In the six years PM (post Mint), dozens of startups have launched with the goal of simplifying group finances. For the most part, they’ve started with two use cases:

In the six years PM (post Mint), dozens of startups have launched with the goal of simplifying group finances. For the most part, they’ve started with two use cases:

1. Sharing rent and utilities among roommates

2. Splitting the bar/dinner tab among friends

Those are the significant financial problems faced by 24-year old founders living in the Bay Area or Brooklyn. But for the rest of the world, those are relatively small or non-existent issues. What we need are financial collaboration tools for adults.

But I’m happy to report there is finally an app for that. And it’s from a fintech company known for providing the PFM plumbing, not the fixtures, Yodlee. The company’s Tandem app made its debut in September at FinovateFall earning a Best of Show award. Tandem repeated with another Best of Show at its international debut last week at FinovateAsia (upper right).

Tandem uses a four-layer "financial circles" approach inspired by Circles in Google Plus (see inset left):

Tandem uses a four-layer "financial circles" approach inspired by Circles in Google Plus (see inset left):

1. You

2. Inner circle: Used to transact

with family members

3. Friends: Used to share expenses

with groups of friends

4. Advisors: Used to collaborate

with professional advisors

The app allows the various circles to jointly manage financial issues, such as siblings chipping in to manage and elderly parent’s expenses. The brilliant thing Yodllee did, which is often overlooked, is to  focus on the communications about group finances. Compared to the relatively simple transaction, communicating is often far more time consuming, prone to error, not to mention creating ill will.

focus on the communications about group finances. Compared to the relatively simple transaction, communicating is often far more time consuming, prone to error, not to mention creating ill will.

In its demo (right), Yodlee showed how siblings could communicate within Tandem about a suspicious charge on their mom’s account. Each person in this financial circle are depicted with thumbnails at the top. Each can communicate with the others using the text-message like interface (lower half of the screen).

Bottom line: There is still hard work required to make Tandem a reality. Yodlee is in discussions with a number of potential clients, but doesn’t expect it to be live much before mid-2014.

Even so, Tandem is the type of tangible improvement that PFM has long promised (note 1). I’d love to move beyond text messaging, and use Tandem to better sync financially with my son when he heads off to college next fall.

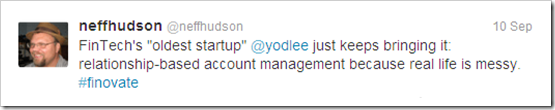

But don’t take my word for it, here’s a final thought from USAA’s acclaimed innovator, Neff Hudson (Tweeted during FinovateFall, 10 Sep 2013)

—————————

FinovateFall 2013 Demo

Check out Yodlee CEO Anil Agora and VP Katy Gibson show it off at FinovateFall (note, this is not an embed, click on the picture and you’ll go to the webpage where you can play it):

——————————————-

Post-show interview of Anil Agora, by Finovate’s David Penn:

For some, PFM innovations are like hearing that the Dallas Cowboys have a new coach or the New York Yankees have a new pitcher. At the end of the day, they are still the Cowboys and the Yankees and you either love them or you don’t.

For some, PFM innovations are like hearing that the Dallas Cowboys have a new coach or the New York Yankees have a new pitcher. At the end of the day, they are still the Cowboys and the Yankees and you either love them or you don’t.

But you could almost hear the collective “yes!” when the Yodlee team presented the “shared finances” feature of their PFM app, TANDEM. Who knew the ability to manage finances for elderly parents or high school age children without having to talk with your ex-husband (or ex-wife, I assume) would be so popular?

Congratulations to Yodlee for helping make PFM new again. Here are a few thoughts on TANDEM from Yodlee President and CEO Anil Arora.

Q. Why did Yodlee win Best of Show?

Anil: We think Yodlee won Best of Show at FinovateFall with our Tandem app for two simple reasons: 1.) It’s truly unique, and 2.) Everyone in the audience could relate to it personally.

With nearly 70 presenters, it’s challenging to create something that is dramatically different. We saw a void (and opportunity) in the market to go beyond traditional money management conversations around budgeting and spending to create real dialogue and action around relationships. One of our favorite tweets recognized that “life is messy.” We are all complicated and social beings. So Tandem was designed to both embrace that and to help create some order and peace of mind around how we manage finances within the context of personal relationships (children, spouses, aging parents, teams, friends, roommates, etc.).

Our goal was to tell the Tandem story through real-world use-cases that everyone can understand. We used scenarios such as having a child in college who needs money for school purchases, communicating with siblings to help an aging parent manage bills and protect against fraud, and business partners working through the process of getting a business loan with their bank. These are just a few of hundreds of scenarios that we all face every

day where our new Yodlee Tandem mobile app could play a valued and proactive role in both the communication around finances and actual money movement. It’s safe, easy, and relevant to every day life.

Innovation is key to Yodlee’s DNA. We are passionate about creating a platform and an ecosystem that solves real problems, breaks down technical barriers, and moves industries forward. We hope our new Tandem app does all that!

Q. What would you like to add to what we’ve learned from your demo?

Anil: Telling a complete story in seven minutes is really tough. For example, we showed only a few use-cases for Tandem out of the hundreds that exist. When you’re excited and passionate about how an app can change lives, it’s hard to choose just two or three instances to show the crowd. We also would have loved to add more about the ease and power of how someone can actually set up a financial circle. It’s very easy and it’s very powerful.

The financial circles concept of communication within pre-determined social circles is really unique, and the ability to control the account-sharing access is paramount. This clearly distinguishes Tandem from other apps and services. We haven’t seen anything else in the market where you can securely interact with others around specific accounts and transactions with distinct parameters around what is shared and accessed, from specific (tagged) transactions to full account access with a trusted advisor. Tandem enables full control while empowering users to have a real dialogue around important financial matters in real-time.

Q. What can we look forward to over the next three to six months?

Anil: Since Finovate, we have received tremendous interest in the Tandem app. We’re really excited about seeing Yodlee Tandem live and in action providing value to millions of people around the world. We’re already getting substantial consumer feedback on both the concept and the user experience and that will increase exponentially when the app goes live.

We will provide Tandem to existing and new customers within both our financial institution business and also within our API business to consumer services companies, large and small. We believe this is a very useful and valuable app that will engage people in all-new ways around managing financial relationships and having productive conversations about a very sensitive topic: money.

———————————-

Notes:

1. We’ve tackled PFM numerous times over the years in our Online Banking Report. Most recently here (subscription).

This time of year I’m always on the lookout for financial companies doing something interesting for the holidays. Gift cards are the obvious opportunity, but there are other financial products that make good holiday gifts as well (stocks, mutual funds, savings bonds, and so on).

This time of year I’m always on the lookout for financial companies doing something interesting for the holidays. Gift cards are the obvious opportunity, but there are other financial products that make good holiday gifts as well (stocks, mutual funds, savings bonds, and so on).