How they describe themselves: Segmint is a fast-growing, dialogue marketing and digital media company offering an unrivaled analytics framework that anticipates consumer spending patterns and helps Financial Institutions deliver highly-targeted, individual online advertising campaigns across the digital spectrum.

How they describe their product/innovation: Segmint’s new and highly-advanced SegmintEngage feature allows FIs to create online campaigns in less than a minute – targeting the offer, creating a banner and assigning website zones – through a completely automated feature of the application. This “One Button” application empowers FI marketers to deliver campaigns without engaging multiple support partners within their organization, ultimately saving time and resources.

Contacts:

Bus. Dev., Sales: Thomas C. Tyler, EVP, (330) 656-4051

Press: Jill Arslanian, Principal, & Jennifer Raynor, Principal, Ardent Communications Group [email protected], (216) 712-7778

How they describe themselves: The simplest way to make smarter business decisions, ShopKeep® POS is the affordable and complete cloud-based point of sale platform for running a store from an iPad. Backed by the industry’s best customer care, the ShopKeep POS iPad app rings sales, processes credit cards and mobile payments, prints and email receipts, and prints orders remotely to the kitchen. Merchants can manage inventory and a customer database and view ClearInsight™ Reports from any web browser. Plus, they can access real-time sales remotely via a smartphone to make important business decisions even when they are not in the store.

Contacts:

Bus. Dev.: Sandhya Rao, VP Marketing, [email protected], (646) 963-6964

Press: Hadley Deming, Marketing Coordinator, [email protected], (646) 963-6989

Sales: Adam Griffin, Point of Sale Specialist, [email protected], (646) 963-6988

How they describe themselves: Stockr, Inc. (“Stockr”) is a social network built for the stock market that allows you to see and discuss the news that’s moving the market. Stockr aims to be the world’s most effective online research tool for investment decision-making.

How they describe their product/innovation: Over 70 million people use the Internet to obtain financial information, yet the current platforms for discussion are archaic and inefficient. Millions of stock market investors visit Yahoo! Finance message boards and/or subscribe to stock newsletters despite the lack of transparency, poor communications, and rampant spamming. Stockr has constructed a social network for investing, bringing identity and transparency to an otherwise anonymous environment, and unveiling a new layer of market information.

Contacts:

Bus. Dev.: Velveth Schmitz, Business Development, [email protected], (424) 247-3832

Press: Vince Bitong, [email protected]

How they describe themselves: The Currency Cloud provides an evolutionary solution to today’s inefficient, expensive and opaque international payment services. The Currency Cloud makes international payments simple. We take care of the complexities of accessing foreign exchange liquidity and the myriad of payment networks, giving businesses an easy and low cost alternative to receive, convert and send international payments.

Customers connect to The Currency Cloud platform via our online application or through our easy-to-use and implement TCC Connect API, ensuring a service perfectly tailored to their needs.

For too long the banks have gotten away with sub-standard services whilst earning inflated margins on international payments – The Currency Cloud is the “New Finance” alternative that the international payments market has been waiting for.

How they describe their product/innovation: The TCC Connect API provides transaction-based businesses with easy and flexible access to The Currency Cloud FX conversion and international payments platform.

The TCC Connect API can be plugged into existing technology within the customer’s business for efficient and lower cost conversion and payments, or can be used as the basis to deliver new international payments apps and services to market.

The TCC Connect API enables full straight through processing (STP) across your own business and the payments lifecycle, automating previously manual processes to reduce operational risk, improve efficiency and monitoring and give you more control.

Contacts:

Bus. Dev.: Nasir Zubairi, Director Product Marketing, [email protected]

Press: Ben Leong or Nicola Koronka, HotwirePR, [email protected], [email protected]

Sales: Stephen Lemon, Director of Sales, [email protected]

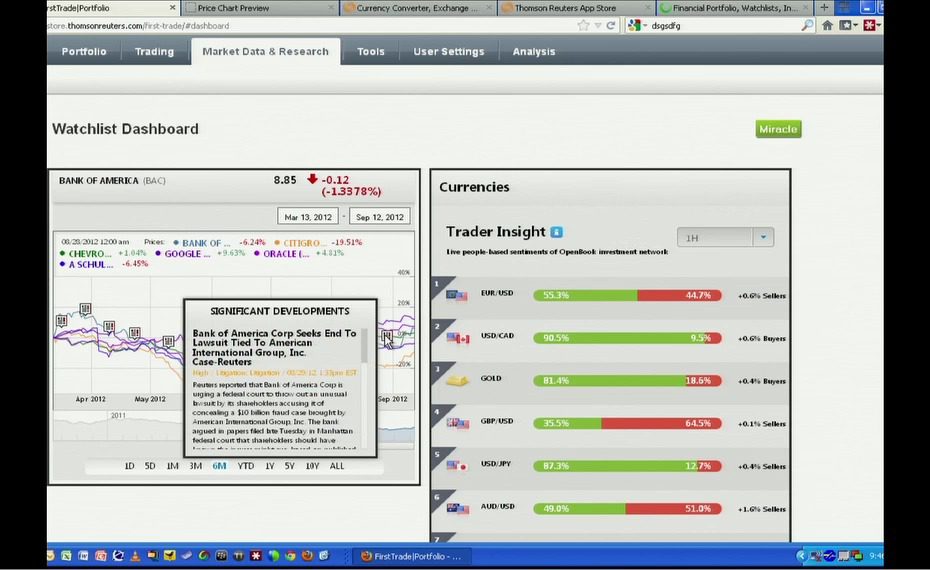

How they describe themselves: Thomson Reuters is the world’s leading source of intelligent information for businesses and professionals.

We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial, legal, tax and accounting, healthcare, science and media markets, powered by the world’s most trusted news organization.

How they describe their product/innovation: Thomson Reuters is pleased to introduce their App Store solution that enables access to the latest innovative capabilities & tools for use across the digital enterprise. The Thomson Reuters solution enables financial institutions and third party developers to effortlessly create pioneering market monitoring and investing apps. By seamlessly integrating the combination of Thomson Reuters content assets with a firm’s customer account data and other data sources, Thomson Reuters is helping institutions leverage the providers of financial insight to deliver a differentiated experience for their customers while lowering both development costs and time to market.

Contacts:

Bus. Dev.: Jaime Punishill, Global Head of Digital Distribution, Wealth Management

Press: Lemuel Brewster, Public Relations Director, [email protected]

How they describe themselves: TouMetis enables leaders in the financial services industry to fully realize the potential of using mobile and desktop channels to both engage consumers/small business owners and reduce service delivery costs for financial institutions. Through tailored mobile and desktop applications that are secure, fast and feature-rich, TouMetis empowers consumers/small business owners by delivering the information they need in a format that allows them to make informed financial decisions anytime, anywhere.

TouMetis celebrated its three-year anniversary in January 2012. Working in three countries, the TouMetis workforce is fueled by a passion for mobile technology. Company co-founders have contributed to the success of mobility since the days of the Palm Pilot. TouMetis is focusing its talent and financial resources on developing innovative tools that make possible best-of-class applications that will work on any Smartphone, tablet or desktop device.

How they describe their product/innovation: TouMetis will be launching at Finovate an extension to Personal Financial Management for small business owners. With over 25M+ small/micro business owners in the United States, it’s the second largest customer segment for financial institutions behind consumer banking. We believe small business owners are largely underserved by today’s financial institutions and yet it is becoming one of the few market segments where financial institutions are seeing revenue growth.

TouMetis will demo $mart, which we believe to be the first global, cash-flow manager for small business owners as an extension to Yodlee PFM solutions. The Small Business Center FinApps include account summary, transactions, expense tracking, invoicing, time tracking, bill pay, budgeting and cash-flow analysis. $mart will allow the small business owner to engage in financial decisions from their desktop, mobile or tablet devices.

Contacts:

Bus. Dev. & Sales: Mark Willnerd (CEO/President), [email protected], (208) 286-2299

Press: Susan Roughton, VP Marketing, [email protected], (208) 841-1388

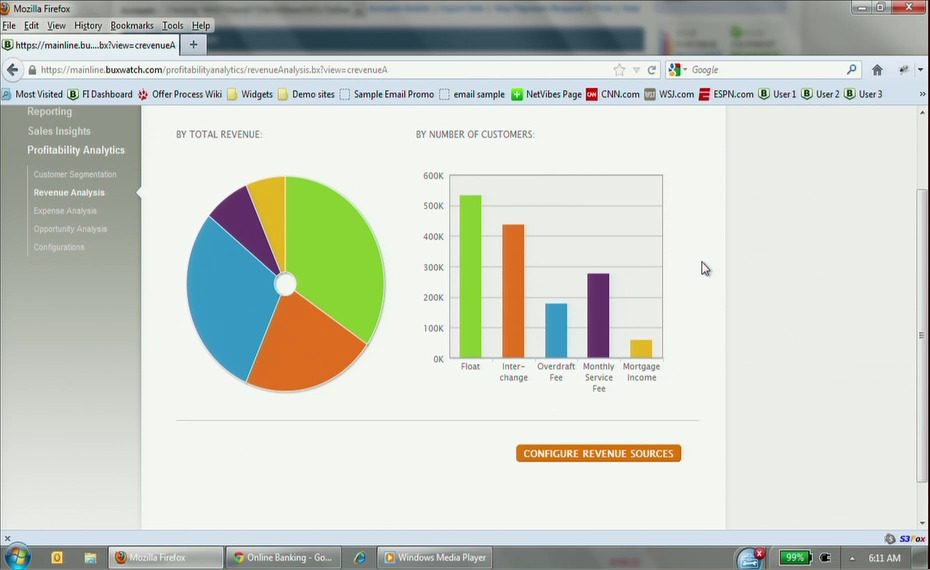

How they describe themselves: Truaxis, creators of the award-winning StatementRewards platform, is the leading provider of personalized transaction-enabled services. Through sophisticated analytics, they deliver a comprehensive spectrum of data-driven services, including in-statement loyalty rewards, personalized merchant offers and recommendations, social benchmarking spend comparisons, and mobile and social rewards.

How they describe their product/innovation: Truaxis understands that big data is a profitability gold mine for banks if properly gathered, interpreted and acted upon. With its Profitability Analytics module, StatementRewards will use transaction and banking data to inform banks what their most profitable customers look like and help banks create sophisticated cross-sell campaigns to capture more of their customers’ financial accounts.

Contacts:

Bus. Dev. & Sales: Casey Newton, VP Sales, [email protected], (415) 322-8475

Carlo Cardilli, SVP Sales & Business Development, [email protected], (415) 385-112

Jen Millard, CRO, [email protected], (415) 235-3021

Press: Matthew Mirandi, Press Relations, [email protected], (917) 338-4933

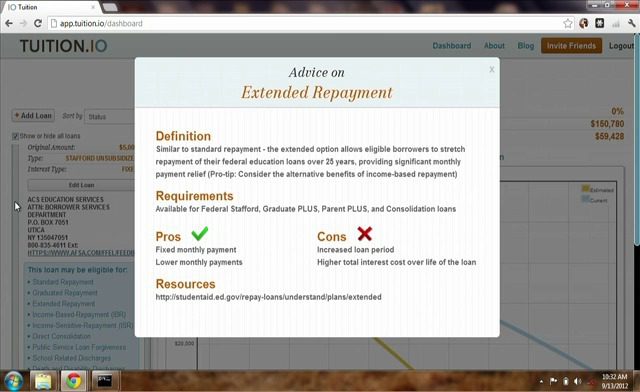

How they describe themselves: Tuition.io is a revolutionary new tool for managing your student loans that lets you optimize your debt for your unique situation.

How they describe their product/innovation: With Tuition.io, student loan borrowers can easily access all their loans in one visually appealing dashboard, use graphical visualization tools to compare them and get customized optimization plans that take advantage of little-known and hard-to-understand restructuring options.

Contacts:

Bus. Dev. & Sales: Steve Pomerantz, Co-Founder, [email protected]

Press: Brendon McQueen, Founder/CEO, [email protected]

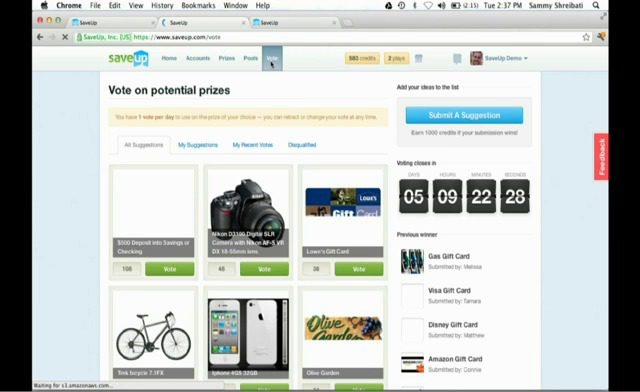

How they describe themselves: SaveUp is the first free nationwide rewards program that encourages people to save money and pay down debt. Americans who bank at over 19,000 US financial institutions can sign up, register financial accounts, and begin earning SaveUp credits for their good financial actions. Users redeem credits for chances to win prizes like vacations, cars, and cash up to $2 million, which are sponsored by top brands including Virgin America, Banana Republic, and TurboTax. Through a fun and simple approach that employs game mechanics, SaveUp reinforces daily habits that help Americans positively engage with their financial progress. Engagement on SaveUp has been very strong with 30% DAU and 80% MAU for customers with linked accounts. In 120 days since launching, over $29 million in deposits to savings and $25 million in debt payments have been made on SaveUp. The technology is powered by Intuit Intelligent Data Services and SaveUp technology is patent pending.

How they describe their product/innovation: Using innovative game mechanics, SaveUp encourages financial success for its users with positive suggestions and better financial product offerings. Financial institutions and financial content providers can use SaveUp as a customer acquisition channel and as a way to educate potential customers about product offerings. Our demo showcases the customized version of SaveUp that financial institutions can use to:

- Engage with existing customers

- Provide a custom set of prizes and rewards for their depositors

- Feature customized educational content

- Relevantly cross-sell their own products and services

- Understand their customer base

Currently, twenty financial institutions are participating in a pilot program to promote the customized version of SaveUp to their customers. They include Bank of the West, Plastyc, Upside Visa Prepaid Card, and Eli Lilly Credit Union.

Contacts:

Bus. Dev. & Sales: Laxmi Poruri, VP of Business Development, [email protected]

Press: Jean Park, Director of Marketing, [email protected]

How they describe themselves: Serverside is focused on delivering innovative technology but then takes it a step farther by exploring and delivering superior marketing practices in how this technology can be offered to the cardholder. We constantly develop new products and services through ideas garnered from closely working with our customers and understanding the ever changing global marketplace to ultimately build better marketing solutions that deliver superior ROI.

How they describe their product/innovation: A Card Customization Facebook app. The app uses card customization as a new and unique way to leverage Facebook in an exciting and engaging way that can drive real brand value, loyalty, and engagement from a bank’s customers. Customers can design a card using an image from one of their Facebook photo galleries. Once the design is approved, it is posted to the user’s wall where all their friends can view it and click on the link to design their own card and thus create a viral marketing effect!

Contacts:

Bus. Dev.: Andrew Cox, VP Head of Development – Americas, [email protected],

646-652-7018

Press: Dominic Hiatt, Rhizome PR, [email protected], T: +44 (0) 20 7851 4757,

M: +44 (0) 75 9522 1604

Sales: Alex Cahn, VP Sales – Americas, [email protected], T: 646-652-7013,

M: 408-439-9865

How they describe themselves: Silver Tail Systems is the leading provider of predictive analytics for detection and prevention of fraud and abuse to some of the most prominent websites in the world. The company offers the industry’s most comprehensive suite of fraud detection and mitigation solutions. Serving some of the world’s largest financial institutions and e-commerce companies, Silver Tail Systems’ award-winning solutions are made possible by the unmatched expertise of its management and technology teams, who bring deep experience, know-how and personal commitment to protect their customers’ businesses against online fraud.

How they describe their product/innovation: As malware becomes more prevalent on end user devices, criminals are devising new ways to exploit these compromised machines. One of the latest threats is parameter injection. In parameter injection, the malware intercepts the html associated with the website before it is displayed on the end user’s machine. The html is modified so that new parameters are shown to the user. These parameters request personal information from the end user in an innocuous way. Silver Tail’s Parameter Injection threat score identifies when there are extra parameters in the http stream returned to the banking website. This can be used to determine when an end user’s machine is infected and whether or not any personal information was lost.

Contacts:

Press: Liz Kuzma, Voce Communications, [email protected], 408-239-9163

Sales: [email protected]

How they describe themselves: Social Money leverages the award-winning technology of SmartyPig to create a customized, bank-audited goal-saving system for financial services companies, merchants and other industries to reach Gen Y savers. Our product greatly enhances savings programs of the past with social networking features and a cutting edge user interface, allowing clients to add a new layer of functionality over existing savings products and software platforms.

How they describe their product/innovation: By using the configurable GoalSaver program, any financial services company in the world may offer its customer base an innovative and attractive approach to saving – quickly and for a fraction of the cost of a new program. The product helps any FI create a social strategy, increase customer engagement and retention, cross-sell other products, drive brand awareness, and gather valuable data on future spending. The system is available to any bank, in any language, using any currency, as a way to create a scalable and customizable application for goal savings. GoalSaver may also be leveraged by leading merchants (Christmas clubs and wish lists), and a host of other industries, such as prepaid or payment processing companies.

Contacts:

Bus. Dev. & Sales: Jon Gaskell, [email protected]

Press: Sarah Foss, [email protected]