BondIT launched with the intention to build and improve fixed-income portfolios. The Israel-based startup’s platform helps advisers construct bond portfolios that are tailor-made and optimized for every client.

In his demo at FinovateFall 2016 COO Eran Nachshon began by explaining the problems BondIT seeks to fix. First, there are more clients, second, clients are seeking more personalized treatment, and third, regulators require an audit trail. “That’s where BondIT comes in,” Nachshon said, “with a hybrid approach that appreciates peoples’ strengths in forging relationships but empowers them with machine learning, data-driven capabilities to construct bond portfolios that are optimized and personalized for each and every client with a clear audit trail. And we do that in two minutes.”

By enabling construction, reallocation, and re-balance of optimal bond portfolios, BondIT helps advisers improve portfolio-management efficiency so they can focus on their client relationship.

Company facts:

- $6.5 million in funding

- 25 employees

- In contracts with several tier 1 banks

- Founded in 2012

BondIT COO Eran Nachshon demoed at FinovateFall 2016 in New York City.

BondIT COO Eran Nachshon demoed at FinovateFall 2016 in New York City.

After FinovateFall, we spoke with Bondit CEO Etai Ravid to learn more about the company and its future plans.

After FinovateFall, we spoke with Bondit CEO Etai Ravid to learn more about the company and its future plans.

Finovate: What problem does BondIT solve?

Ravid: What we’re ultimately solving is lost bond sales. We want to transform the inefficient processes that relationship managers (RMs) currently utilize into a simple-to-use, data-driven and customizable solution.

Here’s how BondIT is transforming the client-RM relationship in fixed income:

1) We improve portfolio management efficiency by enabling the construction, reallocation and re-balancing of optimal bond portfolios in a few minutes.

2) We drive sales by empowering relationship managers and trading desks with personalized and optimized investment recommendations.

3) We improve client’s satisfaction by providing on-demand, timely and comprehensive reports.To achieve this, we have developed some of the most advanced, proprietary machine-learning algorithms in fixed income and then present it in an intuitive interface to users.

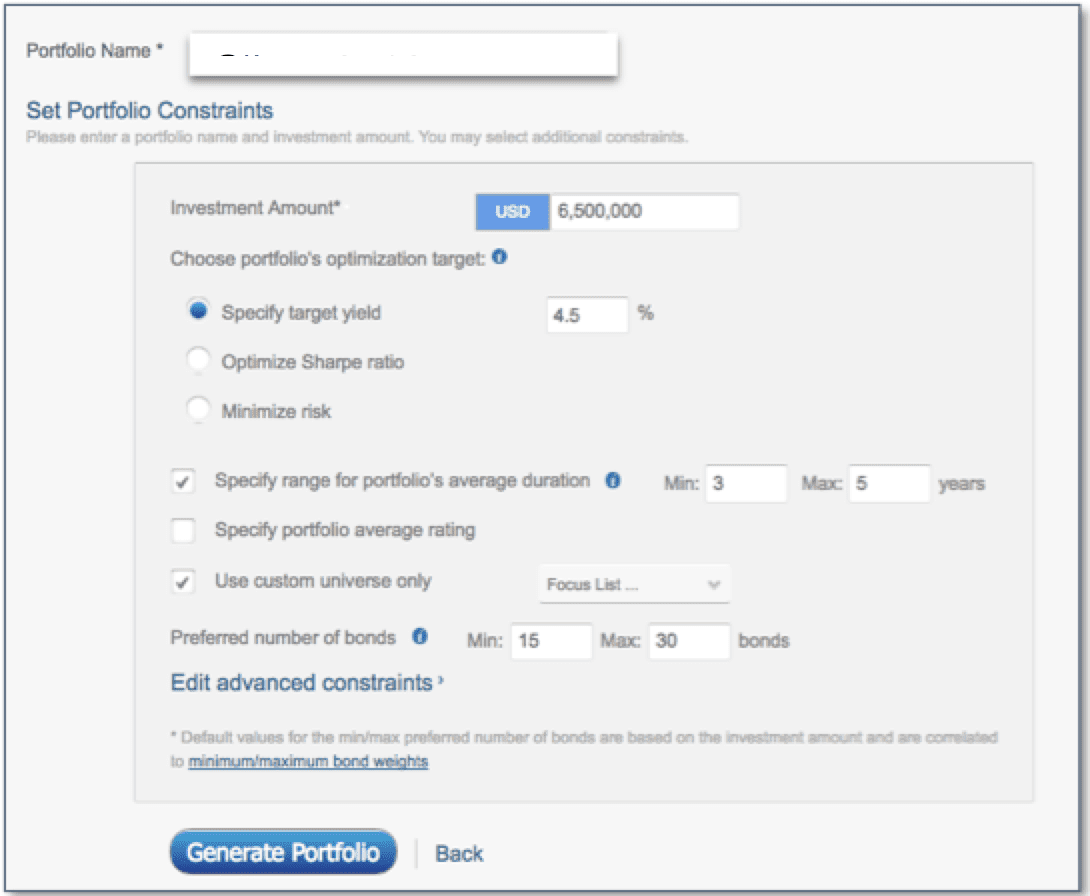

(above) Optimized portfolio construction

(above) Optimized portfolio construction

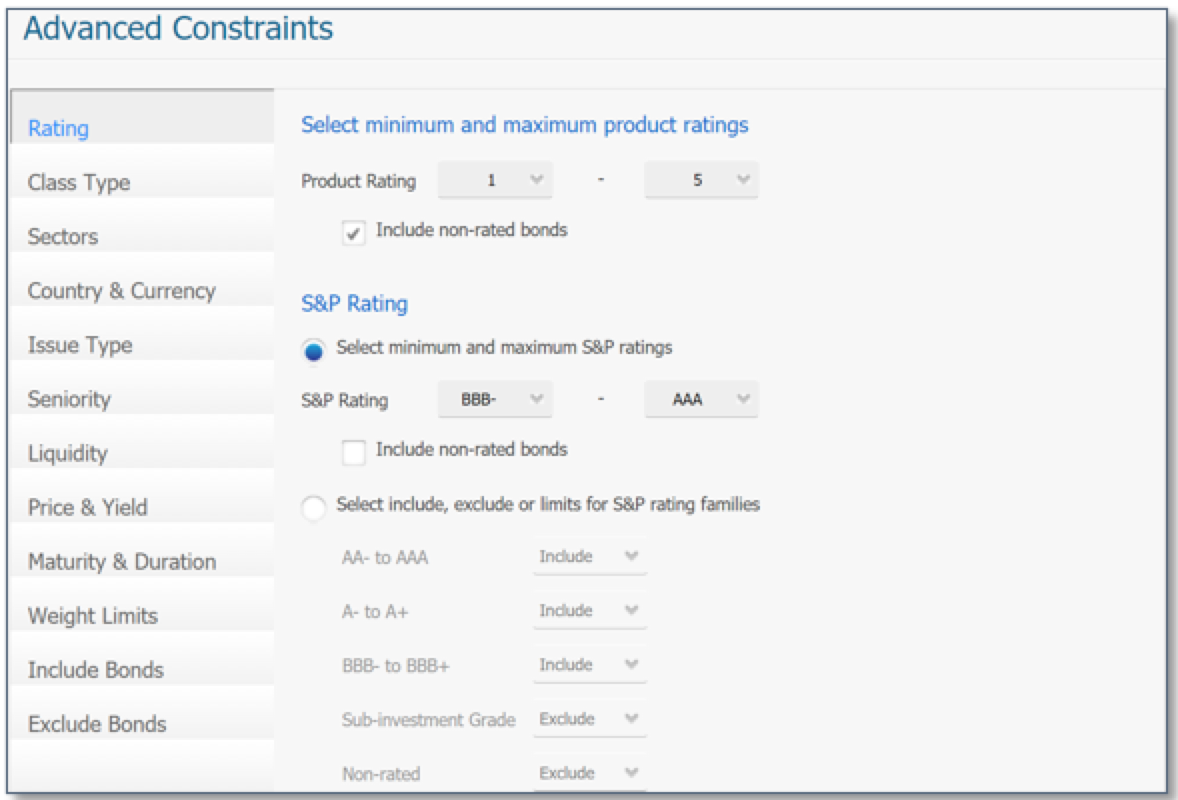

(above) Constraints selection

(above) Constraints selection

Finovate: Who are your primary customers?

Ravid: In general, people who can benefit from our product are financial advisers, relationship managers, and all other professionals whose role is to help people invest their money in a financially prudent way.

Strategically speaking, we’re currently targeting private banks or private wealth arms of large financial institutions and wealth managers, since most AUM is managed by private bankers and wealth managers. BondIT offers material business value-add capabilities to increase AUM and trades.

Finovate: How does BondIT solve the problem better?

Ravid: The problem, to iterate, is lost bond sales. Every time a client calls a bank and has to wait several days to receive an answer, or receives a one-size-fits-all reply, translates into another lost trade, and another dissatisfied client much more likely to migrate to another, nimbler competitor.

BondIT solves this problem better by arming the entire chain of people interacting with clients with a fast (90 seconds); intuitive (15 minutes of training required); tailored (every portfolio is different); powerful (machine-learning) platform. Furthermore, it allows the advisers to proactively engage clients by alerting them to changes in the portfolio that prompt changes (re-balance) which will benefit the client, greatly enhancing the probability for the triple win: bank is happy (more trades); adviser is happy (seems proactive); and client is happy (better portfolios).

Portfolio analytics and management

Portfolio analytics and management

Finovate: Tell us about your favorite implementation of your solution.

Ravid: The following is an excerpt from a user, and it shows how our solution works hand in hand with relationship managers to improve outcomes for all.

On Monday morning, I got a call from a prospective client, asking to hear about what our bank has to offer, as he has heard mixed reviews. Instead of going into the usual spiel (unparalleled research, best client service etc.), I told him about a new software that instantly imports and improves portfolios. He bites, and tells me his 12 positions over the phone.

I punch them into BondIT, hit the “Improve Me” button and chat him up about his goals for a minute and a half. BondIT found a way to enhance his YTM by 70 basis points while maintaining his risk. He was so surprised by the prompt response and excess yield that he set up a face-to-face meeting. Long story short, I converted a $3 million client in a few minutes.

Finovate: What in your background gave you the confidence to tackle this challenge?

Ravid: I came from a finance background with a master’s degree in finance and had professional experience in portfolio management and equity valuation.

I derive my confidence from my family, as I’m a third-generation entrepreneur. This firsthand experience, coupled with my education, instilled a deeply seated belief that it’s always possible to succeed in creating a better way to do things.

Finovate: What are some upcoming initiatives from BondIT that we can look forward to over the next few months?

Ravid:

1) BondIT is working closely with several leading fixed income/financial platform providers on synergetic collaboration. This will complete the advisory service circle from ideation to execution.

2) BondIT will continue its global expansion, with a particular focus on growth in the U.S. and Asian markets.

3) BondIT will be introducing an even more advanced analytics solution, to include investors’ behavior-based analytics; advanced predictive and descriptive analytics algorithms; and some surprises we can’t reveal yet—stay tuned!

Finovate: Where do you see BondIT a year or two from now?

Ravid: We envision BondIT assisting thousands of fixed-income advisers and managers in delivering a superior customer experience, and as a result, enjoy a boost in sales.

BondIT will also be integrated into leading execution/information platforms, creating analytical recommendation as a part of completely friction-less flow.

Ultimately, we want BondIT to be seen as the gold standard when it comes to smart recommendations and data-driven portfolio management for fixed-income investment.

Here’s BondIT’s FinovateFall 2016 demo video. COO Eran Nachshon showcased the platform in New York City: