Cyber security is finally at the frontline of conversations, but is it that easy?

Today we chatted with Sean Sposito, Security Analyst at Javelin Strategy, about the challenges that financial services companies have when dealing with cyber security. While awareness of cyber security has never been higher, Sposito asks whether that really equals an impenetrable safe wall?

Banks: who do you want to be when you grow up?

We ask John Waupsh, Chief Innovation Officer at Kasasa, where the branch stands? “Consumers, including millennials, still want to go into the branch and talk to somebody,” Waupsh says. But he counters with the fact that banks should be investing in a future of embedded banking.

FI + Core Vendor + Fintech: What it takes to make the partnership work

Tina Giorgio, President & CEO of ICBA Bancard, speaks with us live at FinovateSpring 2018 about the three Ts – time, talent, and treasure – that can guide community banks as they seek to adopt new technologies.

Financial wellness first: transforming the digital experience

“As a financial services industry, we have not yet been able to help a customer understand that the decisions that they make today impact their short and long-term goals,” says Tiffani Montez, Retail Banking Senior Analyst for Aite Group. Taking a new perspective on the digital experience, Montez addresses the key themes that can be facilitated by keeping financial wellness at the forefront: mobile experience, the role of the branch, and reinventing the checking account.

Security scars are key to innovation

“What’s your surface area and what are you defending?” is the first question you should be asking yourself when considering cyber security, according to Ben Johnson, CTO & Co-Founder, Obsidian Security. We speak to him live at FinovateSpring 2018 about the best practice and innovations in cyber security today.

“Banks can’t be everything for everyone”

We speak to Alex Jimenez, Vice President Senior Strategist, Zions Bancorporation about the key takeaways from the panels he participated in that addresses payments and platformization.

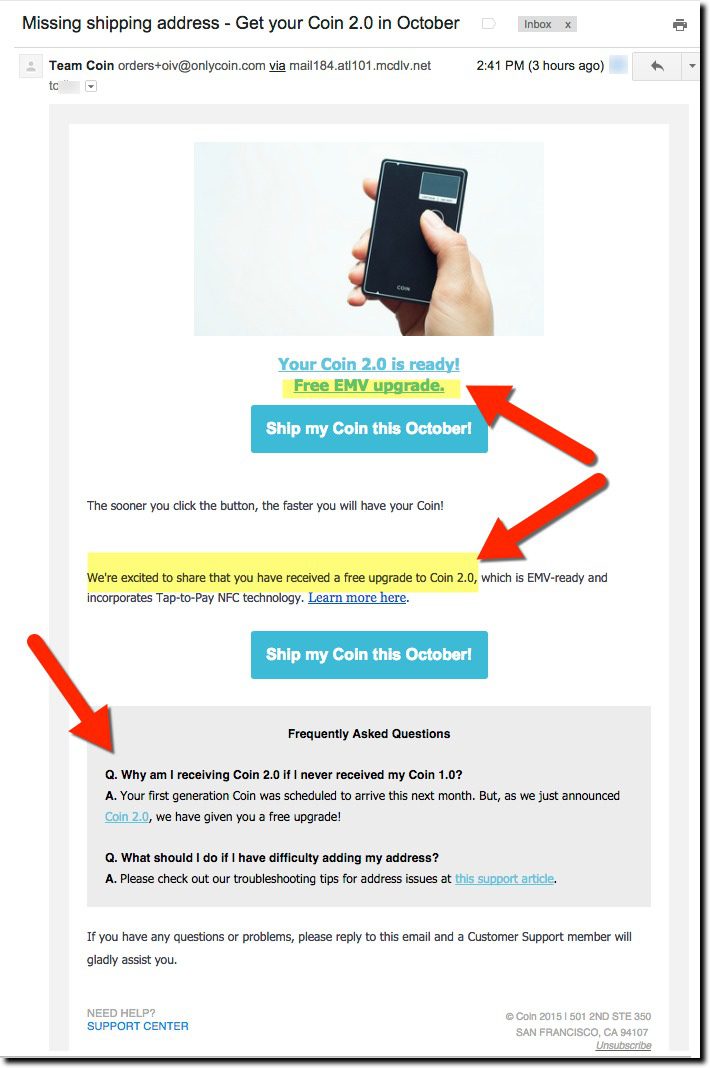

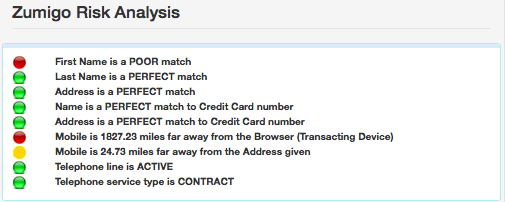

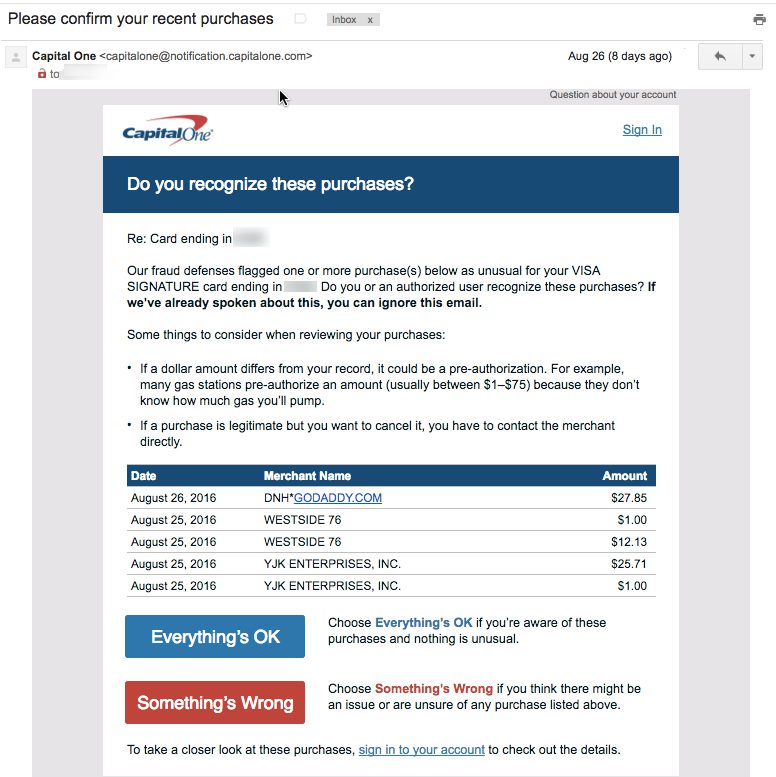

For the third year in a row, I traveled from Seattle to the L.A.-area to drop off my son at college. And for the third year in a row, Bank of America declined my card at Target, buying groceries and incidentals for him. And this time it was an EMV chip-card. Thank goodness I had my trusty Capital One card along, because it seems to do a far better job minimizing false positives (for fraud), at least for my account.

For the third year in a row, I traveled from Seattle to the L.A.-area to drop off my son at college. And for the third year in a row, Bank of America declined my card at Target, buying groceries and incidentals for him. And this time it was an EMV chip-card. Thank goodness I had my trusty Capital One card along, because it seems to do a far better job minimizing false positives (for fraud), at least for my account.