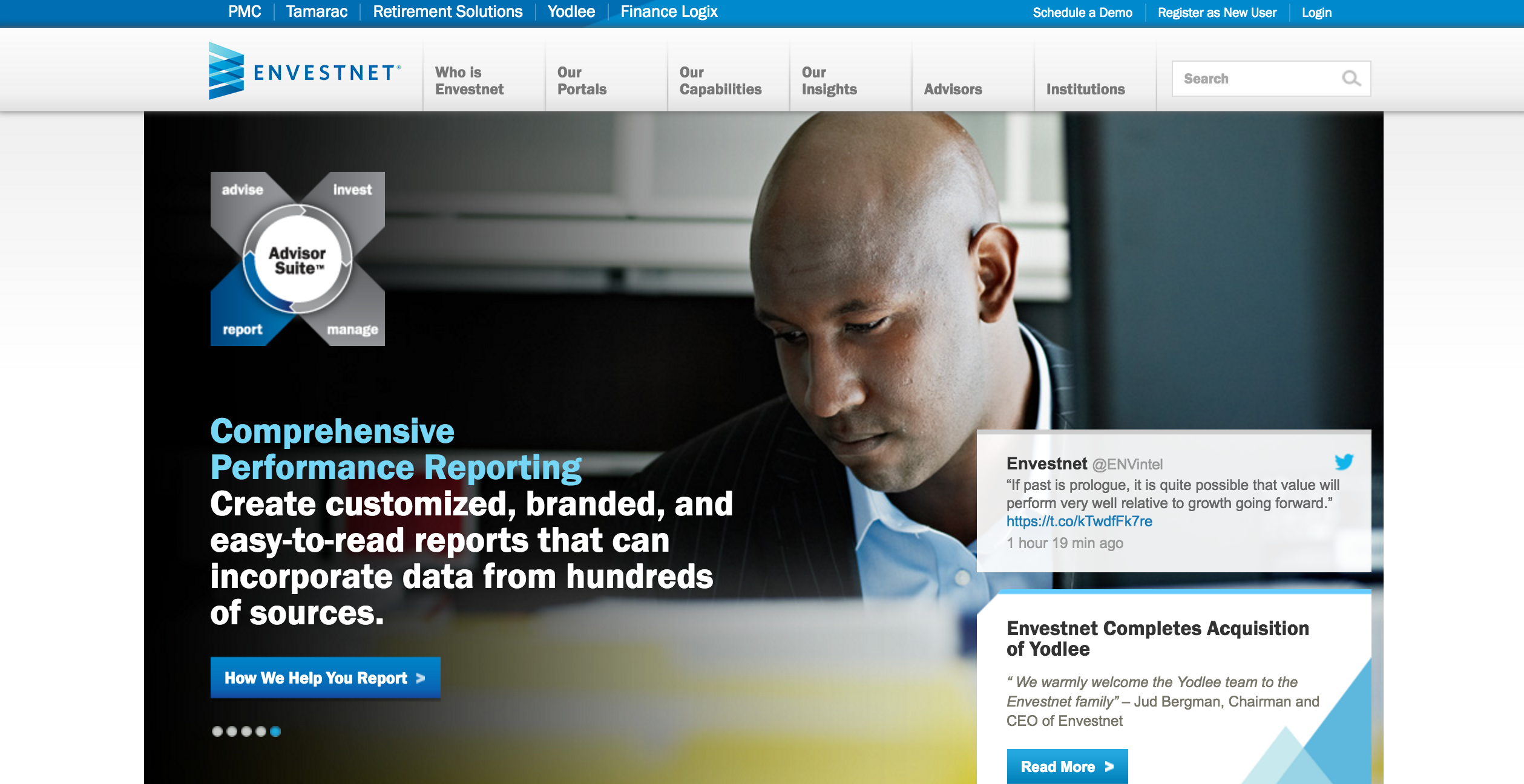

Envestnet offers wealth management technology and services to help advisory firms leave brokerages and compete with large financial institutions. Founded in 1999, it went public in 2010 and acquired data-aggregation company Yodlee in August of 2015 for $660 million.

At FinovateEurope 2016, the company launched Advisor Now, a digital advice portal to help traditional advisers compete with robo-advisers. In the demo, Jay Hummel, SVP of advisory services, says:

The future of the robo-adviser movement isn’t going to be standalone robos, it’s going to be a blend of a digital movement. We believe the future is these institutions being able to blend this digital movement to be able to serve a 20-year-old millennial on the exact same platform that they can serve the 70-year old retiree that’s looking for the relationship with a full human advisor. That one platform is what we call Advisor Now.

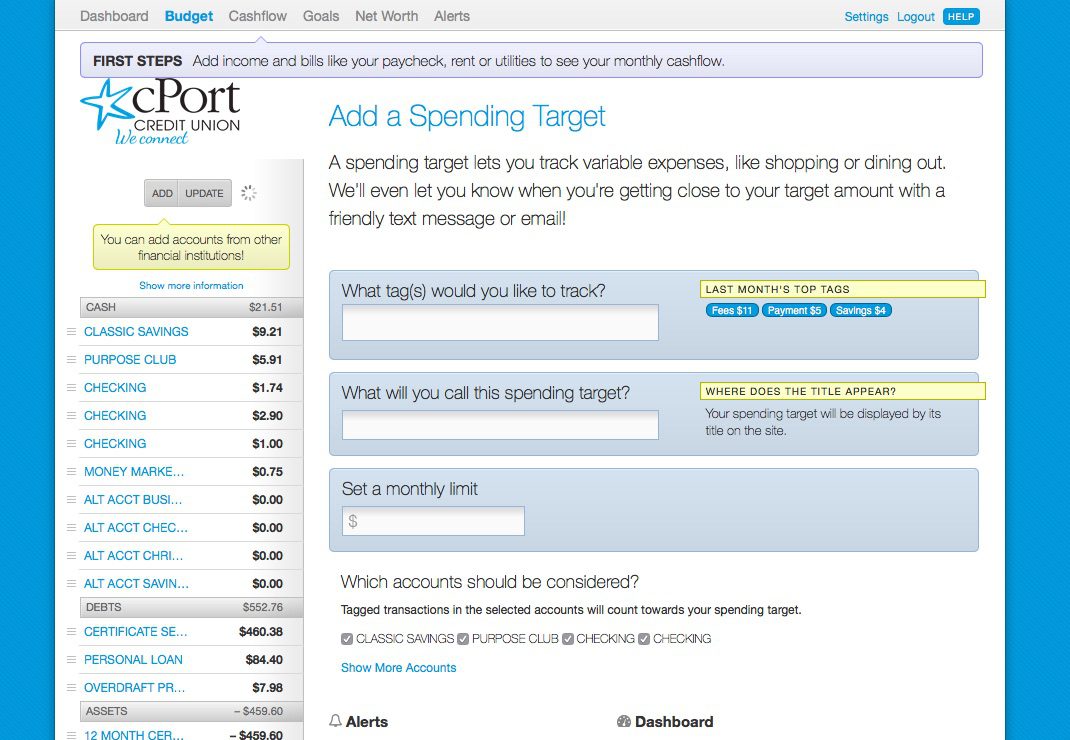

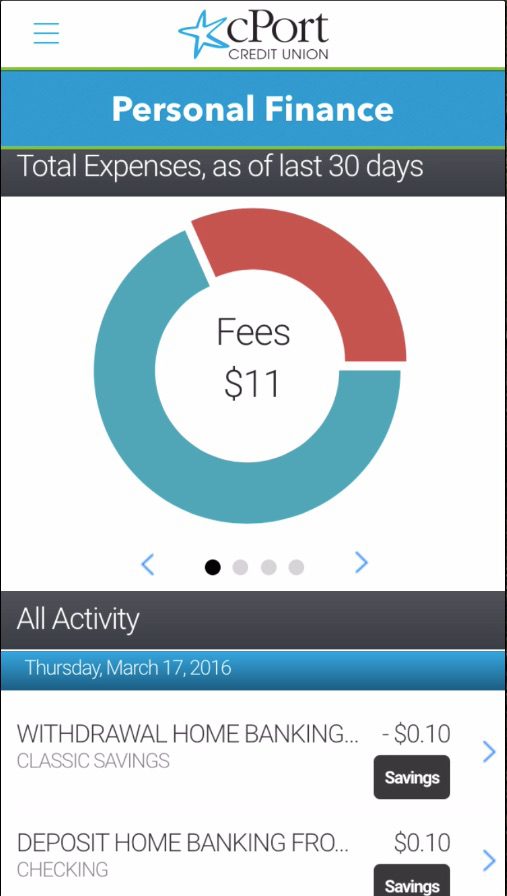

Advisor Now offers a set of white-labeled tools that help clients monitor investments, track net worth, edit budgets, and securely communicate with their personal adviser.

Company facts:

- Founded in 1999

- Based in Chicago, Illinois

- Used by 47,000 financial advisers to support over $851 billion in assets

- 2,500+ employees

Advisory Service SVP Jay Hummel, Blake Wood, SVP, product management, and Molly Pandya, SVP, product management, presented Advisor Now at FinovateEurope 2016 in London.

Advisory Service SVP Jay Hummel, Blake Wood, SVP, product management, and Molly Pandya, SVP, product management, presented Advisor Now at FinovateEurope 2016 in London.

We interviewed Envestnet’s William Crager (LinkedIn) for more insight into Advisor Now. Crager has served as president for 16 years; previously, he was managing director at Nuveen Investments.

Finovate: What problem does Envestnet solve?

Crager: Today’s dynamic investor seeks a personalized approach to investing their money. With the ongoing emergence of the latest technologies that offer intuitive methods to help manage wealth, advisers are confronted with how to demonstrate their value proposition and to differentiate their services. While investors are challenged to understand the implications that managing wealth on their own can mean, Envestnet underscores the importance of good advice to an individual’s financial health and wellness. Through the Advisor Now portal, advisors can cater to a client’s basic investing needs and build on that adviser-client relationship to deliver solutions to more complex situations that require full advisory support in the future.

Finovate: Who are your primary customers?

Crager: Our Advisor Now portal is ideal for enterprises, advisers, and investors. Not only does our fiduciary framework provide support to large institutions that need to centralize small accounts—especially in the wake of a new DOL Rule—but also gives advisers an opportunity to extend their reach to new and existing clients that may include millennials or “savers.” Investors can take advantage of goal-oriented planning and investing, knowing that their adviser is behind the scenes offering guidance. Additionally, our robust data-aggregation capabilities give investors a holistic view of their growing wealth.

Finovate: How does Envestnet solve the problem better?

Crager: Our legacy platform is leveraged by more than 47,000 advisers today. As an extension of Envestnet’s open architecture platform, Advisor Now is powering a digital revolution that brings together the simplicity of a robo-offering with a reputable infrastructure that automates the process of goal planning, portfolio selection, account opening, fund transfers, client communication and more.

Finovate: Tell us about your favorite implementation of your solution.

Crager: With Advisor Now, advisers are able to enhance a client’s investing journey, personalizing the approach to advice according to the needs of the investor. We’re giving advisory firms not only a viable solution to help distinguish themselves from the pack, but a way to powerfully scale their business.

Finovate: What in your background gave you the confidence to tackle this challenge?

Crager: Envestnet was built on a vision to empower advisers. As a founding partner of the firm, we had a vision to level the playing field in a world dominated by the most capitalized firms on Wall Street. Today, our firm is a leading provider of wealth management, and crossing the digital divide was our most logical next step to advancing our cause to further establish the importance of the adviser.

Finovate: What are some upcoming initiatives from Envestnet that we can look forward to over the next few months?

Crager: Traditionally, our core capabilities delivered a fully integrated end-to-end platform to enhance the daily practice of managing wealth. Through a new initiative called Open ENV, we will be unlocking our core technology to deliver wealth-management toolsets that give clients the option to leverage customized portals that reflect specific business needs, as well as the flexibility to leverage singular tools to help emphasize the services that are most important to them.

Finovate: Where do you see Envestnet a year or two from now?

Crager: Envestnet is driving enormous innovation in the advice and wealth management space. I believe within a year it will become clear how powerful the integration of leading cloud-based software with consumer financial data is. It is the digital future of advice that incorporates the entire wealthspan of a consumer, from retirement planning to investments to the myriad of personal finance components of their lives. Today, very disparate parts can be brought together to empower the consumer to reach their financial goals. We are excited about what lies ahead.

Advisory Service SVP Jay Hummel, Blake Wood, SVP, product management, and Molly Pandya, SVP, product management, presented Advisor Now at FinovateEurope 2016 in London.

Advisory Service SVP Jay Hummel, Blake Wood, SVP, product management, and Molly Pandya, SVP, product management, presented Advisor Now at FinovateEurope 2016 in London.

Our

Our