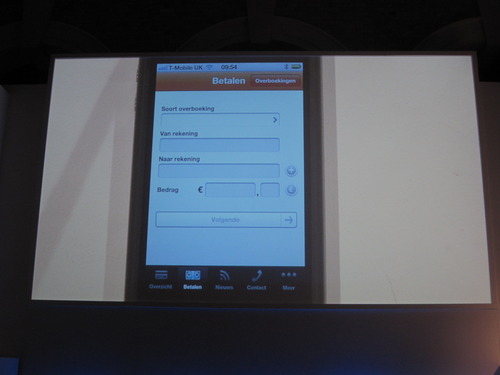

Today, Service2Media showed how the payment method iDEAL supports mobile payments:

“Service2Media and Rabobank introduce mobile payments via banking app for all webshops, starting with bol.com. Customers of Rabobank that installed the Rabobank Mobile Banking app can now pay their mobile purchases as easily as their online purchases, using a mobile version of internet payment method iDEAL. The new mobile payment is facilitated by starting the Rabobank Banking app on an iPhone once a payment request is issued on the merchant mobile site. The transaction is then authorized by the user in the app with his account number and access code before being redirected to the merchant’s mobile site. Mobile banking is now possible without an e-reader (up to €1000).”

Product Launched: 2010

HQ Location: Enschede, Netherlands

Company Founded: 2005

Metrics: 140 employees, offices in Netherlands, UK, Spain, UAE and USA, $10 million (US) investment from Prime Ventures

Website: service2media.com