Yoyo is a mobile wallet at its core, but offers more than just a simple payment capability. The platform blends payments, loyalty, and shopping to help retailers reach their customers in new ways.

Yoyo is a mobile wallet at its core, but offers more than just a simple payment capability. The platform blends payments, loyalty, and shopping to help retailers reach their customers in new ways.

Stats

• $5M seed funding raised

• 25 employees

• 15,000 registered users since launch in January 2014

• Processes over 150,000 transactions a month

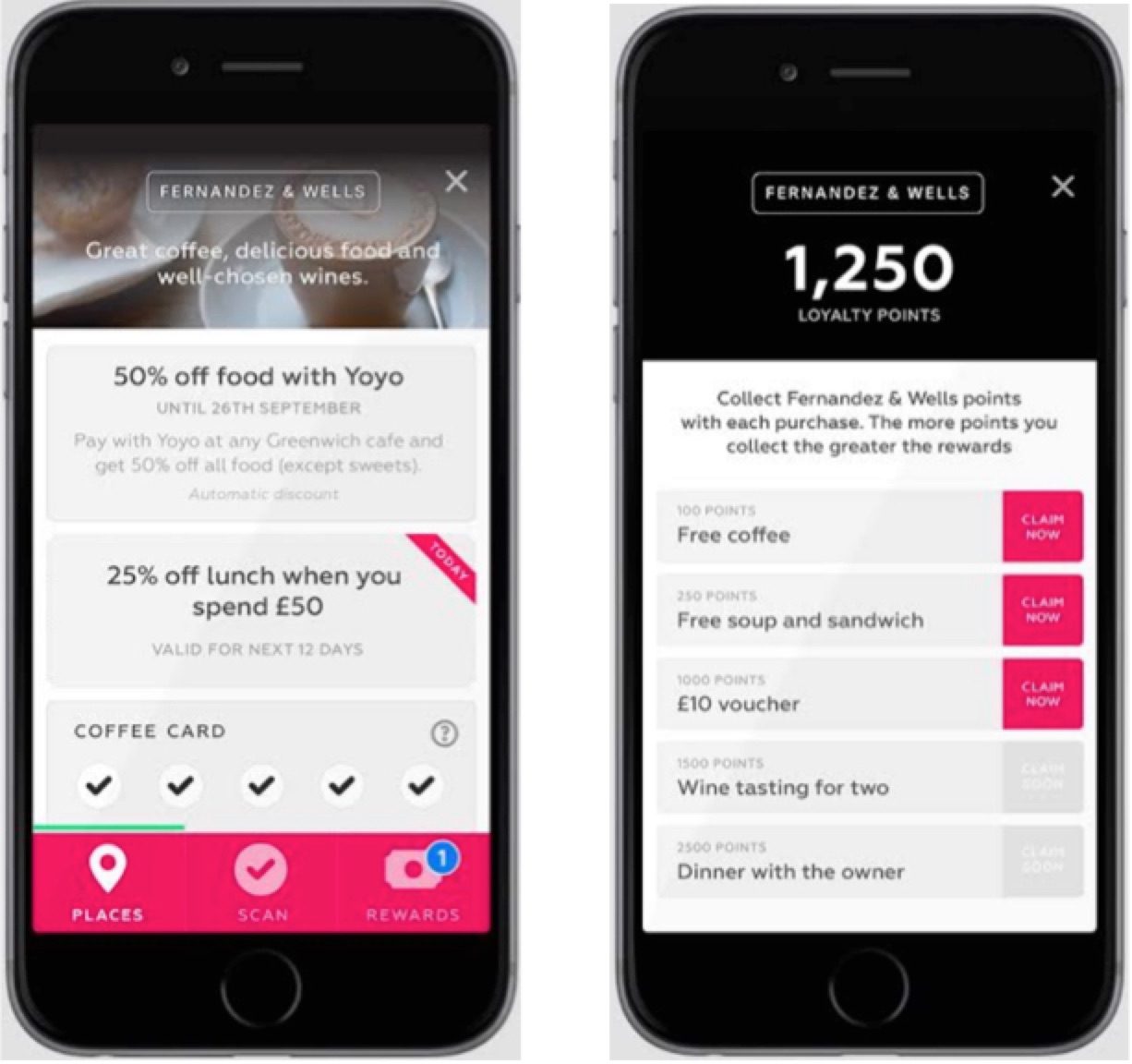

Since customers use a variety of payment methods, most retailers cannot track customer spending patterns. Yoyo gathers level III (item-level) data from purchases. By understanding users’ trends and preferences, Yoyo helps retailers offer rewards, enhance loyalty, and improve the customer experience, while minimizing friction at the point of sale (POS).

For consumers

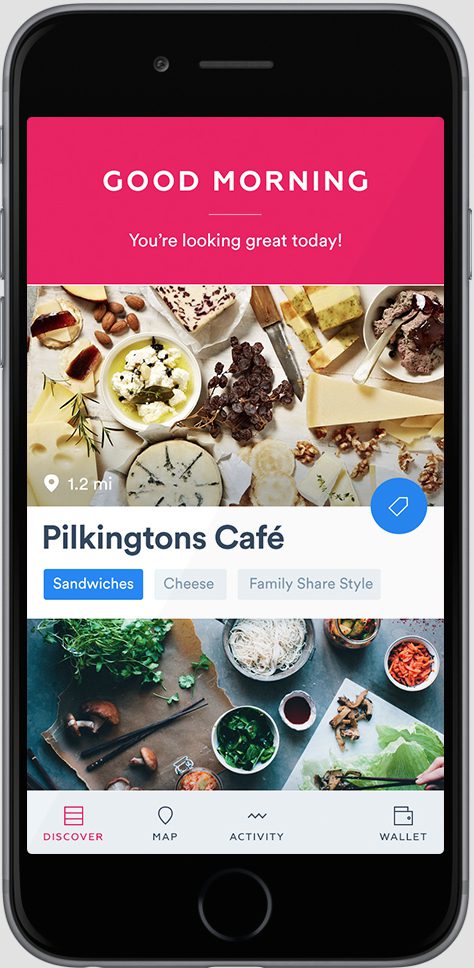

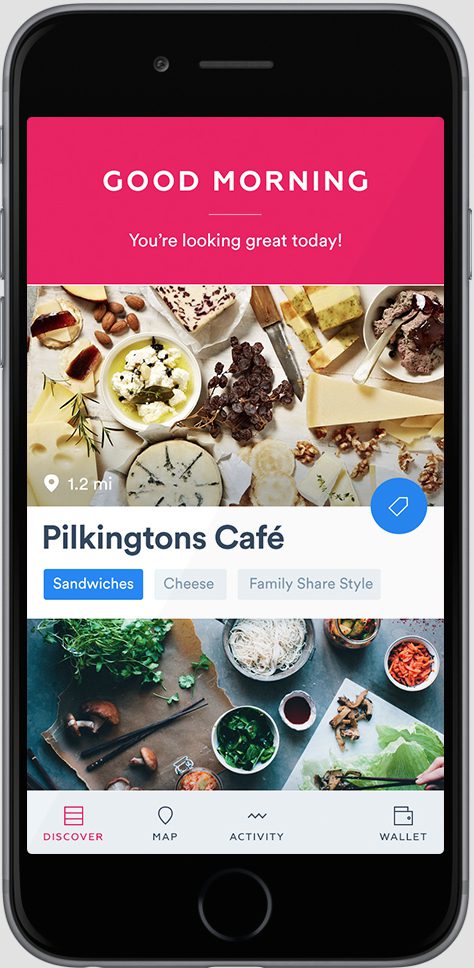

The Yoyo app home screen (pictured above) maps retail locations that accept payment via Yoyo, shows users their payment activity, and offers quick access to the mobile wallet to enable POS payments.

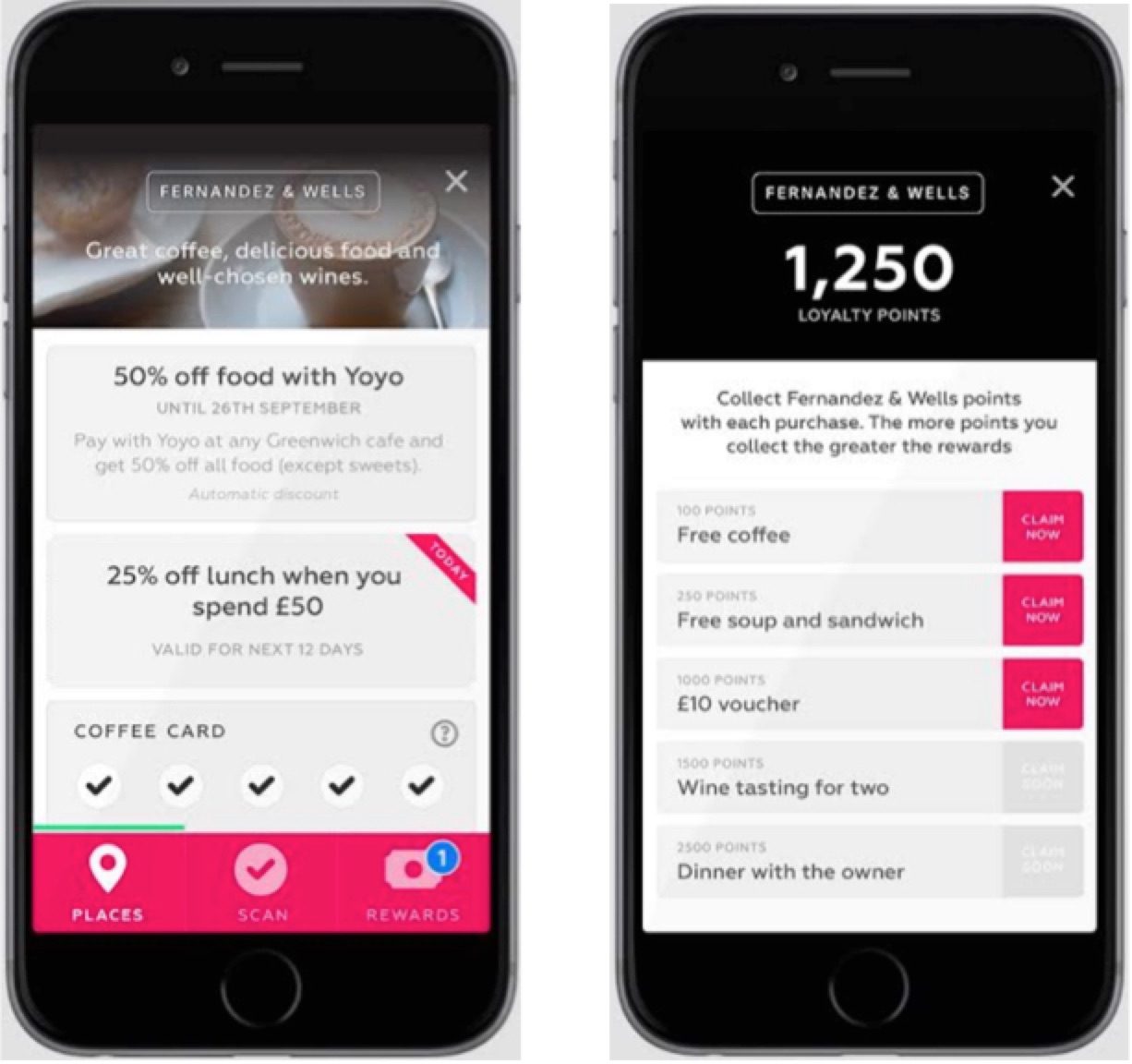

After a customer adds payment information into the app, they pay at the POS using a QR code the app generates for each transaction. When the retailer scans the code, the payment is complete. Yoyo automatically credits rewards or loyalty points earned, updates the balance on their mobile wallet, and digitally stores the itemized receipt.

For retailers

When consumers pay using their Yoyo mobile wallet, they provide data on what and when they’re buying, as well as how much they are spending. Using Yoyo’s analytics and offers, retailers generate campaigns directed at different customer segments to encourage more frequent, higher spending. The campaigns also entice new customers with special deals, as well as inspire one-time customers to return.

Yoyo also offers a companion card. The back of the card has a printed QR code, along with instructions on how to register for a Yoyo account. When a retailer scans the code, new customers immediately begin receiving loyalty points. Additionally, if the customer prefers to pay with cash, they can still reap their loyalty points or redeem coupons when they present the card at the point of purchase.

What’s new?

At FinovateEurope 2015, Yoyo announced it will open the rails of its mobile platform for white-label use. In addition to Yoyo’s new, white-label option, the startup recently announced integration with the Apple Watch, giving users the ability to pay at the POS with a touch of their wrist.

Also, Yoyo is expanding its London-based operations internationally into Asia.

Check out Yoyo’s demo video from FinovateEurope 2015 where it announced the availability of its white-label API.