Half of the companies in the FinTech Forward 20 “Companies to Watch” list presented by American Banker and BAI this week are Finovate/FinDEVr alums. These 10 companies range from payments innovators and security specialists to alt-lending platforms and mobile banking app builders—the list even includes a pair of alums that have earned multiple Best of Show awards.

“The following 20 companies are the standouts among a pool of companies that nominated themselves and ones familiar to our judges,” American Banker declared in an announcement accompanying a slideshow of the FinTech Forward 20. When evaluating the various companies, judges were encouraged to ask themselves questions such as: “Is this organization solving relevant problems for the banking industry?” and “Does it speak to the challenges the industry faces now.”

Below are the ten Finovate/FinDEVr alums that made the cut. The rest of the FinTechForward 20 is listed below.

- Currency cloud (FF16)

- Founded in 2012

- Headquartered in London, United Kingdom

- Michael Laven is CEO

- $35 million raised

- identitii (FF16)

- Founded in 2014

- Headquartered in Sydney, Australia

- Nick Armstrong is co-founder and CEO

- BehavioSec (FF15)

- Founded in 2007

- Headquartered in Stockholm, Sweden

- Neil Costigan is CEO

- More than $8 million raised

- Two-time Finovate Best of Show winner

- InSpirAVE (FF16)

- Headquartered in Pittsburgh, Pennsylvania, and New York City, New York

- Om Kundu, founder, is CEO and chairman

- Moven (FF16)

- Founded in 2011

- Headquartered in New York City, New York

- Brett King, founder, is CEO

- More than $24 million raised

- Two-time Finovate Best of Show winner

Commenting on its spot on the list, Finovate newcomer InSpirAVE founder and CEO Om Kundu said the recognition was a “testament that our patent-pending technology enables financial institutions partnering with us to set themselves apart.” Kundu said his company’s solutions help FIs “tangibly boost deposits and payments revenues” as well as improve customer engagement and share-in-wallet in enduring ways.

Co-founder and CEO of CUneXus credited his firm’s one-click consumer-lending technology for catching the Fintech Forward judges’ attention. He said banks and credit unions were growing the size of their loan portfolios and “competing with emerging technologies” by adopting CUneXus’ solutions.

Speaking for Alkami Technology, which demoed at Finovate 2009 as iThryv, founder Stephen Bohanon, chief strategy and sales officer, pointed to his company’s flagship Alkami ORB platform and called it an example of the sort of “user experience brought about by great design and tightly coupled integration” that increasingly will set FIs apart. “ORB gives banks and credit unions a competitive advantage by placing strong emphasis on delivering the ultimate digital banking experience,” Bohanon said.

Also on the Fintech Forward 20 Companies to Watch list were:

- Autobooks

- Kasisto

- ClickSWITCH

- Built

- BookingBug

- Lenndo

- Supipay

- Self Lender

- Private Wealth Systems

- Yantra Financial Technologies

Fintech Forward is a collaboration between American Banker and BAI that combines research, media, and event hosting into a single professional, educational enterprise. In addition to its Fintech Forward 20 “Companies to Watch” list, Fintech Forward also publishes a Top 100 Companies and Top 25 Enterprise rankings.

A look at the companies demoing live at FinovateAsia on 8 November 2016 in Hong Kong. Pick up your tickets today and save your spot.

Presenter: Sri Srinivasan, Product Leader

Presenter: Sri Srinivasan, Product Leader

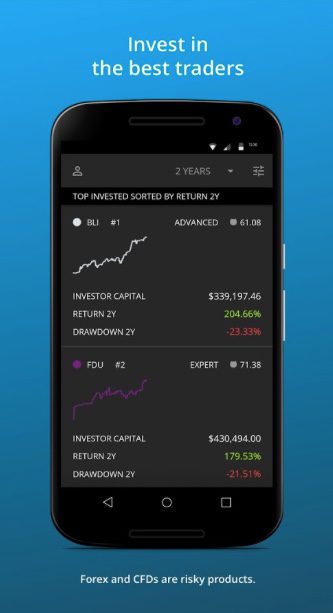

“Owning all our technology affords us a competitive advantage as we don’t depend on third parties,” Darwinex CEO Juan Colón said. “Our Android app is the first of several upcoming feature launches aimed at fundamentally disrupting today’s retail brokerage industry.”

“Owning all our technology affords us a competitive advantage as we don’t depend on third parties,” Darwinex CEO Juan Colón said. “Our Android app is the first of several upcoming feature launches aimed at fundamentally disrupting today’s retail brokerage industry.”