According to data-driven marketing company Cardlytics, every purchase tells a story. And it turns out that every partnership tells a story, too. During its earnings call this week, the Atlanta-based company announced a deal with Wells Fargo under which Cardlytics will power the bank’s cash-back rewards program.

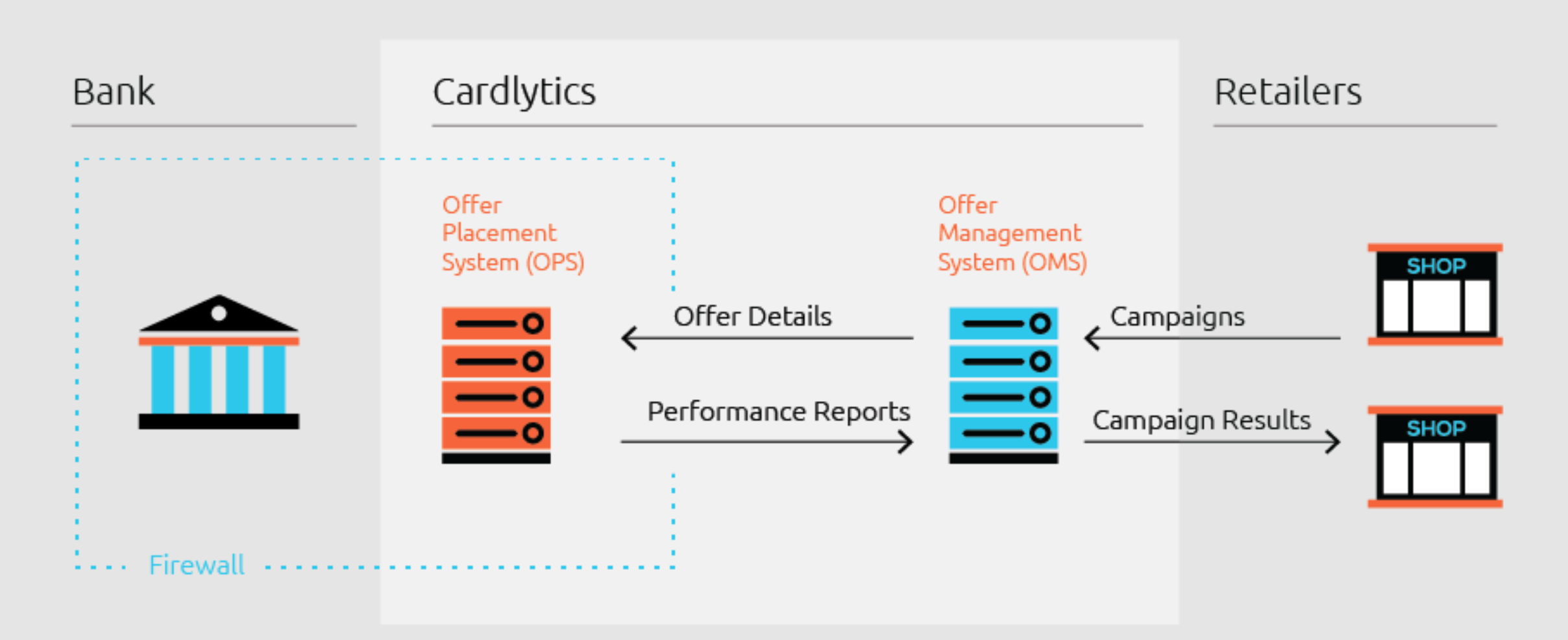

“We are happy to announce the signing of an agreement with Wells Fargo to launch Cardlytics Direct nationally and across all digital channels,” said Lynne Laube, Cardlytics COO and co-founder. Cardlytics Direct leverages the Purchase Intelligence platform, which processes trillions of dollars of raw purchase data from millions of accounts across thousands of financial institutions. The company uses algorithms and machine learning to make it useful for marketing and analytics, developing insights for smarter business decisions.

While Purchase Intelligence will boost Wells Fargo’s cash-back rewards program, it will also benefit Cardlytics, which will receive access to a new wealth of customer data. “Adding Wells Fargo to the Cardlytics Purchase Intelligence platform will further strengthen our ability to provide actionable insights for our marketing clients. Marketers can act on these insights, reaching a scaled audience inside banks’ secure digital channels – where consumers are already thinking about their money,” said Laube.

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

Additionally, Cardlytics released its Q2 earnings report, highlighting a handful of growth metrics:

- Total revenue was $35.6 million

- Revenue increased 8% year-over-year, up from $32.8 million in the second quarter of 2017

- Cardlytics Direct revenue was $35.1 million

At FinovateFall 2013, Cardlytics demoed its geolocation application, a solution that sends bank customers ads and offers based on their location.The company was the first fintech to go public early this year, now boasting a market capitalization of $408 million. Cardlytics also inked a deal with J.P. Morgan Chase and today announced it was listed on the Inc. 5,000 list for the fourth consecutive year. This year, Inc. ranked the company 2886 with revenue of $130.4 million and revenue growth of 142% from 2014 to 2017.

Presenters

Presenters

Presenters

Presenters Brie Tascione, CMO

Brie Tascione, CMO