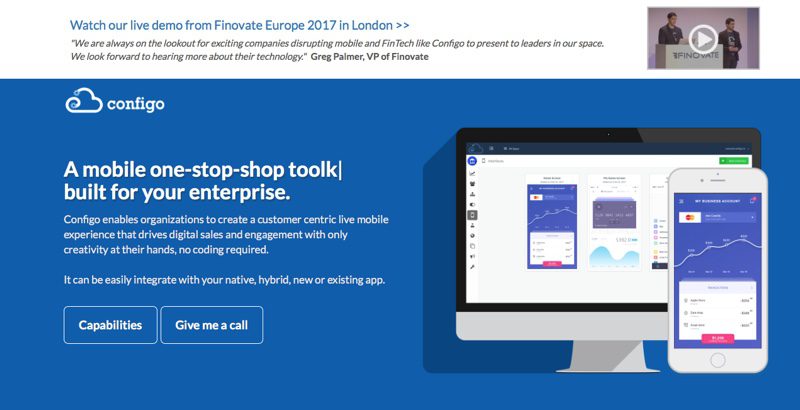

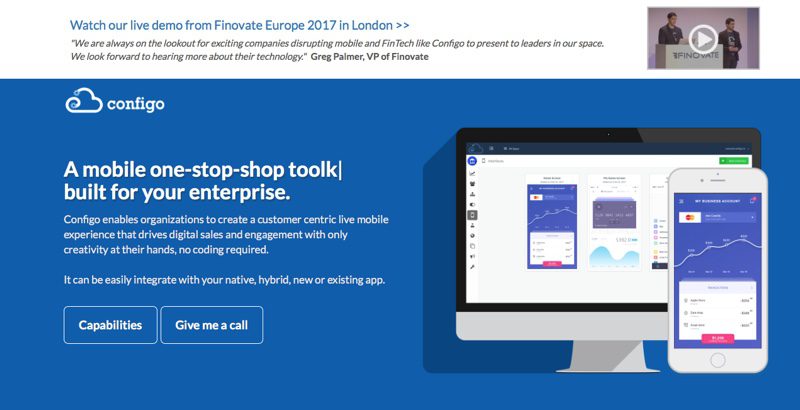

At FinovateEurope earlier this year, Tel Aviv, Israel-based Configo demonstrated its contribution to the cause of greater customer engagement in financial services. The technology, Configo Live Mobile Experience Platform, enables banking marketing professionals and product specialists to design customer experiences that are, in the words of Configo co-founder and CEO Yosi Dahan, “personalized and contextual.”

Dahan warned that nonbanks have done a better job than most banks when it comes to meeting customer expectations of being more innovative and “human-centric.” He said that by leveraging Configo’s ability to bring targeted content to targeted audiences in real time, banks and other traditional financial institutions have the opportunity to regain that lost ground.

Pictured (left to right): Configo co-founders Natan Abramov (CTO) and Yosi Dahan (CEO) demonstrating Configo Live Mobile Experience at FinovateEurope 2017.

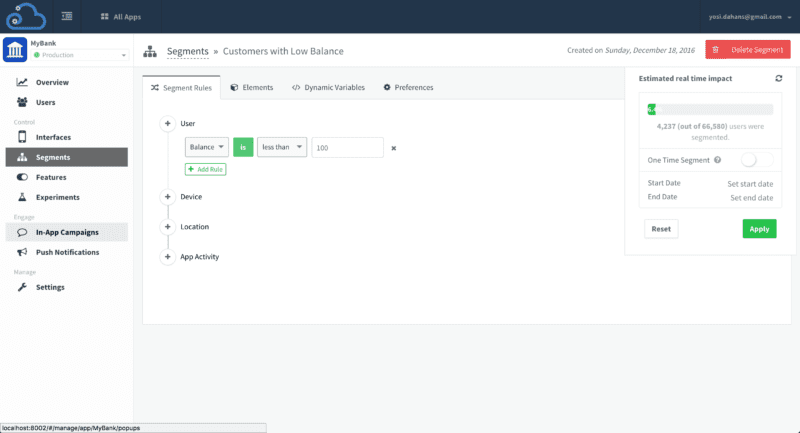

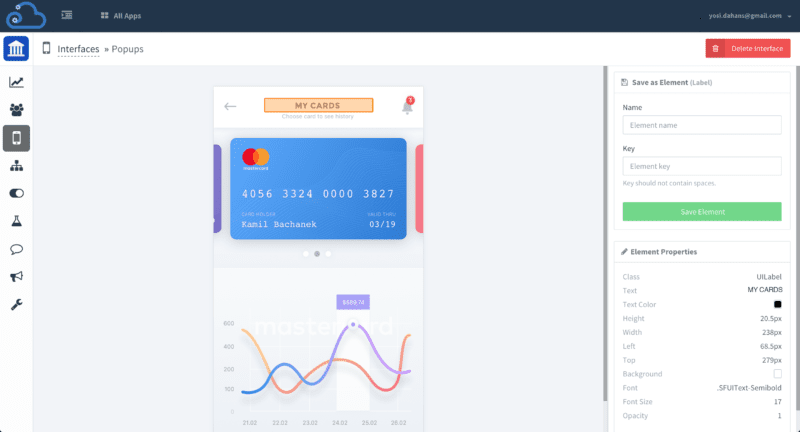

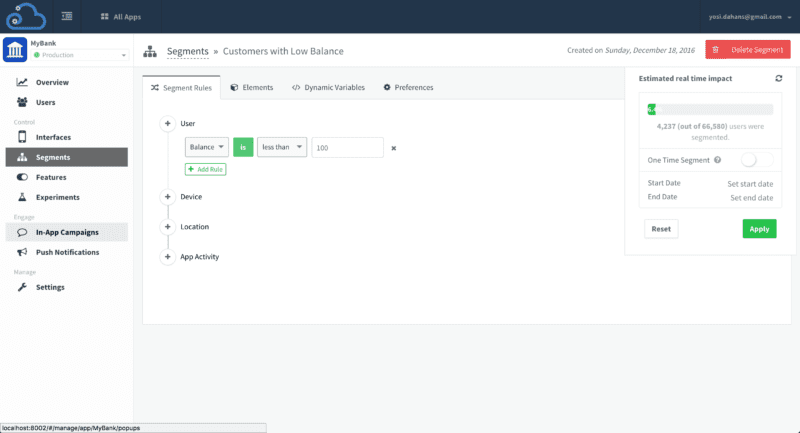

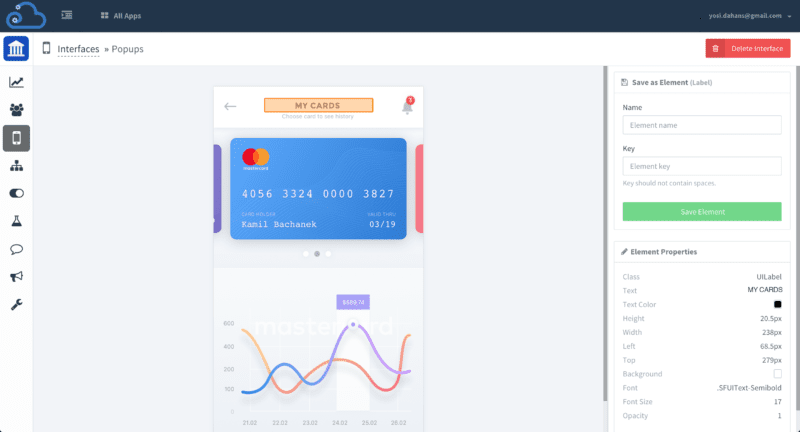

For the live demonstration Configo CTO Natan Abramov showed how the Configo platform scanned the screens of the banking app, and enabled the user to make changes that would appear simultaneously in the app when saved. In addition to being able to make cosmetic changes to text, color, and other features, the platform also supports pushing custom content to user-defined segments such as low-income, families, etc. Virtually any data point, from account balance to age to geolocation to app usage – can be used to define a segment for receiving certain app customizations, targeted messages, or special offers.

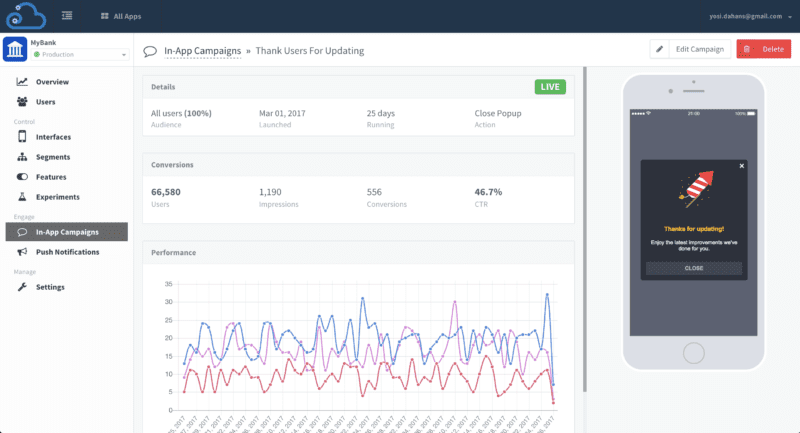

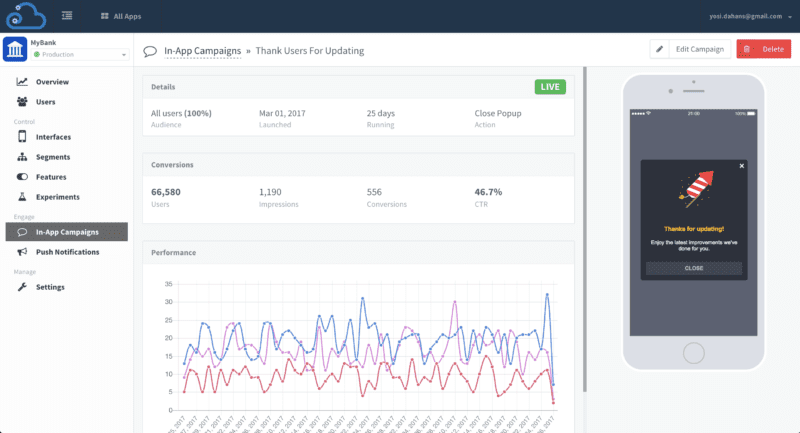

Configo also provides for in-app campaigns to send promotional messages to customers. Users can upload their own design or use one of Configo’s templates, then simply add text, images, and a call to action. Schedule the ad to pop-up at any one of a number of cues: a specific time or when a button on an app is pushed, and the campaign is ready to go. Configo’s platform provides for A/B testing, and works with iOS, Android, native, and hybrid systems.

Once the app’s screens are scanned into the Configo platform, individual content items can be tagged for management later.

“By providing contextual offers and content in real time, you are actively optimizing your customer interaction, driving better engagement and increasing mobile sales,” Dahan said. Emphasizing the ease of adopting the technology (“up and running with virtually no integration and without messing around with code in just a couple of days”), he said his company’s platform ensures that FIs gain “total control of your customer’s journey in your mobile application.”

Company Facts

- Headquartered in Tel Aviv, Israel

- Founded in 2015

- Running more than 10 pilots with banks and credit card companies in Europe

We met with Dahan (pictured) and Abramov, co-founders of Configo, at FinovateEurope in London and followed up with a  few questions for Dahan by e-mail. Here are his responses.

few questions for Dahan by e-mail. Here are his responses.

Finovate: What problem does your technology solve?

Yosi Dahan: Product and marketing managers require rapid iterations, prototyping, and optimizations of their mobile banking product to increase conversion and engagement. Working agile has its benefits, but the release and update cycles are still measured in weeks as most of the tasks go through the R&D teams.

Finovate: Who are your primary customers?

Dahan: Financial institutions.

Finovate: How does your solution solve the problem better?

Dahan: Product and marketing leaders get access to a variety of tools in our platform to simply create new customer experiences, optimizing the customer’s journey and interaction. Configo integrates with any existing mobile app using an SDK and provides a dashboard for management. Segmenting users, running A/B test experiments, launching campaigns, and personalizing the app’s user interface, can be achieved without a single line of code. Configo has managed to cut the time-to-market of app changes and business tasks by over 15%.

The Configo platform supports in-app campaigns and provides total control over how the ads look and appear to the user.

Finovate: What in your background gave you the confidence to tackle this challenge?

Dahan: The team behind Configo has more than nine years of experience of developing mobile apps. Prior to starting Configo, we conducted research involving more than 50 financial institutions around the world in order to understand how their app release cycles look like and how we can reduce the time-to-market to meet customer expectations. Configo has managed to cut the time-to-market of app changes and business tasks by over 15%.

Customers can be segmented based on any datapoint – age, account balance, app usage – on the Configo platform.

Finovate: What are some upcoming initiatives from Configo that we can look forward to over the next few months?

Dahan: We’ll be introducing new tools for both marketing and product managers to help them better understand their customers’ journey as well as increase engagement, decrease churn rate, and provide exceptional user experience. We are also working on creating a solution for the online (web) channel.

Finovate: Where do you see Configo a year or two from now?

Dahan: Our goal is to help financial institutions around the world shape their mobile channel. We are planning on delivering a custom experience to 50 million mobile banking users by 2019.

Configo’s Yosi Dahan (CEO & Co-Founder) and Natan Abramov (CTO & Co-Founder) demonstrating Configo Live Mobile Experience at FinovateEurope 2017.

Presenters

Presenters Darren Bassman, Head of Product, BlinkReceipt

Darren Bassman, Head of Product, BlinkReceipt

Presenters

Presenters Julie Rotz, Senior Consultant

Julie Rotz, Senior Consultant

Presenters

Presenters Alex G. Argudo, TOPAYz CEO and Head of Banking and Insurance at SATEC

Alex G. Argudo, TOPAYz CEO and Head of Banking and Insurance at SATEC

Presenters

Presenters Mark Zangari, CTO

Mark Zangari, CTO

Presenter

Presenter

few questions for Dahan by e-mail. Here are his responses.

few questions for Dahan by e-mail. Here are his responses.