How they describe themselves: RobotDough is a small software company focused on creating better analytical tools for individual investors. We recognize that, although there are many tools available to active traders – tools that focus on technical analysis, charting and attempts to predict the market – there are very few tools that help individuals perform detailed fundamental analysis of companies. Our goal is to take the best ideas from very expensive, professional-grade equity research tools and package them in a format that is suitable for any investor. We hope that our analytical tools help investors make higher profits while reducing their overall investment risk.

How they describe their product/innovation: RobotDough provides online analytical tools for stock market investors. These tools are focused on providing the thoughtful, value-focused investor with the tools they need to perform a complete financial analysis of investment candidates, without needing an MBA or CFA. In addition, RobotDough allows users to build, test, and share investment strategies. Our strategy builder has a backtesting tool that allows a user to test an investment strategy against historical financial and market data. Strategy builders can share their strategies with the rest of the community. Users who don’t care to build their own strategies can use the strategy marketplace to find strategies suitable for their risk tolerance, and then subscribe to them. RobotDough’s toolset covers the global market – we have over 45,000 companies in our database, covering 99% of the world’s market capitalization.

Contacts:

Bus. Dev., Press & Sales: Wilton Risenhoover, CEO, [email protected], 323-230-0048

How they describe themselves: Silver Tail Systems, Inc. is the leading provider of predictive security analytics for fraud detection and prevention to identify and remediate online threats in real-time. Our products deliver complete visibility and control to protect e-commerce websites, online financial institutions, government and Web 2.0 websites. We are a known leader in a new generation of fraud prevention tools that help customers quickly discover and remediate exploits, saving considerable time and resources typically spent on analysis and clean-up of damaged webpages.

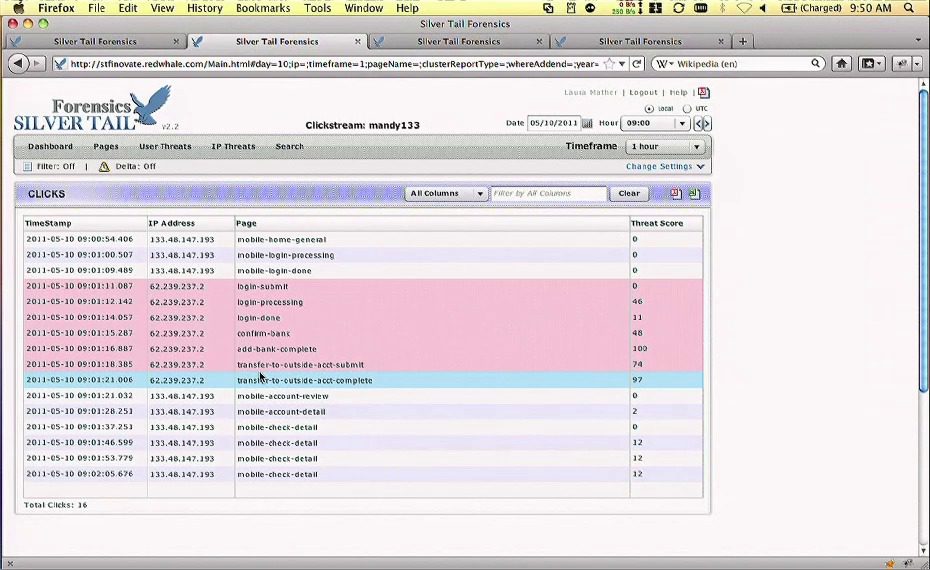

How they describe their product/innovation: User-specific monitoring has been added to our already-released Forensics product. User-specific monitoring performs behavioral analytics not only across a website’s total population, but on an individual user basis. Our Forensics product has been used extensively to protect banks and other online entities from attacks by organized crime and other online criminals. The addition of user-specific behavior analytics addresses additional types of attacks, makes the population-based monitoring of the Forensics solution even stronger, maintains a small hardware footprint, and still has a time-to-value measured in hours.

Contacts:

Bus. Dev.: Laura Mather, Founder and VP Product Marketing, [email protected]

Press: Leah McLean, Supervisor, Voce Communications, [email protected]

Sales: Paul McGowan, VP Sales, [email protected]

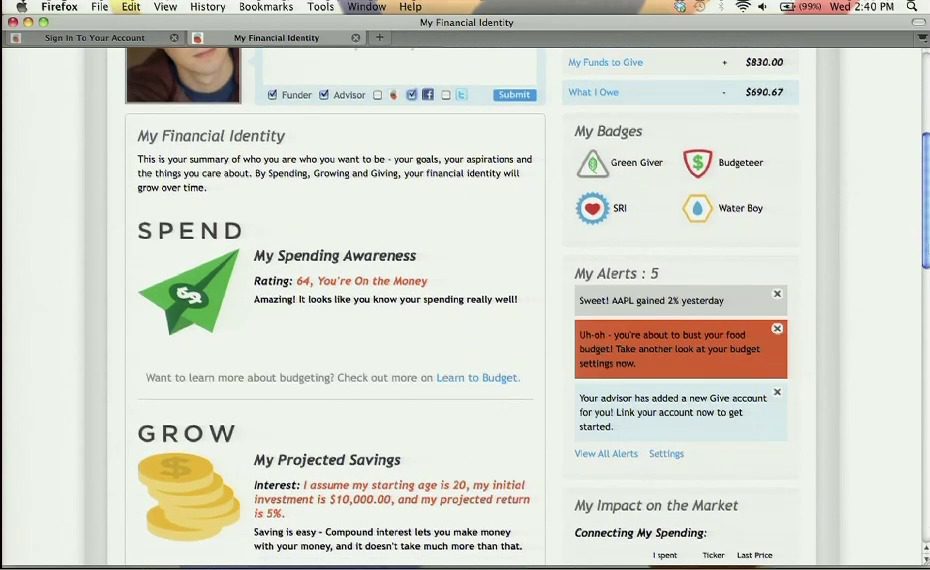

How they describe themselves: TILE – The Investing Learning Environment – offers the first personal finance tool for financial advisors and parents to educate Gen Y (15-25 year olds) about Spending, Growing, and Giving their money. Consumers under age 30 represent the largest sector of the U.S. population, and they will inherit more than $1 trillion over the next 10 to 15 years – a tremendous challenge and opportunity for today’s wealth managers. Using financial tools, community, and content, TILE engages its members to develop their own financial identities. Its unique tone and interface is accessible, relatable, and focused on an attractive – and important – demographic.

How they describe their product/innovation: The TILE Financial Identity Profile page connects the world of finance to how young adults live their everyday lives – who they are, what they care about, and why money matters to them. Young adults use Facebook to express their social identities, and now they have TILE to help them understand and express their financial identities.

Contacts:

Bus. Dev. & Sales: Amy Butte, Founder & CEO, [email protected], 212-905-6250

Press: [email protected]

How they describe themselves: TrustedID provides consumer identity protection services. TrustedID’s IDEssentials is ranked as the industry’s top product (Javelin Research, 2010) and protects customers’ credit and identity with more than a dozen safeguards.

How they describe their product/innovation: IDSafe is the first product designed to give consumers a way to reduce their risk of identity theft at no cost for free. IDSafe delivers a strong, core level of protection, including privacy monitoring, black market Internet scans, credit scores, a $50,000 limited service warranty, and more. IDSafe is an ongoing free service – there is no subscription time limit or requirement to purchase at anytime. In addition, the IDSafe Marketplace brings together best-in-class free services from partners that complement TrustedID’s protections, including five gigabites of backup, reputation monitoring and parental controls. TrustedID’s premium services are available to IDSafe users who wish to deepen or broaden their protection to include credit monitoring and online credit reports and more.

Contacts:

Bus. Dev., Sales: Eric Newman, VP of Sales & Business Development, [email protected], 650-631-2359

Press: Lyn Chitow Oakes, CMO, [email protected], 650-631-2379

How they describe themselves: SecureKey makes online shopping faster, easier and more secure. Leveraging today’s contactless chip cards, SecureKey lets cardholders complete online checkout forms with just a tap of their card. The solution is designed to benefit all parties. Users enjoy faster checkout while using a familiar behavior. Merchants experience increased conversion without requiring any site changes or integration. For card issuers, the SecureKey solution increases online card security, eliminates passwords, and makes their card top-of-wallet.

Although in its early stages, SecureKey already has partnerships with several payments brands and financial institutions globally.

How they describe their product/innovation: SecureKey offers banks and card companies a strong authentication solution that is attractive to consumers and transparent to merchants. This combination of benefits makes SecureKey a company to watch. Instead of requiring the customer to learn some new behavior, SecureKey leverages the cards that consumers already have in their wallet to make authenticating online as easy as paying in a store.

For high value and commercial banking clients, SecureKey also offers a touch screen SecureKey – providing a secure, easy-to-use terminal that simplifies the management of high value transactions while offering unprecedented levels of security.

Contacts:

Bus. Dev., Sales, Press: Chris Gardner, [email protected], 416-214-3624

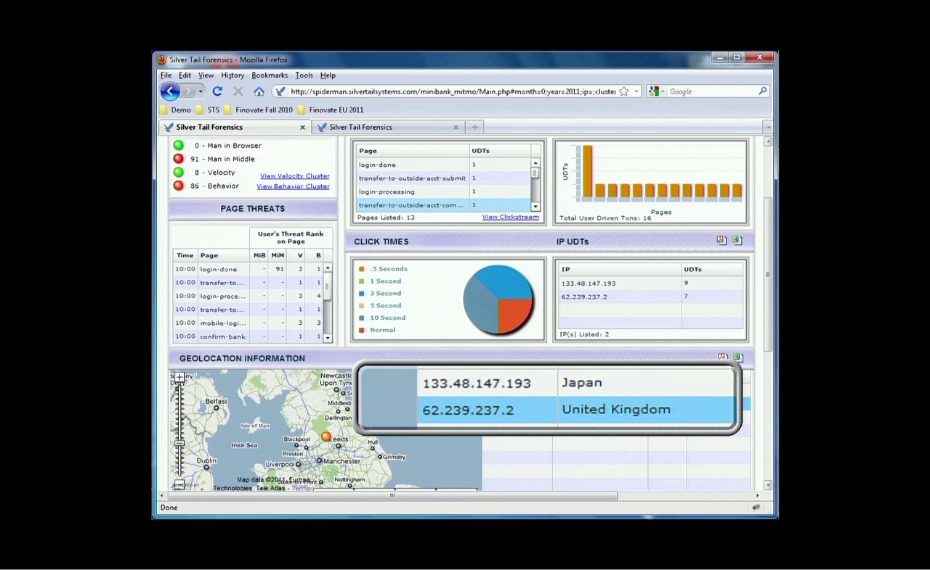

How they describe themselves: Silver Tail Systems provides next generation fraud prevention to protect websites from various types of attacks. Silver Tail Systems’ products use behavior analytics to detect and alert on known threats and emerging threats like Man in the Browser, Zeus, and attacks by organized crime, then enable the business to disrupt these attacks in real-time. Founded by fraud prevention experts from eBay and PayPal, Silver Tail Systems significantly reduces online fraud losses, protects websites, and increases customer trust.

How they describe their product/innovation: Silver Tail Systems is debuting our new product: Forensics MT: the multi-tenancy version of our Forensics product.

Our Forensics product analyzes web session behavior to detect emerging threats. How can we make Forensics more powerful? Instead of monitoring the behavior of web sessions for one bank, monitoring the web session behavior across multiple banks makes suspicious activity even more obvious. This is the power multi-tenancy brings to our new product: Forensics MT. Since Forensics MT monitors sessions for banking aggregators, the analytics engine receives much more data, determines normal behavior more quickly, and identifies suspicious behavior immediately.

Contacts:

Bus. Dev., Press: [email protected]

Sales: [email protected]

How they describe themselves: Solidpass is the offshoot of Aradiom, focused solely on security software especially for the financial vertical. We have a presence in Atlanta, CA, Istanbul and Zurich with resellers in countries ranging from India, Romania, Spain, UK, Germany, Saudi Arabia, Qatar and Azerbaijan. Solidpass is in the process of adding more regional resellers and building territorial alliances. Our software and mobile-based tokens have received plenty of interest from global players.

How they describe their product/innovation: Solidpass will demo their suite of security tokens, and the latest advancements in that space including transaction data signing using 2D barcodes from mobile phones and embedded tokens in mobile applications like mobile banking. These advancements have finally brought usability to the highest forms stronger security including transaction signing for both online and mobile banking.

Contacts:

Bus. Dev.: Selahaddin Karatas, CEO, [email protected], +90 212 254 4895

Press: [email protected], +90 212 254 4895

Sales: [email protected], +90 212 254 4895

How they describe themselves: StockTwits is a real-time, open, community-powered idea and information service for investments. Users can eavesdrop on traders and investors, or contribute to the conversation and build their reputation as savvy market wizards. The service takes financial related data and structures it by stock, user, reputation, etc. With premium content from the StockTwits blog network, StockTwits TV, data products from the StockTwits Store and official company news from verified corporate accounts, no one brings you more raw, real-time trusted financial ideas than StockTwits.

How they describe their product/innovation: The StockTwits Blog Network will provide all members of our community with a platform to share longer form financial content, and build their personal financial brand. At first, users will be able to apply for a blog on the network, but we will quickly follow that up with a downloadable blog kit that automatically adds your blog to the network.

StockTwits will also be demoing StockTwits Connect, which provides a set of APIs that enable the developer community to leverage our APIs in forming customizable social experiences on their financial sites.

Contacts:

Bus. Dev., Sales: Ben Weiss, VP Business Development, [email protected], 917-620-7624

Press: [email protected]

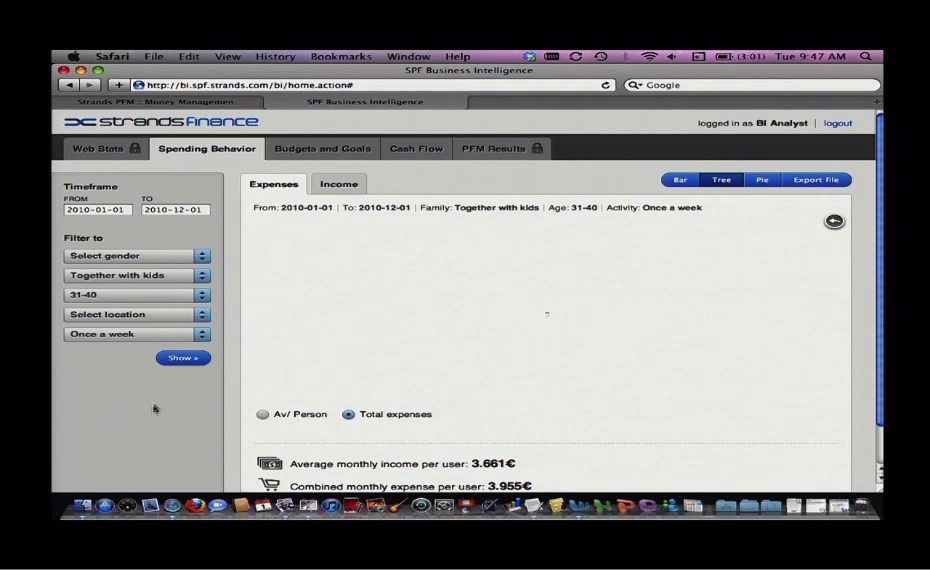

How they describe themselves: Strands Personal Finance (SPF) is a leading provider of PFM solutions to global financial institutions and consumers. Strands PFM provides banks an ability to further engage customers and help users manage their money efficiently. The application allows users to analyze spending, set budgets, compare themselves to a peer community and save money with targeted recommendations. The application allows banks to strengthen their customer relationships, gain valuable customer data, and develop enhanced cross marketing opportunities. Strands PFM technology also powers the 2010 Webby award winning consumer PFM site, moneyStrands. SPF has offices in San Francisco and Barcelona. Web: spf.strands.com or moneystrands.com.

How they describe their product/innovation: Strands Personal Finance Business Intelligence solution (SPF BI) is a web based application that utilizes the user data from a Strands PFM solution and allows banks to easily gain insights and take action to improve the adoption, ROI and profit of PFM solutions. SPF BI will include a dashboard for banks to: (1) quickly and easily access the data from the PFM, (2) visualize key metrics, (3) personalize and customize the PFM and (4) measure ROI and/or key KPIs. These features are designed to provide banking executives with powerful customer information and link data to customer behavior. This increases the opportunity to provide targeted marketing.

Contacts:

Bus. Dev., Sales: Edward Chang, VP Strategy & Business Development, [email protected]

Press: Alla Oks, Marketing Director Personal Finance Products, [email protected]

Sales: [email protected], +90 212 254 4895

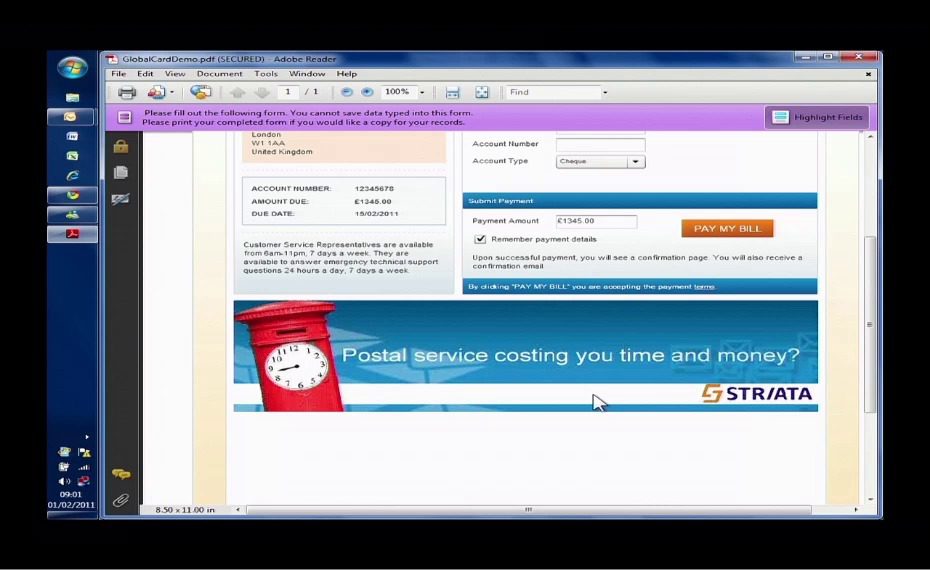

How they describe themselves: Striata is a global eDocuments, eBilling and eMarketing software and services specialist. Striata’s Secure eDocument Delivery and Email Bill Presentment and Payment solution sets deliver an enhanced customer experience, rapid reduction in operational costs and quicker payments. Registration requirements are eliminated by emailing feature rich, interactive, encrypted documents directly to the inbox with innovative one-click electronic payment from within the document itself. Direct email delivery dramatically increases customer adoption of eDocuments, paper turn off and ePayments. Striata’s clients achieve rapid ROI by complementing existing self-service portals and significantly reducing paper output.

How they describe their product/innovation: Utilizing the “killer app” email; Striata will demo a next generation interactive PDF eBill with revolutionary one-click payment functionality for computer and mobile recipients. This model of ‘Biller Direct Push’ boasts the highest customer adoption rates against any other eBilling model on the market today because it delivers the maximum in customer convenience. Our solution is quick to implement, sold as software as a service and delivers strong ROI. Striata’s clients have seen a positive ROI within three months. Furthermore our solution offers mobile presentment by default ensuring that we are future-proofed to meet the growing demand for mobile solutions.

Contacts:

Bus. Dev., Sales: Michael Wright, CEO (Europe), [email protected], +442072683941

Garin Toren, COO (US), [email protected], 646-448-8369

Nicola Els, Head of eBilling (Africa), [email protected], +27 11 530 9600

Keith Russell, Sales Manager (Asia), [email protected], +852 2159 9450

Press: Tamara Hanley, Global Marketing Manager, [email protected], +442072683941

How they describe themselves: Tagit is a leader in inspiring and integrating enterprise mobility for end-to-end consumer applications. Founded in 2004, Tagit has a highly successful track record in designing, developing and deploying industry-specific mobile applications for market leaders such as DBS Bank, POSB Bank, Citibank India, Standard Chartered Bank Breeze, Flex (Standard chartered Bank enterprise mobility solution), Singapore Airlines, BIG Cinemas, Royal Bank of Canada and Commercialbank of Qatar. Millions of people across the globe use Tagit´s applications every day. Tagit provides a comprehensive set of industry-specific, pre-built mobility applications developed on a state-of-the-art mobility middleware platform with standardized, in-built adaptors to backend and 3rd party systems such as payment gateways and social media networks.

How they describe their product/innovation: The Tagit Mobility Platform seamlessly integrates and leverages the existing business of enterprises and organizations into the mobile universe and creates innovative mobile experiences for end customers to increase market reach, speed up time-to-market, reduce complexities and protect existing investments. The pre-built mobility applications run across all major mobile platforms and all major devices including iPhone, iPad, BlackBerry, Android, Symbian, J2ME, Brew and Windows Mobile. The pre-built adaptors integrate backend and 3rd party systems such as payment gateways via standardized web and data services, preconfigured APIs, feeds and streams and intelligent HTML scraping/virtual browsing tools. Certified by multiple security evaluations on behalf of global banks, Tagit´s Mobility Platform has proven to be scalable to handle a high volume of users and transactions and ensures end-to-end data security with high-grade encryption algorithms.

Contacts:

Bus. Dev., Press, Sales: Shankar Narayanan, President, +65 81383640

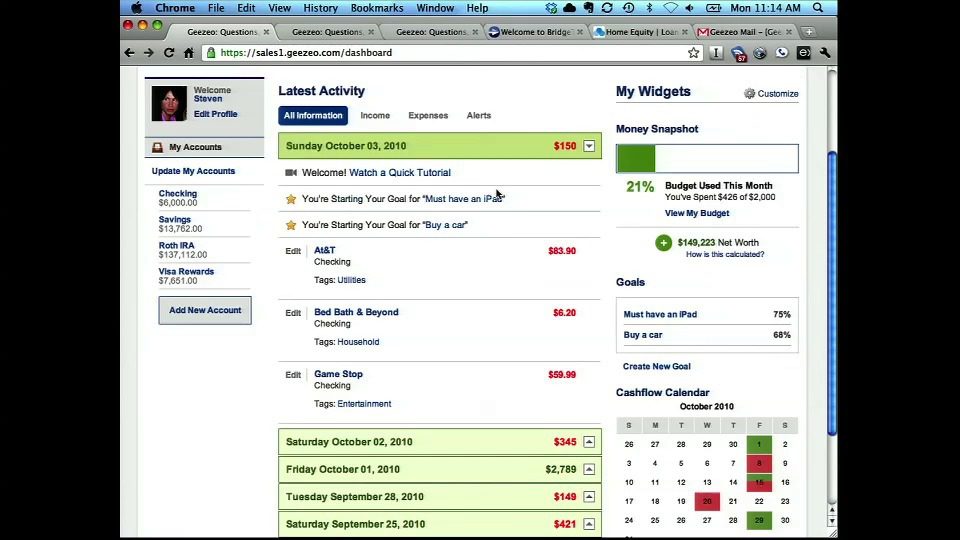

How they describe themselves: SapientNitro/Geezeo, part of Sapient, is a global marketing and technology company. By combining multi-channel marketing, multi-channel commerce, and the technology that binds them, we influence customer behavior across the spectrum of content, communication, and commerce channels, resulting in deeper, more meaningful relationships between customers and brands. For more information, visit www.sapientnitro.com

Geezeo offers an integrated suite of Online Financial Management (OFM) tools and services including Personal Financial Management (PFM) software for banks and credit unions. PFM empowers online customers, giving them a holistic view of their financial assets, liabilities and budgets. Geezeo’s unique platforms help financial institutions develop online customer dialog while generating growth through customer acquisition and increased wallet share. For more information visit www.geezeo.com.

What they think makes them better: Geezeo enterprise marketing powered by BridgeTrack will enable small to medium sized banks to compete effectively in the multi-channel digital marketing space. It empowers marketing teams to leverage customer data enriched by PFM to launch and optimize campaigns across the full spectrum of digital channels, including email. It is equally adept at working autonomously, or with your existing technology, giving you access to real-time data and analytics and providing you with meaningful insights into consumer behavior.

Contacts:

Bus. Dev. & Sales: Alex Sion, Vice President Digital Services, [email protected];

Bryan Clagett, Chief Marketing Officer, [email protected]

Press: [email protected] (SapientNitro/Geezeo);

Bryan Clagett, Chief Marketing Officer, [email protected]