The following is a sponsored post from InterSystems, Gold Sponsors of FinovateWest Digital, November 23 through 25, 2020.

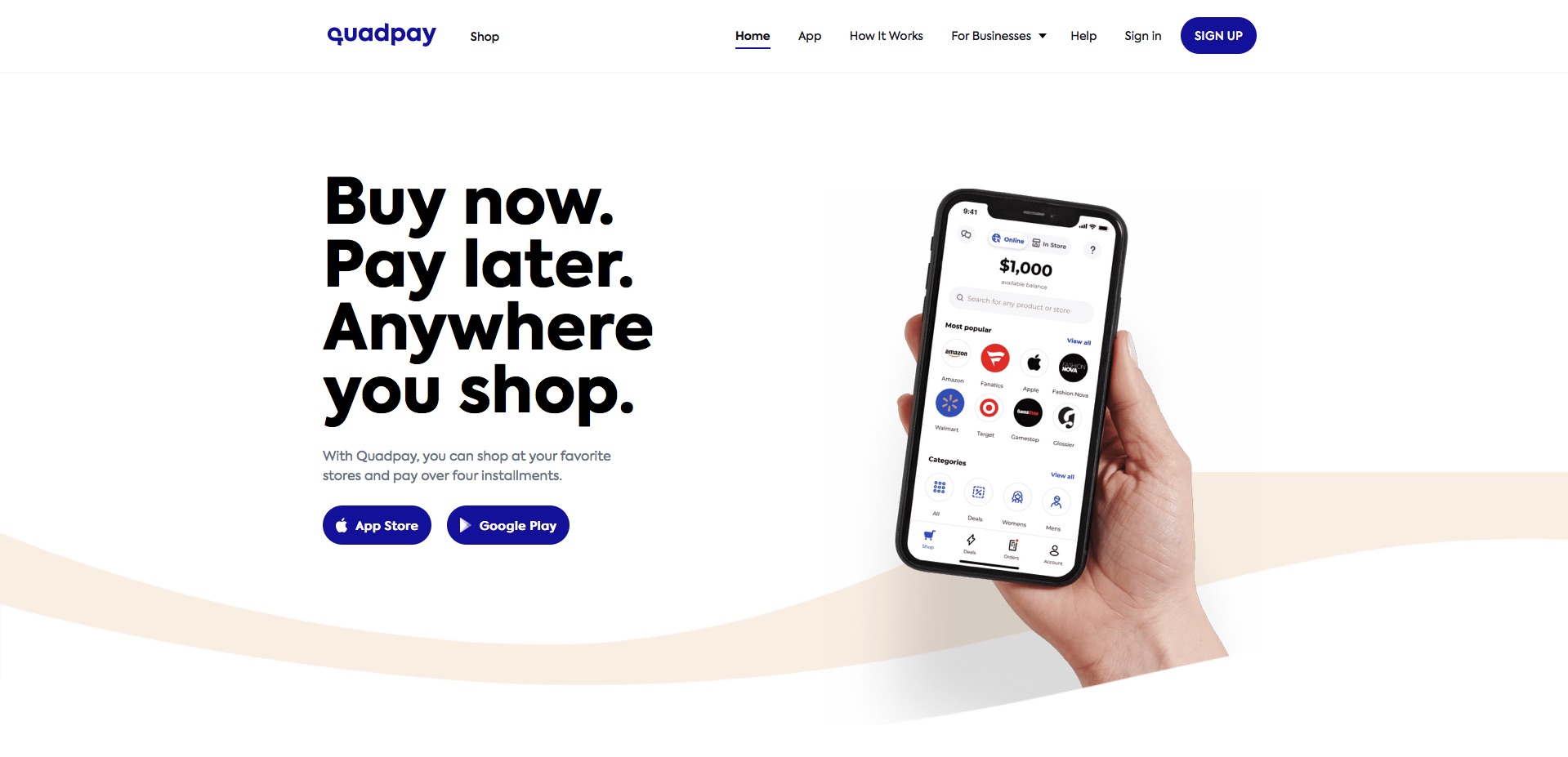

In an increasingly digital world filled with chatbots, tap-and-go payments, and “buy now, pay later” credit lines, hyper-personalization is the new frontier on top of a new frontier in financial services.

What is hyper-personalization?

Hyper-personalization enables financial services organizations to leverage the huge volumes of customer data they have in their systems efficiently and effectively to make more specific and more relevant product recommendations, such as an increase of a credit limit at the point of sale, or a list of previous interactions pushed to the chatbot, allowing it to pick up where it last left off. It does so by analyzing the data available to it through the power of analytics, artificial intelligence (AI), and machine learning.

It offers immense growth opportunities for all financial services providers if they can cater to small and specific groups. Hyper-personalization can foster loyalty in an era in which loyalty has declined, and it pushes the next generation of consumers and investors towards those financial services which can be agile in what they offer.

Traditional firms and hyper-personalization

Traditional firms are often encumbered by processes built up over decades. These processes are ingrained and necessary for them to have operated the way they have successfully and for so long.

To these firms, those same processes hinder the uptake of advances such as AI, data analytics and machine learning.

Yet these and other new technologies do not require traditional firms to re-imagine how processes work, nor does implementing have to be as obtrusive and disruptive as a full digital transformation initiative, for example. Rather, technology can be implemented in the background and effectively manage itself, be installed quickly and efficiently in existing systems without disrupting the rest of the business. Some can even run adjacently to everything else the business does.

Traditional firms have decades or more worth of data. Analytics tools, AI, and machine learning work together to make sense of it all, wherever it might be and in whatever language it might be in, and surface actionable insights from all of it. Importantly, these technologies work in the background, without disrupting any mission-critical processes.

How can traditional firms hyper-personalize?

- Traditional firms can deploy a smart data fabric, which is effectively a layer which sits above all of the firm’s available endpoints and distributed services — whether it be in the cloud, on-premise or both — and ensures those endpoints and their capabilities speak the same language.

- Next, the data needs to be put through proper governance procedures to ensure it is clean, relevant and has the necessary integrity to be used with confidence for the right reasons by the organization — it needs to be accurate, reliable, complete, appropriate, and credible. For this to occur, it goes through something of a digital centrifuge which analyses its health and cleans it before having it ready for primetime.

- Once this is done, the rich streams of data inherent across the company can be mined, analyzed, and surfaced using the power of AI and machine learning.

This may sound like a lot of steps and go against the grain of what we’ve been discussing in this article. But rest assured, all of these technologies can be implemented with little to no disruption to operations, and they work in the background while delivering key insights for the data almost in real-time. It’s through using these technologies that traditional firms can, at last, unlock those rich and extensive streams of historical data dating back decades, which in turn provides a clear method to fostering loyalty. Research shows that customers want a hyper-personalized experience. According to Accenture, 91 percent of consumers are more likely to shop with brands who recognize them, remember them, and provide them with relevant offers and recommendations.

Conclusion

Traditional firms have a hyper-personalization advantage thanks to possessing a trove of legacy data and brand recognition. They just need to embrace what is available to help leverage their data and analytics to get them to their intelligent future — and trust that it can and will co-exist with existing processes.

If they allow technology to do the heavy lifting for them alongside their existing processes, traditional firms will be able to leverage decades of data to their advantage and engage in new ways with customers, without having to re-invent the wheel.