Today, whether you are a small team in a backyard garage or the army of developers in the Googleplex, it is clear that building and sustaining a strong tech company is increasingly about building and sustaining a strong team. Colleen McCreary (pictured), the new Chief People Officer for Credit Karma, helps explain why this is so and how companies can make sure it happens.

Finovate: How long have you been at Credit Karma and what’s your background?

Colleen McCreary: I’ve been at Credit Karma for four months and have been working in various people/HR roles at tech companies for over 20 years. This is my fourth full-time role as a Chief People Officer. I started my career at large public companies but have spent the last decade focusing on scaling startups.

Finovate: Not every company has a Chief People Officer. When does a company know it’s time to hire one?

Finovate: Not every company has a Chief People Officer. When does a company know it’s time to hire one?

McCreary: I’m excited that I’m getting asked this question more often. There’s no perfect science, but you usually need someone in a senior capacity when your scale/growth has outgrown the basics you can read in a book. Because labor is usually your most expensive cost, at some point you want an expert who spends all their time thinking about it. Most of what a CPO brings is the ability to match behaviors with a toolbox of possible solutions.

Finovate: What are the challenges a Chief People Officer faces today compared to 5 to 10 years ago?

McCreary: In theory, people haven’t changed that much in terms of their motivation and desires. However, the big changes in the last five to 10 years have been around: 1) increasing employee confidence about vocalizing their opinions and concerns internally and externally, 2) rising expectations of career development/growth and a willingness to quickly move to another opportunity to find it, and 3) the rise of anonymous sites on the internet.

Finovate: What drew you to this field in general and why Credit Karma in particular?

McCreary: I’ve spent my entire professional career in the technology industry because I love the pace of innovation and the impact it has on individuals and society. There’s nothing more impactful than the ability to gain financial independence. Credit Karma is at the intersection of all of this. However, most important to me was the amazing team that founded the company and the opportunity to work with someone as mission-focused as (CEO) Ken Lin.

Finovate: What skills are most important for a Chief People Officer?

McCreary: There are probably a lot of different answers to this, but when I coach other CEOs who are looking to hire a CPO, here’s my list:

- Deep experience across multiple areas (recruiting, compensation, employee development, performance management)

- A strong point of view and a willingness to share it and push back when appropriate

- Orientation around using data to guide/influence decision-making

- Strong operations experience

- Ability to lead/coach people of all backgrounds

- A thick skin and sense of humor because you can’t please everyone

Finovate: How does a Chief People Officer measure success in her role?

McCreary: From a metrics perspective, we tend to look at things like reduced regrettable attrition, manager effectiveness, offers accepted, NPS (net promoter score) as an employer, etc. However, I think there are some less measurable aspects around employee willingness to vocalize opinions publicly, perceptions of accountability, and overall employee trust in leadership.

Finovate: Thank you for your time.

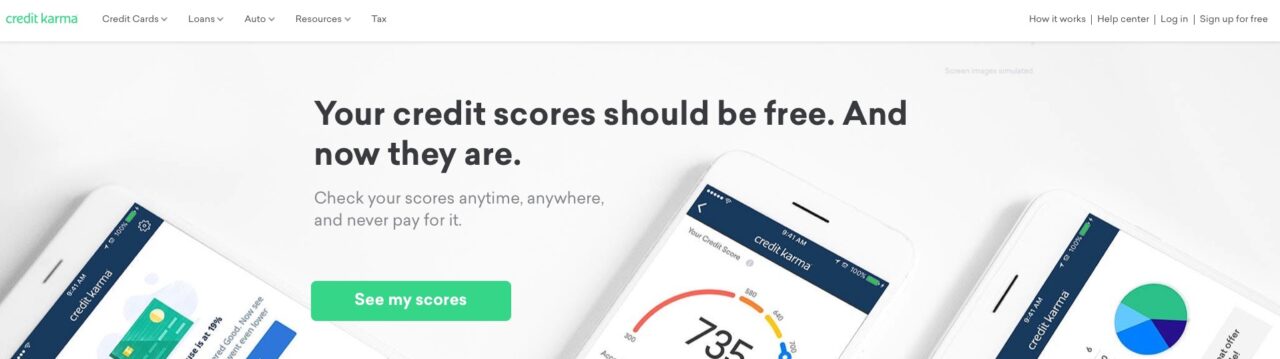

With more than 80 million members across the U.S., Credit Karma offers free credit scoring, monitoring, and reporting to help consumers better manage their debt. Credit Karma helps users of its platform understand how their credit scores impact their ability to get loans and provides personalized recommendations to help consumers save money and use credit more wisely.

One of Finovate’s earliest alums, Credit Karma demonstrated its Debt Manager solution at FinovateSpring 2009. The company was founded in 2007 and is headquartered in San Francisco, California.