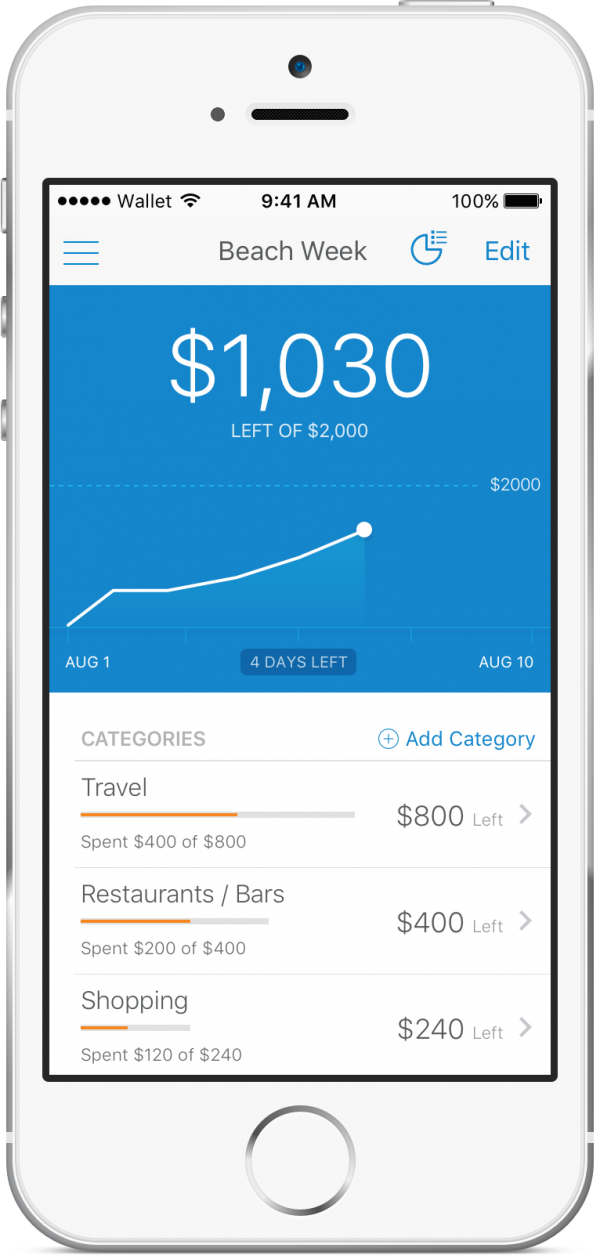

Goals-based saving tools have existed for quite some time, but what if the goal you’ve saved for isn’t just a one-time purchase? HelloWallet’s new feature, Flexible Budgets, launched this week to help users spend wisely over a longer time-period and to help plan for large, infrequent expenses.

The new tool is meant to be used in tandem with a regular monthly budget. Use cases include:

- Track spending while on vacation

- Plan for quarterly insurance payments

- Track an annual clothing budget

- Maintain a budget for a wedding (as someone who’s getting married in two weeks, I’m well aware of the importance of tracking expenses to make sure there’s enough left over to cut the final check for booze at the end of the reception!)

This feature addresses a common complaint among budgeters who struggle with big-ticket, infrequent purchases. It essentially offers a way for users to set up a budget within a budget. The Flexible Budgets feature is now available in the HelloWallet app for iOS and will launch on Android later this year.

While the app would certainly come in handy as I finalize wedding expenditures, I won’t be able to use it any time soon. HelloWallet is only available as a B2B model aimed to help employers help their employees with financial health. The company’s current customers include: Salesforce, T. Rowe Price, Allstate, Vanguard, and more.

Matt Fellowes, founder of HelloWallet, gave a Best of Show-winning demonstration of Retirement Explorer at FinovateFall 2015. Retirement Explorer is a planning tool that allows users to model and save retirement scenarios. During the demo, Fellowes also announced it now allows banks to integrate HelloWallet’s financial wellness programs.

Two months ago, HelloWallet launched a savings and debt guidance tool to help users achieve their saving, spending, and debt-repayment goals. Founded in 2009, the company was purchased by Morningstar in 2014.

Social media compliance company

Social media compliance company

Robert Levine, Global VP Business Development

Robert Levine, Global VP Business Development

Presenters

Presenters