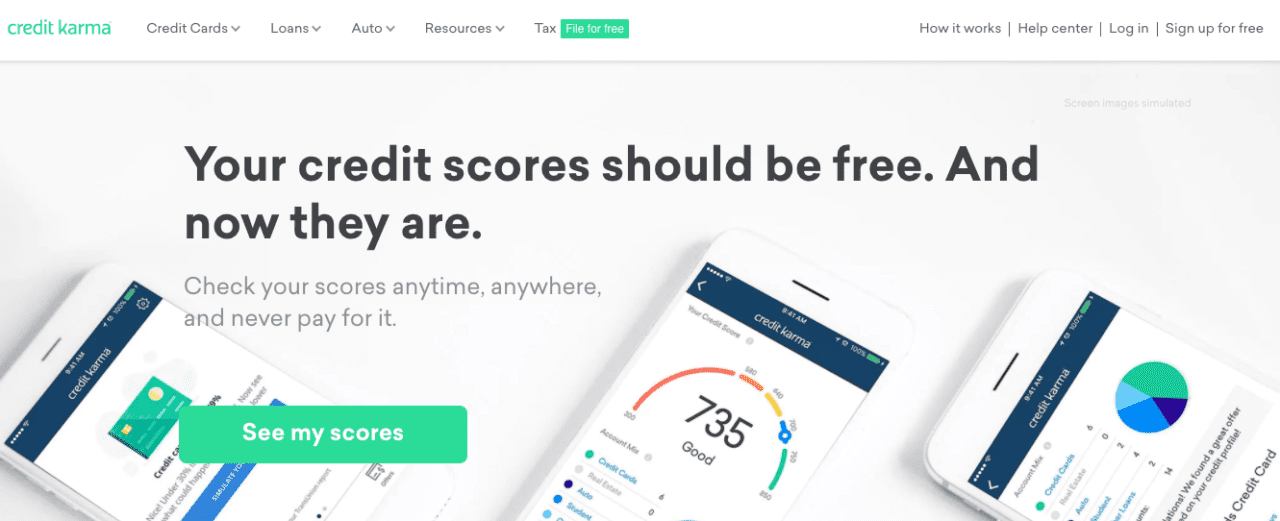

San Francisco-based Credit Karma received a $500 million boost today from Silver Lake. Through a secondary investment process, the technology investing company is taking a significant minority stake from existing investors in the consumer credit monitoring and financial health startup through a secondary investment process. Founder and CEO Kenneth Lin will remain the largest shareholder. Additional terms of the transaction were not disclosed.

Unlike a primary funding round, Credit Karma will not receive any proceeds from the sale and will not issue new shares as a part of the deal. It will, however, benefit from a 23% increase in valuation, making it worth around $4 billion. As TechCrunch explained, the move may be beneficial in placating investors and employees who are eager to cash out their equity, as well as help postpone an IPO.

Lin, who cofounded the company in 2007, said, “As we planned for the future and our continued growth, we sought a partner that could support our growth trajectory and provide existing investors an opportunity to lock in some of the rewards they’ve earned for their support and hard work.”

Silver Lake Managing Partner, Mike Bingle, will join Credit Karma’s Board of Directors. In the press release, he cited multiple reasons for investing in Credit Karma, including the company’s “cutting-edge technology” and its “unwavering focus on long-term partnerships” with both members and financial institutions.

While it’s best known as a consumer-facing tool to help users check their credit for free, Credit Karma’s functionality extends far beyond credit scores, credit card offers, and loan comparisons. Last November, the company launched a new automotive information center where members can manage and organize their vehicle-related finances and information. And in late 2016, Credit Karma unveiled Credit Karma Tax, a free online tax filing service that, thanks to a partnership with American Express, lets users opt to receive their tax refund in advance. The company even has a tool to help return unclaimed money to users.

Credit Karma has 80 million members across North America, almost half of which are millennials and 80% of which access the service via their mobile devices. The company has originated more than $40 billion in credit products including credit cards, personal loans, mortgages, automotive financing, and student loan refinancing. At FinovateSpring 2009, Lin demonstrated the company’s platform, which offers free credit reports from Equifax and TransUnion, and seeks to serve as a hub for users to monitor their financial health.

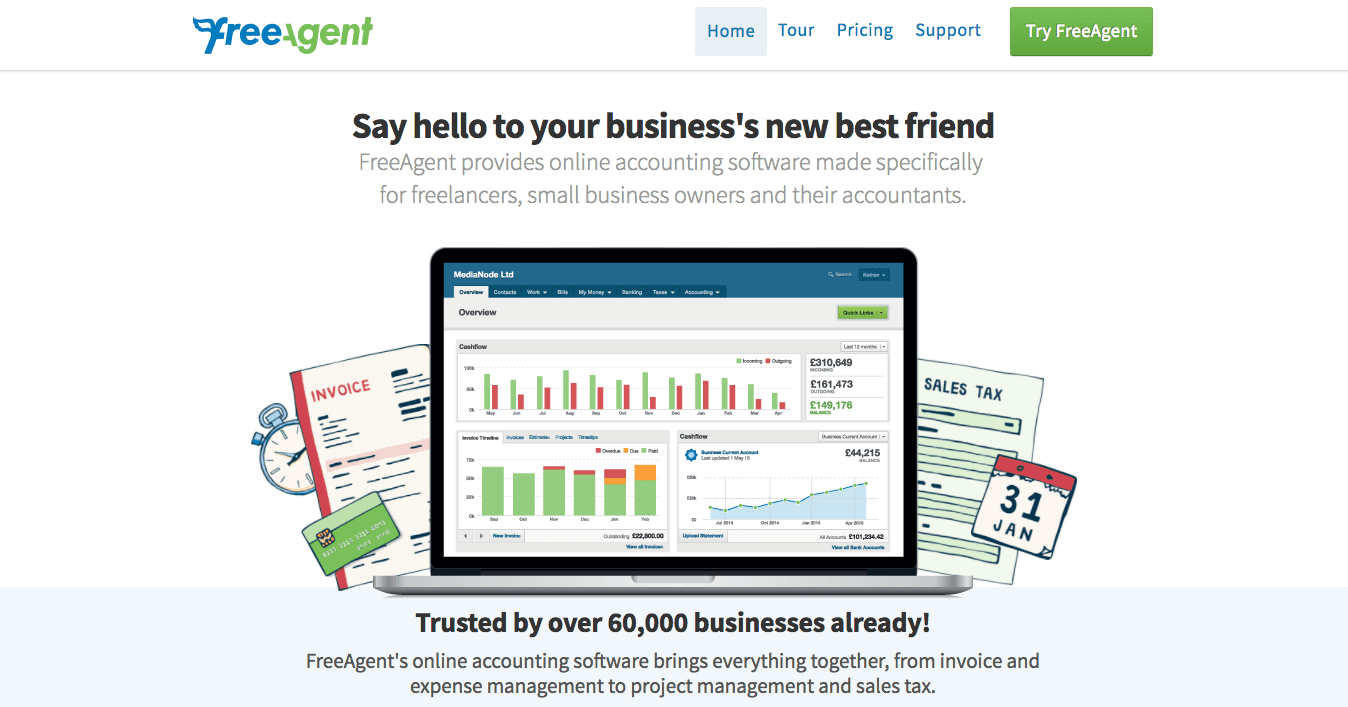

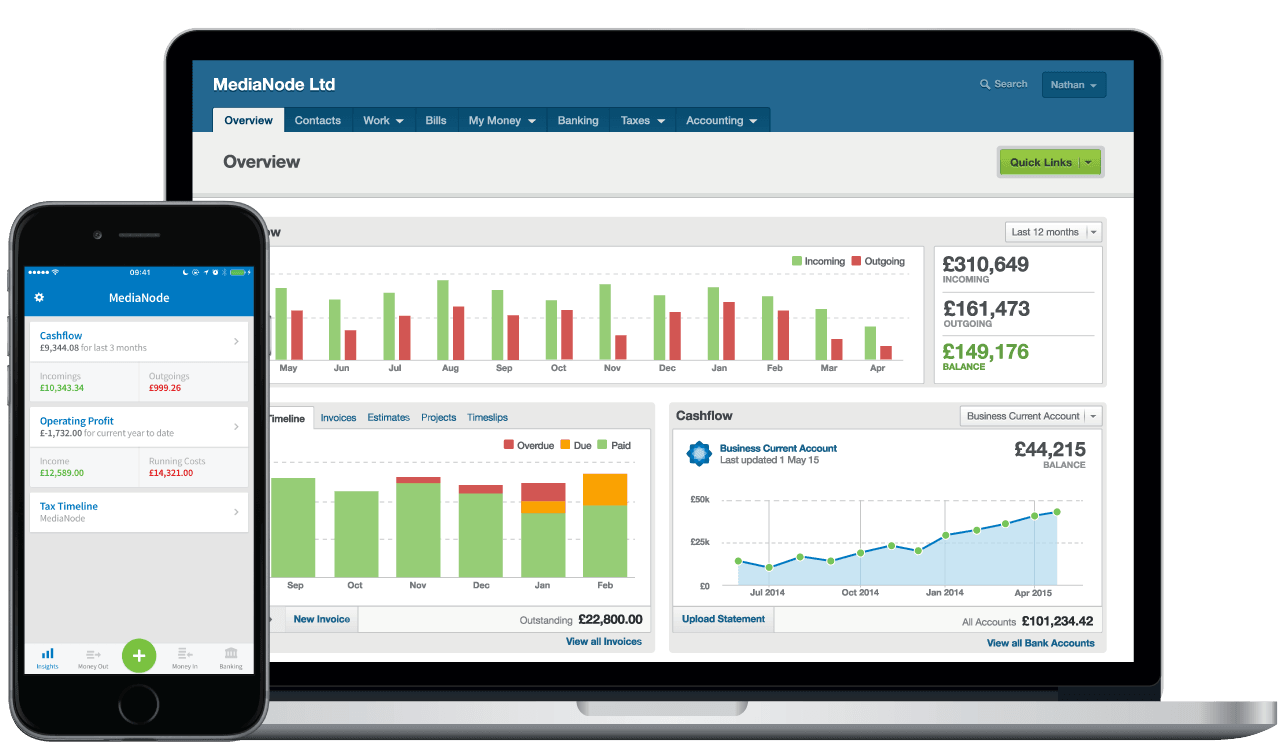

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”