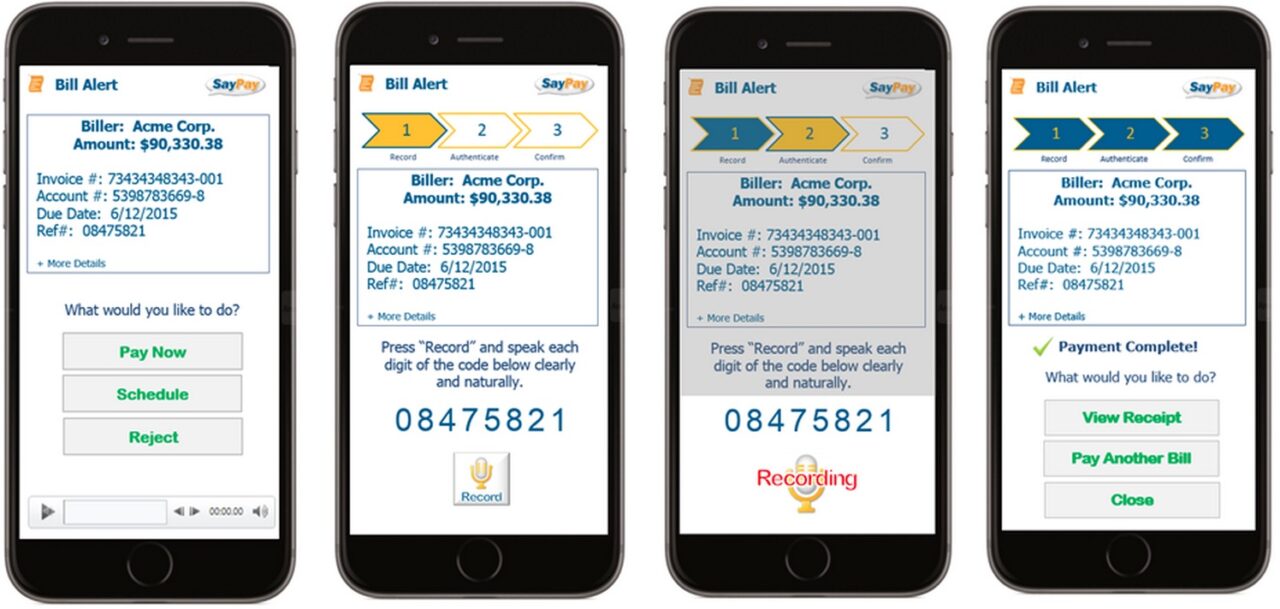

1) Bill pay

After financial institutions integrate SayPay’s white-labeled API into their mobile banking app, clients receive push notifications on their phone to alert them when a bill is due.

Upon opening the push notification, the user views the bill within the bank’s app. At that point, they either set a reminder, pay the bill, or schedule a payment.

When ready to pay the bill, the customer is shown an 8-digit numerical code, unique for each transaction, and which expires if not used. After the client speaks the code, SayPay verifies the code and simultaneously authenticates the voice.

To finalize and schedule the payment, the user selects Confirm and views the receipt. The simple user experience improves cash flow for billers because they receive payment more quickly.

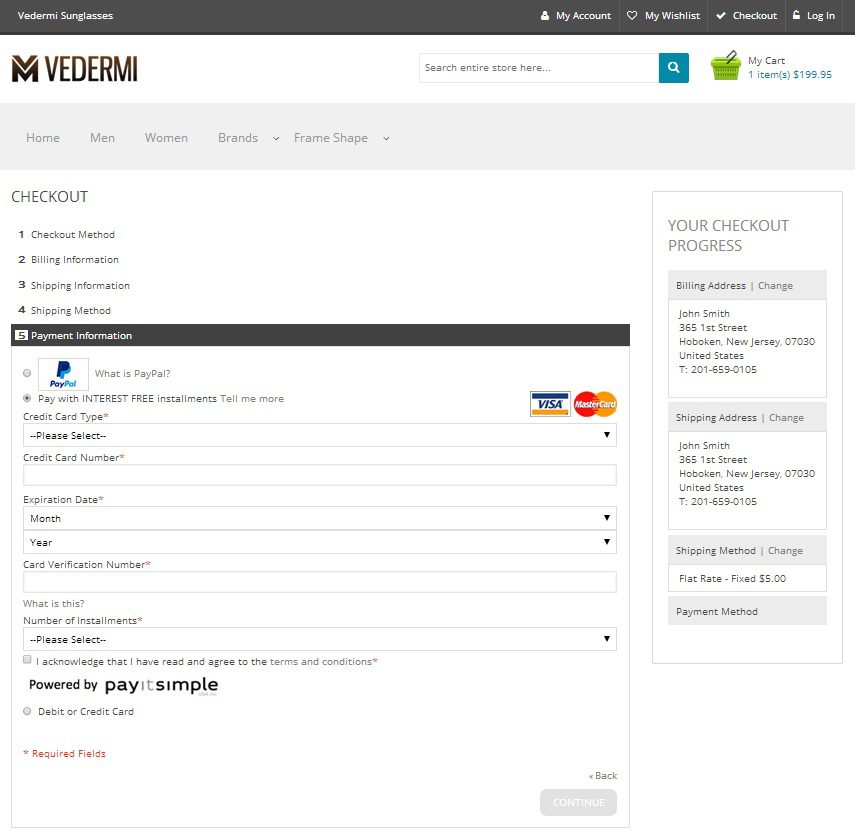

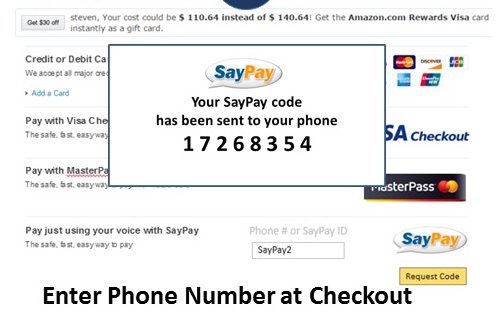

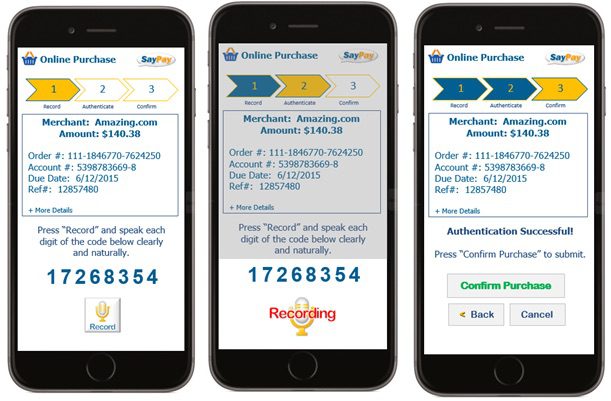

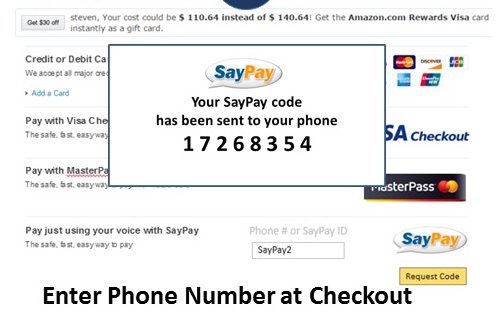

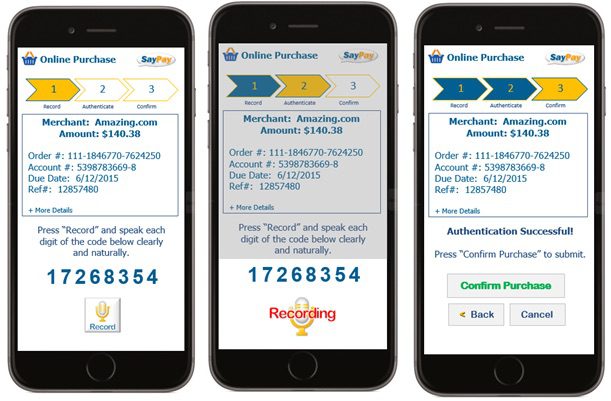

2) E-commerce checkout authentication

Just like SayPay for bill pay, the e-commerce checkout technology authenticates users by sending them a unique code for each transaction, then has them voice the code into their phone.

When shopping at an online merchant that uses SayPay, the customer enters their phone number or SayPay ID into the SayPay option, then selects Request Code.

There is no password needed to complete the transaction. The customer simply speaks the one-time code they were presented with on the checkout screen, selects Confirm Purchase, and the transaction is complete.

According to Steve Hoffman, SayPay CEO, 64% of all online-initiated checkouts end in abandonment. SayPay reduces this statistic by eliminating data entry, thereby streamlining/hastening the process, especially important for mobile consumers.

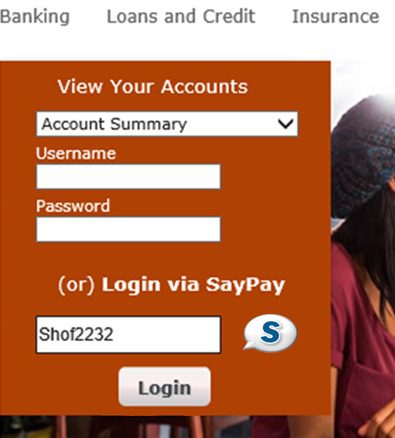

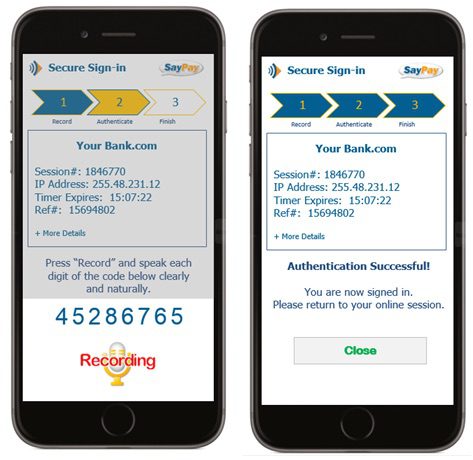

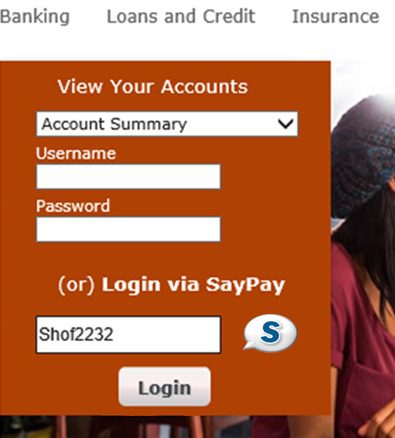

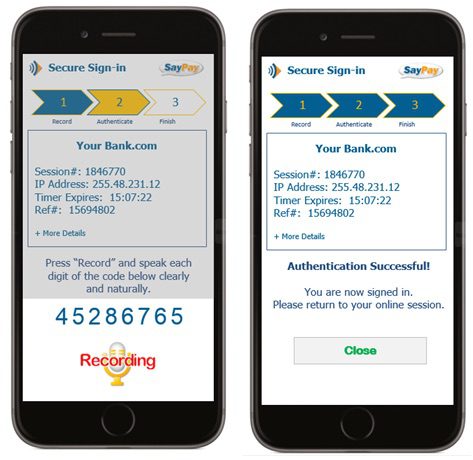

3) Online banking login

Financial institutions can use SayPay across the enterprise: from ACH and P2P payments, to online login and step-up authentication, and bill pay.

Using SayPay as an online banking-login solution, banks offer an improved customer experience with enhanced security.

In lieu of entering traditional online banking log-in credentials, a user simply enters his or her SayPay ID and reads out loud the 8-digit code shown on the mobile device. Once authenticated, SayPay logs the user into the online bank account.

Security

Because SayPay relies on biometrics, it has inherent three-factor authentication. The three factors include the user’s phone, the SayPay code, and the user’s voice. The startup uses 256-bit encryption and never stores personal information on the user’s device.

Additionally, e-commerce and online banking login interactions are out-of-band when customers use SayPay on their laptop.

International Growth

SayPay sees opportunity in the Asia Pacific market, specifically Hong Kong, and is considering international expansion in that direction.

Expansion into more biometrics

As the quality of voice biometrics technology continues to improve, SayPay expects other biometrics to follow the same quality growth curve. For this reason, it hopes to adopt new biometric solutions as they become mainstream. While SayPay has launched with the VoiceVault partnership, it hopes to license its technology to other biometric service providers to plug in other biometric solutions.

Farther in the future, the company plans to expand by offering its API to vendors in different verticals such as healthcare. It also plans to move into wearables, once adoption picks up.

SayPay launched its bill pay and web sign-in offerings at FinovateSpring 2015 in San Jose.

If you live in the U.S., you may be looking forward to spending your long Memorial Day weekend catching up on Finovate demo videos in your backyard theatre.

If you live in the U.S., you may be looking forward to spending your long Memorial Day weekend catching up on Finovate demo videos in your backyard theatre.