Smart contracts platform Symbiont announced this week it has teamed up with the Center for Research in Security Prices (CRSP) to help Vanguard improve the distribution of index data.

This partnership will allow index data to move between index providers and market participants in real time over a single, decentralized database. The project, which has been in a testing phase for the last several months, delivers the data over a blockchain and automates the workflows using smart contracts. The result is three-fold: it expedites data delivery, eliminates the need for manual updates, and reduces risks. The groups expect that CRSP index data delivery and intra-day updates over the blockchain will be available in early 2018.

Generally, transmitting index data relies on multiple parties and channels. Explaining the benefits of the improved distribution method, Warren Pennington, a principal in Vanguard’s Investment Management Group said, “Using this platform, investment managers will be able to instantly distribute, receive, and process index data, resulting in better benchmark tracking and significant cost savings that potentially results in better returns for our clients.”

Mark Smith, CEO and co-founder of Symbiont, said he is “pleased” that CRSP and Vanguard were willing to collaborate on the new method. “Through this collaboration we were able to show how Symbiont’s blockchain technology and smart contracts can enhance market data distribution among disparate parties,” Smith said.

Symbiont was founded in 2015 and offers three products, each of which leverages the blockchain. Symbiont Assembly offers a single, global accounting ledger, Symbiont Secure Channels is a mechanism for sharing confidential data, and Symbiont Smart Securities is a platform that models the complex states and interactions for financial instruments. At FinDEVr New York 2016, the company’s CTO and cofounder Adam Krellenstein gave a presentation titled Distributed Ledgers and Smart Contracts.

Last month, Symbiont won the Buy-Side Technology Award for Best Distributed Ledger Technology Project by Waters Technology for the second consecutive year. Earlier this summer, the company closed an undisclosed strategic investment from China’s Hundsun Technologies. Headquartered in New York, Symbiont has a total of $7 million in funding.

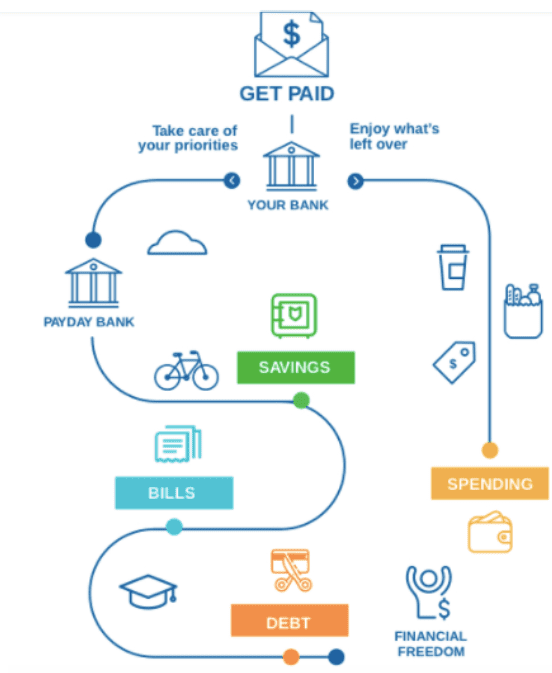

Financial management technology startup

Financial management technology startup