With FinovateEurope right around the corner, we wanted to take a look at the companies that have won Best of Show trophies from FinovateEurope conferences since we first took the show across the pond back in the winter of 2011.

Specifically, we focused those FinovateEurope alums that have won multiple Best of Show awards to see how they reflect the development – and anticipate the future – of fintech in Europe.

eToro (FinovateEurope Best of Show 2017, 2015, 2012, 2011) – Innovator in social trading and investing

- Headquarters: London, U.K.

- Founded: 2007

- Total funding raised: $72.9 million

- CEO: Yoni Assia (founder)

- Most recent Finovate appearance: FinovateEurope 2017

Winner of a Best of Show trophy at the inaugural FinovateEurope in 2011 and picking up another three awards since, eToro is a pioneer in social investing. The company has more than 4.5 million traders and investors in currencies, commodities, indicies, and CFD stocks operating in more than 170 countries. Last month eToro launched GoodDollar, a new non-profit, open source initiative to use cryptocurrency to reduce income inequality.

Winner of a Best of Show trophy at the inaugural FinovateEurope in 2011 and picking up another three awards since, eToro is a pioneer in social investing. The company has more than 4.5 million traders and investors in currencies, commodities, indicies, and CFD stocks operating in more than 170 countries. Last month eToro launched GoodDollar, a new non-profit, open source initiative to use cryptocurrency to reduce income inequality.

Meniga (FinovateEurope Best of Show 2018, 2015, 2013, 2011) – Digital banking solutions specialist

- Headquarters: London, U.K.

- Founded: 2009

- Total funding raised: $23.4 million

- CEO: Georg Ludviksson (co-founder)

- Most recent Finovate appearance: FinovateEurope 2017

Meniga is a digital banking solutions provider with offices in London, Reykjavik, Stockholm, and Warsaw, Poland. With more than 50 million digital banking users in 20 countries, Meniga most recently demonstrated its technology at FinovateEurope 2017, presenting its new UX and API, Personal Finance Challenges. November was a big month for the company, picking up an investment of $3.4 million from long-time client Islandsbanki, and inking a deal with Singapore’s United Overseas Bank.

Meniga is a digital banking solutions provider with offices in London, Reykjavik, Stockholm, and Warsaw, Poland. With more than 50 million digital banking users in 20 countries, Meniga most recently demonstrated its technology at FinovateEurope 2017, presenting its new UX and API, Personal Finance Challenges. November was a big month for the company, picking up an investment of $3.4 million from long-time client Islandsbanki, and inking a deal with Singapore’s United Overseas Bank.

Backbase (FinovateEurope Best of Show 2018, 2017, 2014) – Digital banking platform provider

- Headquarters: Amsterdam, The Netherlands

- Founded: 2003

- CEO: Jouk Pleiter (co-founder)

- Most recent Finovate appearance: FinovateEurope 2017

A leader in banking digitization and modernization and a long-time Finovate veteran, Backbase provides FIs with the tools and platform they need to turn traditional core banking systems into platforms that offer modern, seamless, digital customer experiences. The company has more than 80 major financial entities around the globe using its technology – including Barclays, Credit Suisse, Fidelity, and Al Rajhi Bank. Backbase most recently announced that it would power omnichannel digital services for BGZ BNP Paribas Bank.

A leader in banking digitization and modernization and a long-time Finovate veteran, Backbase provides FIs with the tools and platform they need to turn traditional core banking systems into platforms that offer modern, seamless, digital customer experiences. The company has more than 80 major financial entities around the globe using its technology – including Barclays, Credit Suisse, Fidelity, and Al Rajhi Bank. Backbase most recently announced that it would power omnichannel digital services for BGZ BNP Paribas Bank.

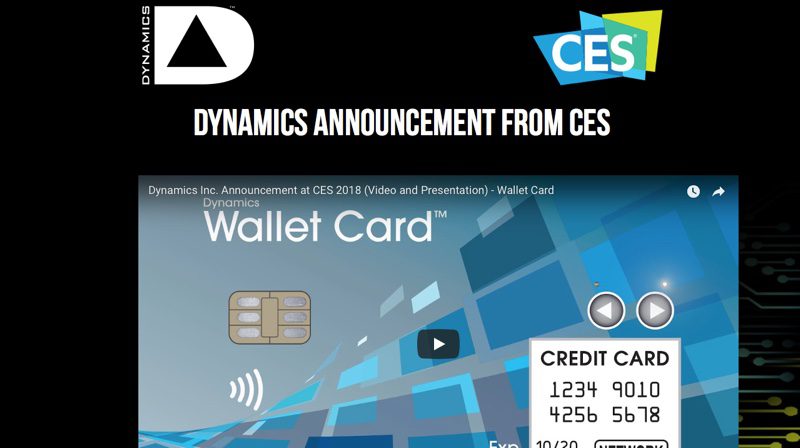

Dynamics (FinovateEurope Best of Show 2014, 2012) – Manufacturer of battery-powered, next-generation payment cards

- Headquarters: Pittsburgh, Pennsylvania, U.S.

- Founded: 2007

- Total funding raised: $110.7 million

- CEO: Jeffrey Mullen (founder)

- Most recent Finovate appearance: FinovateFall 2017

One day plastic cards may become a thing of the past. Until then, with card usage for debit and credit remaining a strong preference for many consumers, companies like Dynamics will continue to innovate on that platform. The company builds next generation, battery-powered payment cards that give issuers the ability to offer customers single cards that are able to perform a wide variety of payment functions. Dynamics’ technology enables secure transactions across multiple networks, with global acceptance at most points of sale. Expanding to the Japanese market earlier this year, Dynamics announced a partnership with Mumbai-based IndusInd Bank last month.

One day plastic cards may become a thing of the past. Until then, with card usage for debit and credit remaining a strong preference for many consumers, companies like Dynamics will continue to innovate on that platform. The company builds next generation, battery-powered payment cards that give issuers the ability to offer customers single cards that are able to perform a wide variety of payment functions. Dynamics’ technology enables secure transactions across multiple networks, with global acceptance at most points of sale. Expanding to the Japanese market earlier this year, Dynamics announced a partnership with Mumbai-based IndusInd Bank last month.

Tink (FinovateEurope Best of Show 2017, 2014) – Builder of PFM solutions

- Headquarters: Stockholm, Sweden

- Founded: 2012

- Total funding raised: $30.7 million

- CEO: Daniel Kjellen (founder)

- Most recent Finovate appearance: FinovateEurope 2017

Two Finovate appearances. Two Best of Show awards. Not a bad showing for the Swedish PFM designer Tink. The company’s solution marries account aggregation and information with payment initiation services to provide consumers with a virtual bank experience that is fully PSD2-compatible. Of late, Tink has teamed up with banks, expanding its offerings beyond B2C to bring its technology to FIs like Nordea, Klarna, and Nordnet (see the Tink Technology homepage pictured). The company also launched its developer platform, enabling developers to leverage the company’s Account Aggregation and Categorization solutions via API.

Two Finovate appearances. Two Best of Show awards. Not a bad showing for the Swedish PFM designer Tink. The company’s solution marries account aggregation and information with payment initiation services to provide consumers with a virtual bank experience that is fully PSD2-compatible. Of late, Tink has teamed up with banks, expanding its offerings beyond B2C to bring its technology to FIs like Nordea, Klarna, and Nordnet (see the Tink Technology homepage pictured). The company also launched its developer platform, enabling developers to leverage the company’s Account Aggregation and Categorization solutions via API.

mBank (FinovateEurope Best of Show 2015, 2013) – Universal bank

- Headquarters: Lodz, Poland

- Founded: 1986

- CEO: Cezary Stypulkowski

- Most recent Finovate appearance: FinovateEurope 2015

mBank’s FinovateEurope appearances have been occasions to celebrate the power of partnerships. The fourth largest retail bank in Poland, mBank has shown through live technology demonstrations with firms like virtual reality specialist i3D, global management consultancy Accenture, and fellow Finovate alum Efigence how an openness to collaboration can enable banks to provide a better experience for customers while building their brand. Earlier this month, a corporate customer survey sponsored by Euromoney named mBank to be the Best Service Bank in Poland. In November, mBank unveiled a new, free, multi-currency service for its Visa cardholding customers.

mBank’s FinovateEurope appearances have been occasions to celebrate the power of partnerships. The fourth largest retail bank in Poland, mBank has shown through live technology demonstrations with firms like virtual reality specialist i3D, global management consultancy Accenture, and fellow Finovate alum Efigence how an openness to collaboration can enable banks to provide a better experience for customers while building their brand. Earlier this month, a corporate customer survey sponsored by Euromoney named mBank to be the Best Service Bank in Poland. In November, mBank unveiled a new, free, multi-currency service for its Visa cardholding customers.

Etronika (FinovateEurope Best of Show 2014, 2013) – Digital banking platform provider

- Headquarters: Vilnius, Lithuania

- Founded: 2000

- CEO: Arnoldas Jankunas

- Most recent Finovate appearance: FinovateEurope 2016

Out of our eight multiple-time Best of Show winners from FinovateEurope, four are digital banking platform providers. Lithuania-based Etronika, a member of the European FinTech 50, specializes in providing not just a state-of-the-art digital platform, but also solutions like a visualized API engine that makes it easier for FIs to connect, bundle, and offer a variety of financial services through an omnichannel user interface. The company forged a partnership with Comarch last spring and, last fall, Etronika’s mobile banking solution was featured in IDC MarketScape 2017’s vendor assessment.

Out of our eight multiple-time Best of Show winners from FinovateEurope, four are digital banking platform providers. Lithuania-based Etronika, a member of the European FinTech 50, specializes in providing not just a state-of-the-art digital platform, but also solutions like a visualized API engine that makes it easier for FIs to connect, bundle, and offer a variety of financial services through an omnichannel user interface. The company forged a partnership with Comarch last spring and, last fall, Etronika’s mobile banking solution was featured in IDC MarketScape 2017’s vendor assessment.

CREALOGIX (FinovateEurope Best of Show 2018, 2017) – Digital banking solution provider

- Headquarters: Zurich, Switzerland

- Founded in 1996

- CEO: Thomas Avedik

- Most recent Finovate appearance: FinovateEurope 2018

If recent Best of Show wins are any indication, digital banking solution provider  CREALOGIX is one of our hottest Best of Show winning alums. The Swiss firm picked up its second trophy in February, impressing our audience with a live demo of its customer banking app. Since then the company has helped private bank Hauck & Aufhauser launch its digital asset management solution, gained a few spots in the IDC ranking of the global top 100 fintech companies, and reported record sales for a third consecutive year. With more than 450 bank customers around the world, CREALOGIX has more than 1,200 installations of its technology.

CREALOGIX is one of our hottest Best of Show winning alums. The Swiss firm picked up its second trophy in February, impressing our audience with a live demo of its customer banking app. Since then the company has helped private bank Hauck & Aufhauser launch its digital asset management solution, gained a few spots in the IDC ranking of the global top 100 fintech companies, and reported record sales for a third consecutive year. With more than 450 bank customers around the world, CREALOGIX has more than 1,200 installations of its technology.

And here’s the full list of FinovateEurope Best of Show winners since 2011.

FinovateEurope 2018

- Backbase

- Be-IQ

- CREALOGIX

- iProov

- Meniga

- Microblink

- W.UP

FinovateEurope 2017

- Backbase

- CREALOGIX

- Dorsum

- eToro

- Memento

- SaleMove

- Tink

FinovateEurope 2016

- Capitali.se

- DriveWealth

- EyeVerify

- IDscan Biometrics

- SwipeStox

- Valuto

FinovateEurope 2015

- Avoka

- Coinjar

- ebankIT

- eToro

- Jumio

- mBank & i3D

- Meniga

FinovateEurope 2014

- Backbase

- BehavioSec

- Dynamics

- Etronika

- Misys

- Luxoft

- Tink

- Toshl

- Momentum (FKA YourWealth)

FinovateEurope 2013

- Credit Agricole

- Etronika

- mBank & Efigence

- Meniga

- Moven

- Pockets United

- SumUp

- Virtual Pigy (Oink)

FinovateEurope 2012

- Cardlytics

- Dynamics

- eToro

- Nutmeg

FinovateEurope 2011

- eToro

- Finantix

- Liqpay

- Meniga

FinovateEurope 2019 is only a few months away. Join us February 12 through 14 for three days of live fintech demonstrations and insightful keynotes and presentations on some of the most innovative technologies and trends in fintech. Tickets are on sale now, so be sure to visit our registration page and save your spot today.

Top image designed by Freepik

Meniga is a digital banking solutions provider with offices in London, Reykjavik, Stockholm, and Warsaw, Poland. With more than 50 million digital banking users in 20 countries, Meniga most recently demonstrated its technology at FinovateEurope 2017, presenting its new UX and API, Personal Finance Challenges. November was a big month for the company,

Meniga is a digital banking solutions provider with offices in London, Reykjavik, Stockholm, and Warsaw, Poland. With more than 50 million digital banking users in 20 countries, Meniga most recently demonstrated its technology at FinovateEurope 2017, presenting its new UX and API, Personal Finance Challenges. November was a big month for the company,