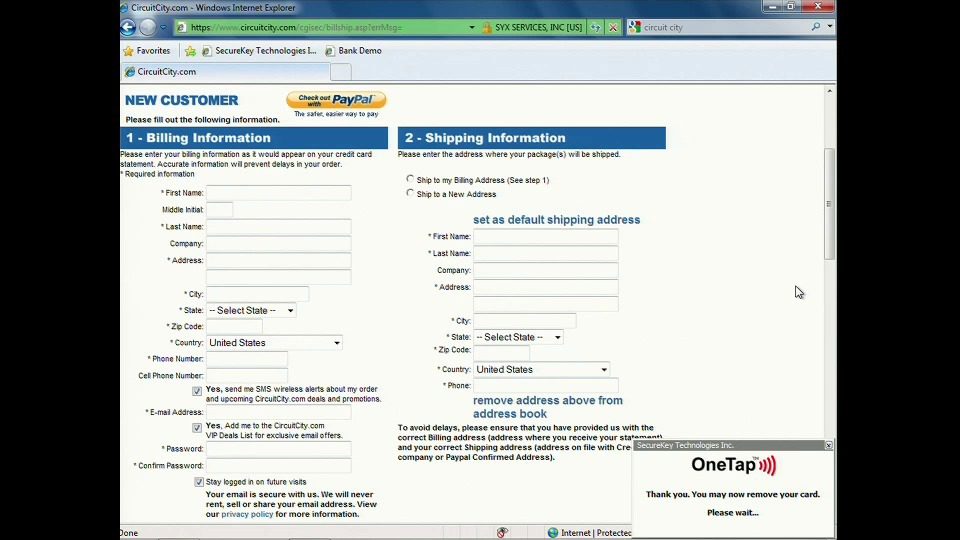

How they describe themselves: SecureKey makes online shopping faster, easier and more secure. Leveraging today’s contactless chip cards, SecureKey lets cardholders complete online checkout forms with just a tap of their card. The solution is designed to benefit all parties. Users enjoy faster checkout while using a familiar behavior. Merchants experience increased conversion without requiring any site changes or integration. For card issuers, the SecureKey solution increases online card security, eliminates passwords, and makes their card top-of-wallet.

Although in its early stages, SecureKey already has partnerships with several payments brands and financial institutions globally.

What they think makes them better: SecureKey offers banks and card companies a strong authentication solution that is attractive to consumers and transparent to merchants. This combination of benefits makes SecureKey a company to watch. Instead of requiring the customer to learn some new behavior, SecureKey leverages the cards that consumers already have in their wallet to make authenticating online as easy as paying in a store.

For high value and commercial banking clients, SecureKey also offers a touch screen SecureKey – providing a secure, easy-to-use terminal that simplifies the management of high value transactions while offering unprecedented levels of security.

Contacts:

Bus. Dev., Sales & Press: Chris Gardner, [email protected], 416 214-3624

How they describe themselves: Seeking Alpha is a leading source of financial analysis from the world’s top money managers, financial experts and industry commentators. Our new Investing Applications are web-based tools to help users discover, manage, track & analyze their investments. Our research shows that investing tools for self-directed investors are hard to find and vary in the quality of their offerings. We believe that everyone should have easy and cost-effective access to the best investing tools.

The Seeking Alpha Investing Apps Beta launch includes 15+ tools that we have identified to meet the needs of a cross-section of investors. Users start with our Investing App Store to easily find and use the Applications which suit their investing style.

What they think makes them better: Our name, Seeking Alpha, underscores our core mission: to help investors make smarter investment decisions and realize alpha – higher risk-adjusted returns on their portfolio. Seeking Alpha has become widely known for finding and publishing the highest quality investment articles by the best writers in the financial blogosphere. We’ve got lots of great content and now, we apply the same high standards to research, data and analysis tools: our Investing Applications.

With the launch of our Investing App Store, SeekingAlpha.com is the only place for self-directed, serious investors to get access to all of the tools they need to manage their investments and research new investment ideas. It’s the only a-la-carte platform for Investing Apps, with Seeking Alpha as the sole contact for support and billing.

Developers can use the Investing App API we’ve built to get their applications in front of our highly targeted, financially savvy audience of money managers, financial professionals and high net worth self-directed investors.

Contacts:

Bus. Dev. & Sales: Mike Rodov, Director of Business Development, [email protected], 646-209-5460

Press: Fara Hain, Director of Marketing, [email protected], +972-52-483-4304

How they describe themselves: Segmint, a financial services technology company, is focused on helping clients build personal digital relationships with their customers. Segmint’s innovations in targeted content placement allow personalized messages on a wide variety of online, mobile and social mediums. Segmint is re-defining “marketing” to be a “segment of one”.

What they think makes them better: Segmint increases the relevance of targeted online advertising. Our clients unlock valuable customer insights utilizing Segmint’s unique (patent-pending) technology to bring together a powerful micro-targeting analytics engine with precise message targeting and delivery capabilities to place the most effective message in front of their customers at exactly the correct time. Segmint allows Financial Institutions (FIs) and third party providers to build digital relationships in a relevant and timely way with FI customers, delivering the answer to the strategic challenges faced by FIs:

- Fee Income Goals: Generating a very substantial new fee income stream for FIs – with zero cost to customers

- Cross-Sell Goals: Delivering the right offer at the right time with unmatched precision

- Retention Goals: Offering reward offers, increasing client engagement

- Acquisition Goals: Finding new customers online based on knowledge about your current customers

- Marketing Budget Goals: Reduce online marketing expenses while increasing ad spend ROI

Contacts:

Bus. Dev. & Sales: John Relyea, VP, Banking & Strategic Partnerships, [email protected], (888) SEGMINT x 204

Press: Kim Pupillo, Senior Account Supervisor, Marcus Thomas, LLC, [email protected], 216-292-4700 x 3041

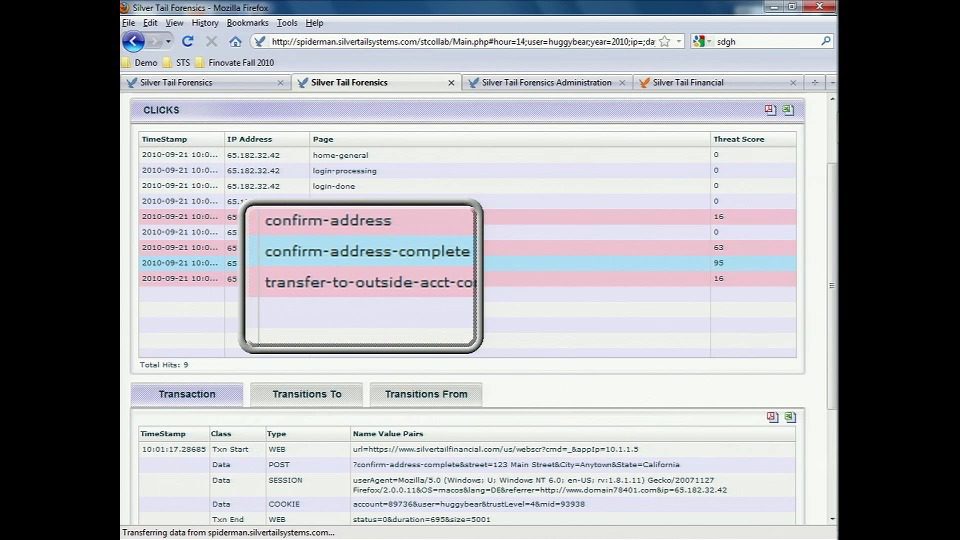

How they describe themselves: Silver Tail Systems provides next generation fraud prevention to protect against business logic abuse – a rising threat costing financial institutions hundreds of millions of dollars a year. Silver Tail Systems’ products use real-time behavior analysis to detect and alert on known threats and new behaviors like Man in the Browser, Zeus, and attacks by organized crime, then enable the business to disrupt these attacks in real-time. Founded by fraud prevention experts from eBay and PayPal, Silver Tail Systems significantly reduces online fraud losses, protects your institution, and increases customer trust.

What they think makes them better: Currently, when an online criminal finds a new type of attack, the criminal can get amazing return on investment for the attack. If the criminal uses the attack against Bank A, it may take Bank A days or weeks to find and stop the attack. Once Bank A has found and stopped the attack, it’s no problem for the criminal to repurpose the attack on Bank B, and so on. This gives attacks an almost infinite lifespan.

Silver Tail Systems’ Federation service shares data and rules and allows each customer to tune the rules to their needs. This is substantially different than other offerings that give banks a blacklist, but the only alternative is to use the entire blacklist “as is” or not at all.

Silver Tail Systems’ Federation service goes far beyond this. It gives customers rules they can customize to accommodate traffic levels and page flows of their site. In addition, Silver Tail System’s customers can customize the way they use the “bad lists” (IP addresses, email addresses, etc.) to control the false positive rates for their fraud detection.

Contacts:

Sales: Paul McGowan, VP of Sales, [email protected]

How they describe themselves: SmartyPig is the first and only online banking product that combines the intuitive functionality of Web 2.0 user applications with the viral nature of social networking communities. SmartyPig allows customers to open goal-based savings accounts, earn cash back from top merchants, and invite friends and family members to support their efforts with financial contributions. Separately, SmartyPig provides its banking partners increased visibility as to the timing and amounts of customer deposits, as well as spend data, thereby enabling banks around the world to manage funds and information in the most strategic manner possible.

What they think makes them better: SmartyPig is well-positioned to leverage its deep knowledge of customer psychographic data and purchasing information, as well as its fully audited bank transaction engine, as a means to market a wide array of products and services, from the white labeling of the product itself for top merchants and other financial institutions to a cost-effective deposit and information gathering product for leading non-profits. This precision has allowed SmartyPig to create a powerful, detailed customer information database which serves as a funneling mechanism for directing purchases to specific retail partners and service providers through redemption programs, advertising and product offers.

Contacts:

Sales: Jon Gaskell, Co-Founder & President, 515-256-2086

Press: Sarah Foss, Media Relations, 515-256-2086

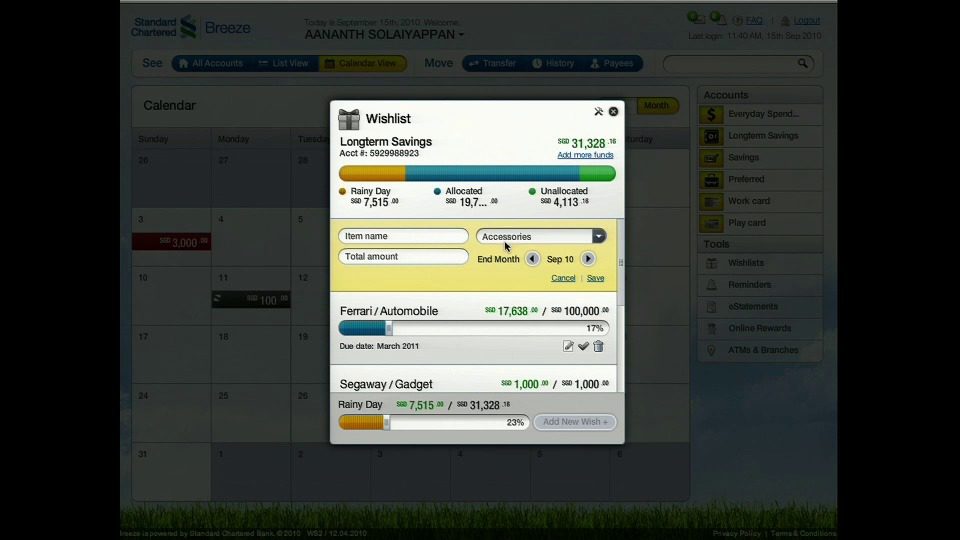

How they describe themselves: Standard Chartered PLC is a leading international bank, listed on the London and Hong Kong stock exchanges. It has operated for over 150 years in some of the world’s most dynamic markets and earns around 90 percent of its income and profits in Asia, Africa and the Middle East. This geographic focus and commitment to developing deep relationships with clients and customers has driven the Bank’s growth in recent years. It is committed to building a sustainable business over the long term and is trusted worldwide for upholding high standards of corporate governance, social responsibility, environmental protection and employee diversity. The Bank’s heritage and values are expressed in its brand promise, ‘Here for good’.

What they think makes them better:

Breeze is an engaging and intuitive banking experience that helps users manage their money and aims at making banking simpler, accessible and convenient. Breeze:

- Is designed for the young at heart, built with a strong emphasis on usability keeping the user and the medium in mind

- Uses social media to further the product development for and with the users in a continuous stream of innovation

- Provides a fully fungible experience across the web, iPhone, iPAD and will soon be available on other platforms.

Contacts:

Bus. Dev., Sales & Press: Kanags Surendran, Programme Manager, Innovation, [email protected], +65 6596 3084

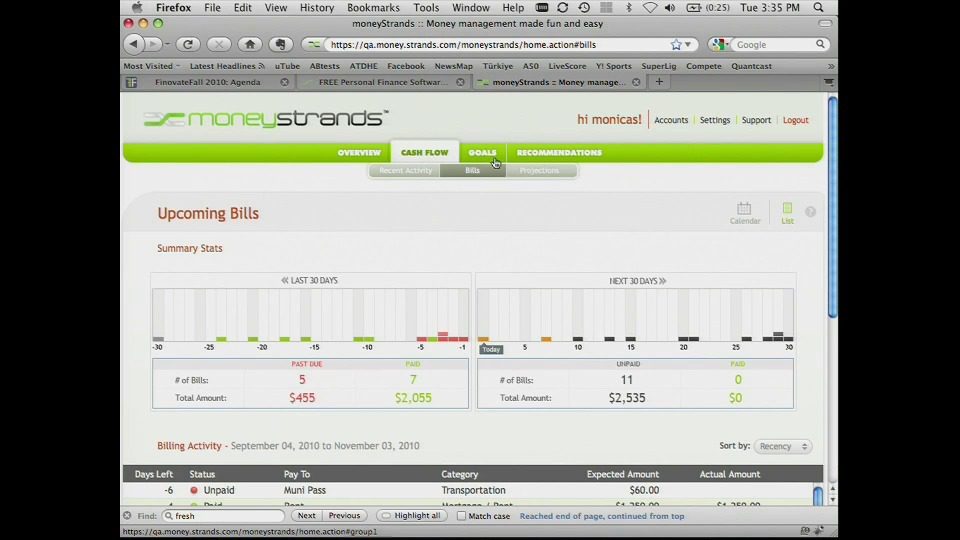

How they describe themselves: Strands Personal Finance is an independent business unit of Strands Labs, Inc., an industry leader in the personalization space. The company provides innovative online and mobile personal finance management (PFM) solutions to global financial institutions as well as to the end consumer.

Strands Personal Finance’s scalable and highly customizable software solution enables financial institutions’ customers to better manage their money and allows the financial institution to improve their customer relationships through increased engagement and insights. Financial institutions can gain a deeper understanding of their customers’ needs and further utilize sophisticated recommendation engines to connect the right products to the right customers.

Strands Personal Finance also powers the online consumer PFM service moneyStrands that combines proven core PFM use cases with a cutting-edge UI.

What they think makes them better: Strands Personal Finance’s proven technology is used by some of the world’s largest financial institutions. We’re continuously enhancing our technology to provide the most innovative money management features, designed to help people develop better financial habits. Our team has worked hard this past year to make moneyStrands an effortless way for anyone to take control of their finances quickly, easily and with better results. By adding advanced cash projection features, further simplifying the user interface and tightly integrating the involved use cases, moneyStrands has become a ‘must-have’ cash flow management tool that is also available for Financial Institutions to adopt in full or module by module.

Contacts:

Bus. Dev. & Sales: Edward Chang, VP Business Development, [email protected], 415-398-4333

Press: Lucia Giacomantonio, Community Outreach Manager, [email protected], 415-398-4333 x 207

How they describe themselves: The Receivables Exchange is the world’s first online marketplace for real-time trading of accounts receivable. Changing the landscape of business financing, The Receivables Exchange provides a new dimension in working capital management. The Exchange connects a global network of accredited institutional investors (Buyers) to the nation’s millions of small and midsize businesses (Sellers) in search of capital to grow. Buyers get direct access to a $17 trillion new investable asset; Sellers gain access to a new competitive working capital management solution by having their receivables bid on in real-time by multiple Buyers.

What they think makes them better: In 2007 we launched the first capital marketplace for small and midsize businesses, and have since continued down a path of innovation to change business financing. Holding true to TRE’s mission to deliver efficient access to capital through standardization, transparency, centralization and competition, we have created an entirely new cash flow management ecosystem for small and midsize business, and now large corporations. We introduce these new services after more than 200 years of industry stagnation. Every day we’re trading millions of dollars of receivables and helping SMBs nationwide access affordable capital while lowering their cost of capital more than 30%, on average.

Contacts:

Bus. Dev.: Barbara Brandfass, SVP of Bus. Dev., [email protected], 504-708-4171

Sales: Dana Stetson, SVP, Global Head of Sales, [email protected], 504-708-4156

Press: Laurie Azzano, SVP of Marketing, [email protected], 415-786-3317;

Bea Broderick, RLMpr, [email protected], 917-576-9321

How they describe themselves: Thwakk is a technology company specializing in youth customer acquisition platforms. Our customized, private-labeled, web platform integrates a strong financial education curriculum with the excitement of 3D simulation-based game play and rewards to affect positive behavioral change. Financial organizations can mitigate risk through financial education and identify knowledgeable, financially confident customers. We have created a new, exciting business channel to interact with the next generation consumer in a familiar format that they enjoy.

What they think makes them better: : Mo’doh Island is a cutting edge customer acquisition platform with real business applications. Not just financial education, but interactive tools that differentiate you from the competition.

- While competitors struggle to get 5 seconds of a young adult person’s attention, youth interact repeatedly and with prolonged exposure with your brand through our exciting, 3D platform

- Incentive-based learning keeps it exciting and creates interaction points with customers

- Customized solutions to build trust in your brand

- Real business applications – capabilities include account opening, loan applications, etc.

- Risk mitigation and the ability to develop knowledgeable, financially confident customers

- With over 100 million active virtual world users and tremendous growth, this is a critical business channel.

Contacts:

Bus. Dev., Sales & Press: Scott Moriarty, CEO, (t): 804-366-7665, (e): [email protected]

How they describe themselves: TouMetis innovation enables leaders in the financial services industry to fully realize the potential of the mobile channel to engage consumers, increase efficiency, and reduce service delivery costs.

TouMetis offers a complete client-server solution. Tailored applications are fast, feature-rich, and work on any mobile device. The server has the capacity to audit and record every mobile interaction — essential for compliance and risk mitigation. Together they provide business with a powerful mobile solution that is secure, extensible, and easy to manage that can be hosted either onsite or in the cloud.

What they think makes them better: Applications from TouMetis are built in the mobile browser and then wrapped in native code. To the user they look and function much like a native application. However, for the developer this unique approach results in richer applications that support location-based services, video, vector graphics, and much more. In addition, the company’s innovative development platform renders 85% of the application code compatible with Android, Symbian, iOS4, or Blackberry operating systems. So clients get richer applications that work across a broader selection of mobile devices, in less time.

Contacts:

Bus. Dev. & Sales: Dan Faricy, VP Sales, office: 208.514.0446, mobile: 208.890.7991

Press: Marshall Brezonick, VP Marketing, office: 208.541.0453, mobile: 208.861.1645

How they describe themselves: SafetyPay is a global, safe and secure online payment solution that enables online banking customers to make internet purchases from merchants worldwide and pay directly through their local bank account in their local currency. SafetyPay was developed in response to the growing need for a safe and secure online payment method, which also could be used internationally. It is an innovative, patent-pending e-payment process that operates as a clearing house; adding value to all participating parties – banks, merchants and consumers. SafetyPay eliminates fraud and identity theft risk for merchants and consumers, expands merchant’s customer base with an international reach of more than millions of potential banking customers and provides banks an additional revenue stream and cross promotional opportunities.

What they think makes them better: Unique from other methods of online payments,

SafetyPay: (1) shares revenue with bank partners, (2) requires no enrollment or registration, (3) discloses no confidential or financial information, (4) guarantees no fraud, (5) allows users to shop globally and pay via their local bank in local currency, (6) ensures all transactions are completed from the personal online banking environment and are not redirected to the merchant site, and (7) enables merchants to receive payments in their currency of choice even if a user pays in a different currency.

Contacts:

Bus. Dev.: Ronald Wieselberg, VP Bus. Dev., 786-294-6411×225, [email protected]

Press: Maribel Garcia, Head of Marketing USA, 786-294-6411×250, [email protected]

How they describe themselves: Segmint, a financial services technology company, has

developed a system enabling Financial Institutions (FIs) to build digital relationships with their customers. Segmint:

- Anonymously analyzes the transaction stream of individual FI consumers and small businesses

- Serves appropriate FI acquisition, cross-sell and retention offers, and collection messages, via a personalized mix of banners

- Delivers banners on FI websites and across the Internet

- Provides personalized reward offers, enabling FIs to enhance customer engagement and thank their customers

- Shares revenue from reward offer providers with FIs, delivering substantial fee-based income, significantly exceeding the nominal Segmint subscription cost

What they think makes them better: Segmint allows Financial Institutions (FIs) and third party providers to build digital relationships in a relevant and timely way with FI customers by:

- Targeting actual spending over time, not websites or pages viewed

- Classifying each anonymous customer with a personalized mix of activities and interests from a pool of over 40,000 lifestyle attributes

- Enabling fast and user-friendly online campaign creation and banner targeting

- Delivering the correct offer to the correct customer at the correct time based on actual purchase behavior using both FI websites and across the Internet

- Reporting purchase conversions within transaction streams

Contacts:

Bus. Dev. & Sales: John Relyea, (888) SEGMINT x204, [email protected],

Press: Beth Hallisy, Partner, Marcus Thomas LLC, 216-292-4700, [email protected]