How they describe themselves: In a world where personal information has become a commodity, TASCET returns privacy to individuals. Its Technology as a Service (TaaS) aims to counteract the explosion in identity fraud, the use of fraudulent credentials, and the creation of synthetic identities. TASCET created an Identity Infrastructure based on the principles of privacy, flexibility, and third-party management, ensuring consistency of identity across organizations and industries. TASCET’s Identity Infrastructure helps organizations maintain data integrity, meet compliance requirements, and eliminate the use of government-issued identifiers.

As a non-transactional company, TASCET does not data-mine, sell, or share customer information and treats customer privacy as its top priority.

How they describe their product/innovation: Financial ICONN™ is a digital representation of a person’s identity as confirmed through TASCET’s Identity Infrastructure. Financial ICONN gives financial institutions a means to identify their customers without relying on Social Security numbers, virtually eliminating identity fraud and the use of synthetic identities.

Customers activate their Financial ICONN within each institution with whom they do business by providing two Fingerproofs, a Faceproof and limited biographic information. Once activated, consumers regain their privacy because ICONN verifies their identity when conducting transactions or accessing financial information. Financial ICONN allows financial institutions to give customers a personal firewall and engages them in the fight against fraud.

Contacts:

Bus. Dev.: Noah Kunin-Goldsmith, Business Development Director, [email protected],

608-442-8888

Press: Jason Niosi, Director of Public Relations, [email protected], 608-442-8888

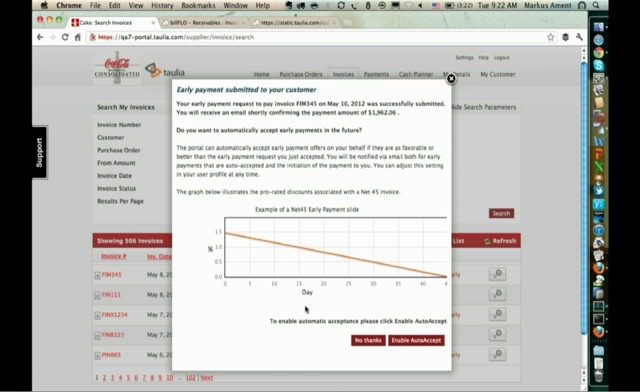

How they describe themselves: We build simple solutions that help customers uncover hidden savings opportunities in their supply chains. Taulia enables Dynamic Discounting, a process whereby suppliers can choose to receive early payment on their invoices in return for a discount given to their buyer. Unlike conventional fixed invoicing terms, the supplier has the freedom to select the precise date they get paid that balances their cash flow needs and the discount given to the buyer. Our management team combines veterans of both large enterprise and small business markets. Our founders previously built and sold Ebydos, a leader in large enterprise invoice automation for Global 2000 customers. Our small business expertise was strengthened by the integration of billFLO, a cash-flow management solution for small businesses, acquired in June ‘11.

How they describe their product/innovation: Taulia is an expert in Early Payments through Dynamic Discounting. We are launching our Early Payment Network, which expands the power of Early Payments beyond our existing network to every business. The combination of our knowledge of Dynamic Discounting, our network of financing sources, and our new API allows us to extend our Early Payment Network to users of any Accounting System, ERP software or E-invoicing Network. In fact, any financial software provider can now offer Dynamic Discounting directly to their install base via the new Taulia powered API. A very simple, one-time integration opens the door for the financial software provider to instantly share in the revenue generated by Early Payments.

Contacts:

Bus. Dev.: Ian Sweeney, VP Product, 415-376-8280

Press: Natalee Gibson, [email protected], 720-323-5382

Sales: Bertram Meyer, CEO, 415-376-8280

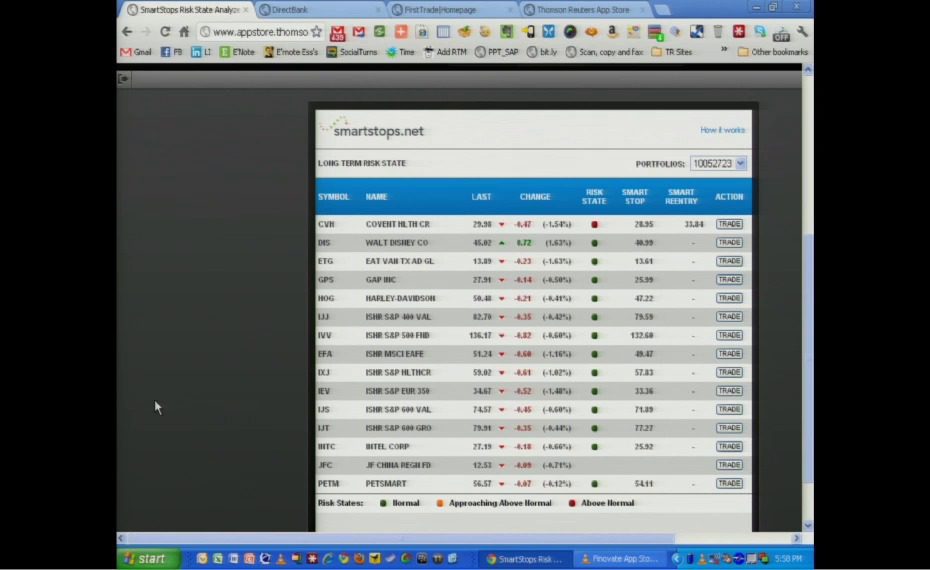

How they describe themselves: Thomson Reuters is the world’s leading source of intelligent information for businesses and professionals.

We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial, legal, tax and accounting, healthcare, science and media markets, powered by the world’s most trusted news organization.

How they describe their product/innovation: Thomson Reuters is pleased to introduce their new App Store solution that enables access to the latest innovative capabilities & tools for use across the digital enterprise. The Thomson Reuters solution enables financial institutions and 3rd Party developers to effortlessly create pioneering market monitoring and investing apps. By seamlessly integrating the combination of Thomson Reuters content assets with a firm’s customer account data and other data sources, Thomson Reuters is helping institutions leverage the providers of financial insight to deliver a differentiated experience for their customers while lowering both development costs and time to market.

Contacts:

Bus. Dev.: Jaime Punishill, Global Head of Digital Distribution, Wealth Management [email protected]

Press: Lemuel Brewster, Public Relations Director, [email protected]

Sales: Nancy Hannigan, Global Head of Wealth Management Sales, [email protected]

How they describe themselves: TIO Networks (TSX.V: TNC) is a cloud based multi-channel bill payment processor serving the largest telecom, wireless, cable, and utility bill issuers in North America, enabling these companies to provide bill payment services to the population of over 60 million under-banked consumers. With more than 55,000 physical location endpoints to its bill payment processing network, TIO symbolizes fast, convenient, and secure access to expedited payment services. TIO Wallet will change the way the under-banked pay their bills while providing an onramp to a personal financial management platform that will include services such as credit building, micro finance, and money remittance.

How they describe their product/innovation: TIO MobilePay is the first mobile application in North America to offer customers the ability to pay thousands of telecom, utility, financial service and insurance bills safely and conveniently using their Visa or MasterCard credit/debit card. By offering same-day expedited payment processing, we help our customers avoid expensive late fees and service interruptions. Unlike traditional online and mobile banking applications, TIO MobilePay is the only smartphone application that lets customers pay all their bills in one place with their credit card, keeping cash in their pocket longer while earning reward points.

Contacts:

Bus. Dev.: Steve Barha, EVP Mobile & Web, [email protected]

Press: Rob Goehring, CMO, [email protected]

Sales: Conal Campbell, Director of Business Development, [email protected]

How they describe themselves: Our mission is to end the extractive $250 billion “Hidden Fee Economy.” We are dedicated to making simplicity, clarity & transparency the standard for consumer financial services.

We take complex consumer financial services agreements that the “fine print” people ignore or don’t understand and turn them into simple, clear & transparent information that can be understood with a 9th grade education. Our product is ‘transparency’ and it offers a wealth of potential in empowering consumer choice, fairness & better financial outcomes.

Our vision is of a financial services industry that promotes trust, supports the long-term prosperity of responsible consumers with a “transparency premium,” promotes a “transparency dividend” for American enterprise to remain competitive in a complex global economy, and transforms the method & humanity with which people and the financial services businesses they rely on communicate.

How they describe their product/innovation: Transparency Labs enables Americans to increase and preserve their retirement savings by addressing the transparency deficits that prevent people from staying invested in retirement and maximizing their savings.

- We address America’s “Cash-Out Crisis” by helping retirement savers understand the penalty, fee & tax implications of “cashing-out” their retirement savings as they change jobs. Every year, 4 in 10 people cash-out their 401k when they change jobs – an estimated $80B leaks from the system annually this way.

- We help reunite people with their orphaned 401k money. Millions of Americans have orphaned accounts left at former employers, accruing unnecessary fees with limited choice, at the heightened risk of being cashed-out.

- We offer comprehensive fee disclosure for the estimated $75B+ that Americans pay annually in mutual fund fees and costs. Most people do not even know they pay these fees – and these costs can be substantially reduced.

In response to the cash-out epidemic in the retirement system, Transparency Labs has developed automatic retirement preservation solutions to help Americans stay invested in retirement, reunite with their orphaned accounts, and dramatically lower their hidden fees and risks.

Contacts:

Bus. Dev.: David Hirsch, [email protected], 818-442-1096

Press: [email protected]

How they describe themselves: Sandstone is a leading provider of innovative online banking solutions to financial institutions globally. Our solutions include systems for Loan Origination processing, Internet Banking, Mobile Banking, Online Financial Management, and Online Applications.

Sandstone’s solutions have been recognised with industry awards over the past few years. Bank of Queensland’s Sandstone developed mobile banking solution won consecutive AMBER Awards in 2009 (Best Mobile Commerce solution) and 2010 (Best Mobile Banking solution) defeating banking leaders such as CBA, NAB, Westpac and ANZ along the way. In 2011, Suncorp Bank’s Sandstone developed budgeting solution was recognised with an Innovation Excellence Award at the CANSTAR CANNEX Awards.

How they describe their product/innovation: Sandstone will be showcasing its next generation mobile banking app that contains sophisticated money management/ OFM tools, the latest anti fraud and security measures, and advanced user experience capabilities. Using the latest html5 technology, the app can be developed once and then delivered seamlessly across many of the popular smart phone app stores to run on nearly all smart phone devices. The registration process for the app locks the user to the device while page-fingerprinting technology ensures that fraudulent users will not be able to connect to the secure server.

Contacts:

Bus. Dev.: Colin Rankin, General Manager of Sandstone Technology (Europe), [email protected], +44(0) 771 541 9570

Press: Evan Diacopoulos, Marketing & Communications Manager, [email protected], (M) +61 410 329 504, (P) +61 2 9911 7109

Sales: Andrew McPherson, General Manager of Sales & Marketing, [email protected], (M) +61 412 056 644, (P) +61 2 9911 7119

How they describe themselves: Serverside was founded in the UK in 2003 by two brothers, Adam & Tom Elgar. The idea was to allow customers to personalise their payment cards with a picture of their choice. People who personalise their cards (e.g. with pictures of kids or pets) are proven to use their cards more often, be more loyal to their bank, and will ultimately put that card front of wallet!

How they describe their product/innovation: A Card Customization Facebook app. The app uses card customization as a new and unique way to leverage Facebook in an exciting and engaging way that can drive real brand value, loyalty, and engagement from a bank’s customers. Customers can design a card using an image from one of their Facebook photo galleries. Once the design is approved, it is posted to the user’s wall where all their friends can view it and click on the link to design their own card and thus creating a viral marketing effect!

Contacts:

Bus. Dev. & Sales: Anthony Lloyd-Perks, Head of Sales (EMEA),

[email protected], +44 7769 143787

Press: Dominic Hiatt, Rhizome PR, [email protected], +44 (0) 20 7851 4757,

+44 (0) 7595 221604

How they describe themselves: Service2Media is the leading provider of Advanced App Solutions for smart phones, tablets, and an unbounded range of emerging devices. With its industrialized and future proof App Lifecycle Platform and AppCenters, the company overcomes the challenges of corporate partners to design and deploy apps across all mobile Operating Systems without excluding any customers. Its core and critical apps are some of the most popular available with hundreds of thousands of downloads and high app store rankings. People no longer need to work in a browser, but now can fully work in an app. Service2Media’s App Lifecycle Platform helps corporate partners stay on top of operating system fragmentation and device innovation. We deliver high quality apps services on our agile, robust App Lifecycle Platform that supports rapid device evolution and high levels of scalability and performance. We support all operating systems, supporting native runtimes for iOS, Android, BlackBerry, J2ME, Windows Phone 7, as well as Hybrid and HTML5 deployments.

How they describe their product/innovation: Service2Media and Rabobank introduce mobile payments via banking app for all webshops, starting with bol.com. Customers of Rabobank that installed the Rabobank Mobile Banking app can now pay their mobile purchases as easily as their online purchases, using a mobile version of internet payment method IDEAL. The new mobile payment is facilitated by starting the Rabobank Banking app on an iPhone once a payment request is issued on the merchant mobile site. The transaction is then authorized by the user in the app with his account number and access code before being redirected to the merchant’s mobile site. Mobile banking is now possible without an e-reader (up to €1000).

Contacts:

Bus. Dev. & Sales: Lisette Sens, VP Sales, [email protected]

Press: Nathan Kotek, VP Marketing & Analyst Relations, [email protected], LEWIS PR, [email protected], 0031402354600

How they describe themselves: Striata is a global organization specializing in paperless communications. We provide software and services that replace print and post processes with interactive documents and messages delivered directly to customer’s inboxes. Striata’s innovative email billing and payment solutions enable companies to drive adoption of paperless processes and achieve ROI. Our transactional capabilities efficiently communicate important information in the most effective manner that enhance branding and provide transpromo opportunities.

Striata has operations in New York, London, Sydney, Hong Kong, and Johannesburg and partners in North, Central & South America, Europe, and across Asia Pacific.

How they describe their product/innovation: Striata will demonstrate its paperless adoption technology, which moves the control of paperless conversion into the hands of the biller – no longer relying on the customer to proactively enroll and switch off paper. This results in optimal adoption and faster ROI.

Banks and financial institutions invest heavily in online initiatives aimed at reducing paper, but struggle to get customers to adopt their technology. To achieve ROI on paperless solutions, innovation at the adoption point is crucial. Our innovative adoption techniques not only completely eliminate the registration barrier but also enable customers to switch off paper in just one click.

Contacts:

Bus. Dev. & Sales: UK & Europe – Eric Darling, Head of Sales, [email protected], +442072683941

US – Barrie Arnold, VP of Sales, [email protected] +1 888 8USAPAY or +1 646 448 8369

Africa – Nicola Els, Commercial Director, [email protected] +27 11 530 9600

Asia – Keith Russell, Sales Manager, [email protected] +852 2159 9450

Press: Tamara Hanley, Global Marketing Manager, [email protected], +442072683941

How they describe themselves: Tradeshift is a business-to-business social network that helps companies connect with each other on a secure platform to manage business processes such as invoicing and cash flow. Because the Tradeshift e-invoicing service is free for suppliers, it’s easy to get suppliers on the network, saving time and money.

In the Tradeshift business cloud, companies can create a network with suppliers, customers, and partners to work together more efficiently, powered by the latest social technologies. All Tradeshift applications including e-invoicing, electronic purchase orders, and automated document validation can be fully integrated into finance and ERP systems.

How they describe their product/innovation: Instant Payments will allow businesses – and particularly SMEs – to receive instant payment for invoices approved through the platform. Companies will benefit from interest rates significantly lower than alternative funding options and will no longer see cash flow impacted by long payment terms or late payers. This new service integrates seamlessly with Tradeshift’s existing e-invoicing solution which is free to suppliers, providing the financial flexibility small businesses need to succeed.

Contacts:

Bus. Dev. & Sales: Christian Hjorth, CCO, [email protected], +453 118 9106

Press: Renette Youssef, CMO, [email protected], +453 118 9153

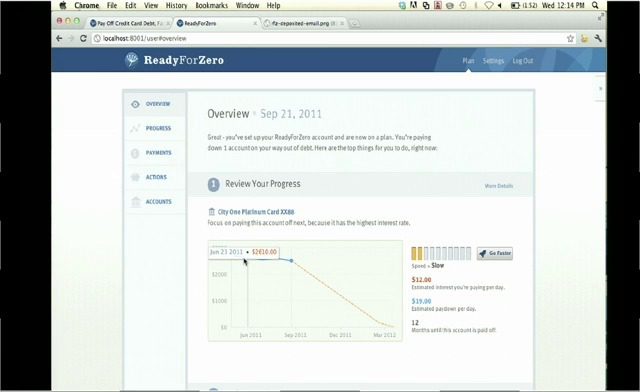

How they describe themselves: ReadyForZero creates a financial software program that helps people better manage and reduce personal debt and improve their credit reputations online. The software benefits both consumers and lenders by proactively preventing challenging financial situations while improving engagement and retention. ReadyForZero is a focused technical product team with specialized expertise in predictive data modeling, machine learning, and user experience design.

About the founders:

- Rod Ebrahimi: Rod started and sold his first technology company while still in high school. At 18 years old, he moved to Silicon Valley where he helped build scalable e-commerce systems. Rod holds a B.S., with Distinction and Department Honors, in Cognitive Science with a specialization in Human-Computer Interaction.

- Ignacio Thayer: Ignacio is an ex-Googler and machine translation expert. Previously, he was a Senior Software Engineer and Tech Lead for Google Research. Ignacio is named on 3 patents for his work at Google. Ignacio holds 2 degrees in Computer Science from Carnegie Mellon and UCLA. He is currently on leave from Stanford’s PhD program in Computer Science.

How they describe their product/innovation: ReadyForZero’s online program reduces bank credit losses and lowers collection costs by helping average borrowers better understand, manage, and pay down their debts. By using real-time data about a person’s financial situation, ReadyForZero delivers personalized payment and behavioral recommendations that can immediately save people time and money while at the same time improving retention and reducing credit losses.

Contacts:

Press: [email protected]

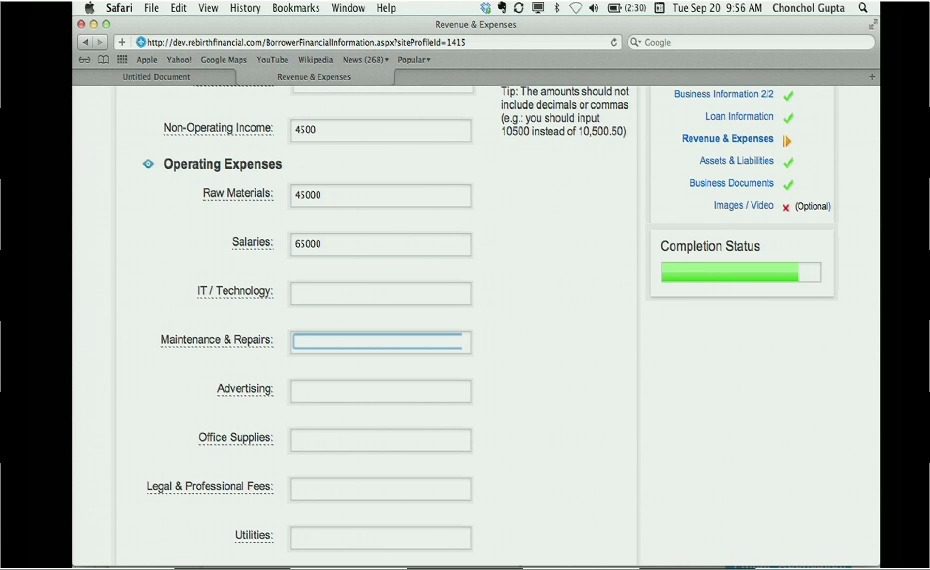

How they describe themselves: Rebirth Financial connects small business borrowers directly with individual and institutional lenders. The company hosts an online platform that is structured like an E-Trade for loans. As opposed to LendingClub or Prosper, Rebirth Financial is focused on lending to small businesses. Business financials and documents are available for lenders to browse. Loans are made directly to a business, not to an individual. Loans may be participated amongst financial institutions and individuals. Rebirth Financial also has tools that allow institutional lenders to lower default risk exposure while lessening CRA due diligence requirements.

How they describe their product/innovation: Rebirth Financial will demo its new JAS Rating System: a first-of-its-kind scoring system that determines the financial health of a small business. The JAS Rating System delivers a clear 1 through 100 score for small businesses, and displays industry specific comparisons. S&P and Moody’s can predict the financial health of a publicly traded business with a close to 96% accuracy. The JAS Rating System can predict the financial health of a private business with 86% accuracy.

Contacts:

Bus. Dev.: Chonchol Gupta, [email protected], 504-782-1665

Press: Matthew Deitch, [email protected], 888-810-7180

Sales: Xavier Cabo, [email protected], 888-810-7180