As we’ve mentioned before, there are surprisingly few fee-based online financial services in the United States (see note 1). But things may be changing. In the past month we’ve looked at three innovative services charging fees:

As we’ve mentioned before, there are surprisingly few fee-based online financial services in the United States (see note 1). But things may be changing. In the past month we’ve looked at three innovative services charging fees:

- Mercantile Bank of Michigan’s Funds Manager, a $4.95/mo service that gives users a sneak peek at pending transactions, before they can cause an overdraft (previous post).

- LowerMyAssessment.com offers a $125 service to help consumers challenge their property tax assessment for their home (previous post).

- Home-Account charges $9.95/mo for its home-management service (based on a one-year commitment).

Today, we highlight a fourth new fee-based service, also charging $4.95/month (or more), vSafe from Wells Fargo. vSafe is a secure online storage solution that sells for $15 to $15 per months as follows:

- $4.95/mo for 1GB of storage

- $9.95/mo for 3GB of storage

- $14.95/mo for 6GB of storage

The service was introduced several months ago, and I’ve been using it for a couple months. The service automatically stores Wells Fargo statements, and allows users to upload any other file up to the storage limit. It would be even more useful if it offered automated retrieval and storage of other bank and biller statements.

Wells Fargo homepage (1 June 2009, 1:15 PM PDT)

Landing page (link, 1 June 2009)

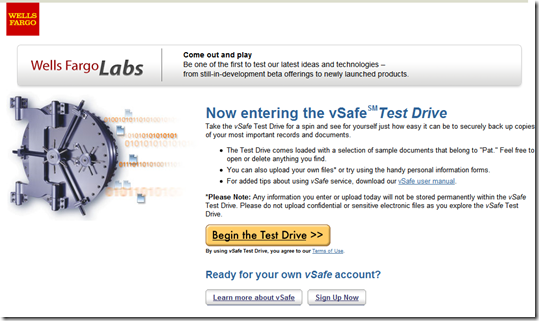

Take a test drive in the Wells Fargo lab (link, 1 June 2009)

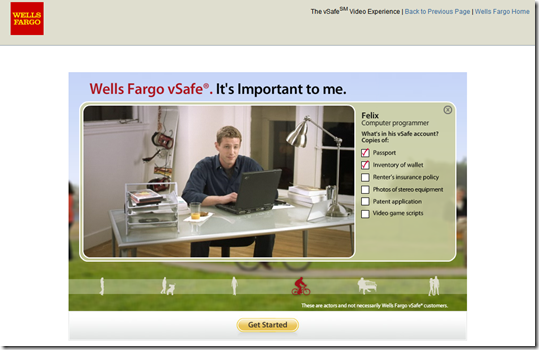

Interactive video highlighting benefits

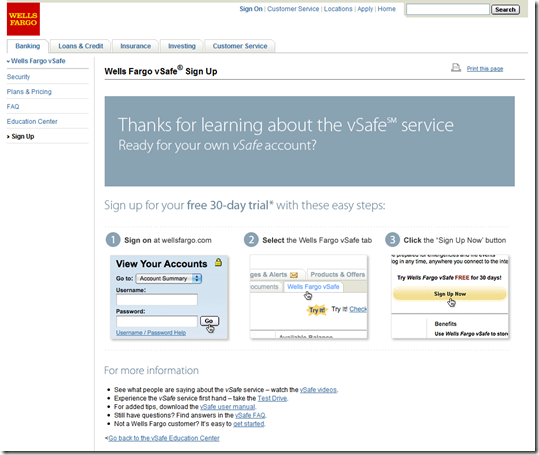

Signup explanation

Notes:

1. The golden rule of consumerism: “You get what you pay for.” Because online banking services are typically offered free of charge, U.S. consumers have had to contend with clunkier, slower, less secure and less feature-rich online services than consumers in other countries that pay for online access. Fees for online services can be a win-win, allowing financial institutions to offer premium online services for those willing and able to pay for them, while at the same time offering basic services free of charge so that everyone can benefit from online banking.

2. Article updated 9 July 2009 to remove incorrect reference to Expensify’s $4.95/mo fee (see comments).