Banks have ratcheted up the design aspects of their websites substantially during the past 18 months. But in my annual look at holiday website designs, I found little change over past years. Only nine of the 20 largest U.S. banks displayed any holiday graphics or promos this year. That’s one more than last year, but still one less than 2010.

Banks have ratcheted up the design aspects of their websites substantially during the past 18 months. But in my annual look at holiday website designs, I found little change over past years. Only nine of the 20 largest U.S. banks displayed any holiday graphics or promos this year. That’s one more than last year, but still one less than 2010.

Here’s a rundown of the 2013 holiday UIs:

Once again PNC Bank led the pack with its three-decades-long holiday CPI (Christmas present index). Zions Bank and Comerica (with the same promo as last year) were decked out in full-screen holiday graphics. Union Bank, BB&T, US Bank, TD Bank and Wells Fargo also displayed notable holiday imagery. Chase just hinted at the holidays, earning a single bulb.

Many smaller banks and credit unions post creative holiday imagery. For example, Austin, TX-based Amplify Credit Union ran four holiday elements on its hompage on Christmas Eve (see last screenshot).

The scrooge list: top-20 banks with no holiday promotions or graphics on 24 Dec 2013:

Bank of America, Bank of the West (BNP Paribas), Capital One, Capital One 360 (formerly ING Direct), Citizens (RBS), Fifth Third, Harris Bank (BMO), HSBC, Key Bank, SunTrust, Union Bank (Mitsubishi UFJ)

Following is a quick overview of the promotions, including a 1- to 5-bulb rating.

Previous year-end holiday posts: 2012, 2011 (big banks), 2011 (CUs/community banks), 2009 part 1, 2009 part 2, 2007, 2006, 2006, 2004

_____________________________________________________________________

Big banks in the holiday spirit

(rated from 1 to 5 bulbs; screenshots from Tuesday morning, 24 Dec 2013)

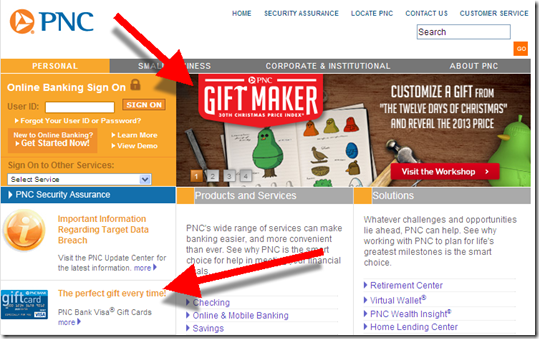

PNC Bank

- Animated Gift Maker tied to its annual 12 Days of Christmas CPI price index (which it’s published for 30 years)

- Visa Gift Card promo (lower left)

Hompage: PNC is leading with its Gift Maker and 12 days of Christmas price index

—————————-

Comerica

- Large gift card in main promo area (#3 in 4-promo rotation) with engaging holiday graphics

- Gift card promo in bottom center position with green background

————————–

Zions Bank

- Default “Merry Christmas” message with holiday graphics across the page (#1 of 4-promo rotation)

———————————

Union Bank

- Rewards credit card (#2 in 3-promo rotation)

——————————

BB&T

- Checking account promo with holiday graphics

- Small Visa gift card promo near the bottom of the page

———————————

TD Bank

- Holiday budgeting tips

Homepage

Landing page

—————————–

US Bank

- Customers (1st screenshot) saw some PFM messaging, the “Holiday money manager,” which was touting the bank’s online banking and alert functions (U.S. Bank does not offer advanced PFM functions)

- Non-customers (2nd screenshot) saw a “Tis the season” checking-account promo

Hompage displayed to visitors known to be customers (via cookies)

Homepage displayed to non-customers

—————————————

Wells Fargo

- Holiday message in lower left (below the fold)

- Plush pony for opening new account

—————————————

Chase Bank

- Credit card offer: “Save on holiday balances and new purchases”

Score: ![]()

——————————–

Bonus standout: Amplify Credit Union

- Holiday bells integrated with logo

- Skip-a-payment promo to free up holiday cash, with humorous holiday graphic

- Holiday closures schedule

- No payments until 2014 on auto loans

————————-

Notes:

1. Observations taken between 9 AM and Noon, Pacific Time, on Tue, 24 Dec 2013, from Seattle IP address, Chrome browser with cookies cleared

2. Animation from http://www.millan.net/anims/christmas.html#

CaixaBank

CaixaBank