It’s difficult for outsiders to judge a bank’s service levels unless you

interview a number of customers as Vividence and others are doing or use the

bank’s products yourself. However, the bank’s website does provide clues to

the relative value placed on e-service. Here are the things we would look

for as a prospective customer, all of which are affordable even to the

smallest organization:

Table 35

Ten Clues You Are Dealing with a Top E-Service

Organization

1. Help function accessible from every page

2. Easy-to-find prices (not buried on the eighth page of the

account agreement)

3. Contact Us or About Us section prominently

displays telephone numbers, email,

and mail addresses

4. Service standards and guarantees prominently posted

5. Detailed and up-to-date FAQs

6. Customer feedback encouraged; for example, suggestion box or

satisfaction survey

7. Third-party endorsements/affiliations displayed, such as

Member Better Business Bureau, Chamber of Commerce, TrustE,

etc.

8. Hours of operation displayed in appropriate areas

9. Customer service staff and/or line management (especially branch

managers) identified by name with online bios/pictures

10. Customer testimonials and/or Q&A forums with actual customer

questions

Source: Online Banking Report, 3/04

Table 36

Customer Experience at Major U.S. Card Issuers*

|

Rank |

Card Issuer |

|

1 |

Capital One |

|

2 |

American Express |

|

3 |

Discover Card |

|

4 |

Citibank |

|

5 |

Wells Fargo |

|

6 |

Bank of America |

|

7 |

Chase |

|

8 |

Bank One (First USA) |

|

9 |

MBNA |

|

10 |

Fleet |

Source: Vividence, 4/04; Evaluations took place in July and August 2003;

Banks evaluated but not making the top 5 were: Fleet, US Bank, Wachovia

In terms of actual service experiences, we can only judge the companies

we’ve personally used, they include: American Bank, American Express, Bank

One (card only), Bank of America (card only), Capital One, Centura,

CharterOne, Chase (card only), Citibank (card and account aggregation),

DeepGreen Bank, Everbank, ING Direct, Juniper Bank, National City

(aggregation only), NextCard, Providian, Security First Network Bank, U.S.

Bank, Wells Fargo (card only), X.com/PayPal. Many of these accounts are

little-used, so we don’t have much opportunity to experience the entirety of

the company’s service efforts. However, among those accounts only ING

Direct, PayPal, and before they went out of business, NextCard, standout in

terms of overall online delivery. Other places do a great job servicing our

accounts online, but have not provided a truly memorable experience, the

kind of performance that generates unsolicited word-of-mouth referrals.

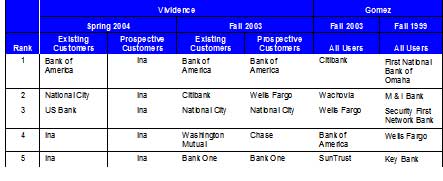

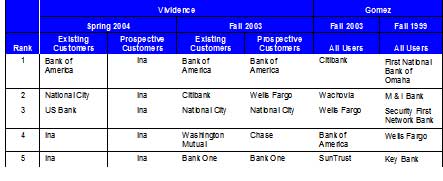

A number of third parties evaluate financial website usability and

service. One of the most thorough is Vividence,* which evaluates

customer experience at the 10 largest banks and ten largest card issuers. In

its latest analysis completed this month, Vividence ranked Bank of

America tops in customer experience for existing customers, National

City was second, and US Bank third.

The longest-running service evaluation is by Gomez Advisors (now

owned by WatchFire), which ranks online banks across five categories,

including customer confidence. Gomez determines the customer

confidence score by evaluating the bank’s website and mystery shopping

customer service. The most recent Gomez scorecard ranked Citibank first,

Wachovia second, and Wells Fargo third.

Table 37

Ranking Customer Experience at Major U.S. Banks

Sources: Vividence and Gomez, see below for details

Vividence, 4/04 & 9/03; Evaluations took place in July and August 2003;

Banks evaluated but not making the top 5 were: Fleet, US Bank, Wachovia;

Vividence Customer Experience Rankings are benchmarking studies using

proprietary software tracking behavior and opinions across a 2000-user

panel.

Watchfire Gomez Pro 10/03 & 10/99; Banks evaluated in Fall 2003 but not

making the top 5: American Bank/pcbanker.com, American Express-Banking,

Associated Bank (WI), Bank One, Chase, Charter One Bank, Citizens Bank,

Commerce Bank (NJ), E*TRADE Bank, First Internet Bank of Indiana, First

National Bank of Omaha, First Tennessee Bank, Fleet, Hibernia National Bank,

Huntington, NetBank, National City Bank, Key Bank, HSBC, PNC Bank,

SouthTrust Bank, U.S. Bank, Union Bank of California, Washington Mutual,

Webster Bank

Password management is a pain and only promises to get worse as banks and other ecommerce providers tighten up access controls due to sophisticated fraud attacks.

Password management is a pain and only promises to get worse as banks and other ecommerce providers tighten up access controls due to sophisticated fraud attacks.