A week ago we introduced you to half of the companies that will be demoing their technologies on stage for FinovateEurope 2014.

Today we’re providing the second half of our scheduled roster for February.

For more information, and to get your tickets, visit our Finovate Europe 2014 page

here.

Luxoft’s iStockTrack is an innovative iPad solution providing mobile banking services for private and premium banking clients.

Matchi is an innovative matchmaking platform for banks and innovators to establish collaborative relationships that deliver increased ROI for innovators and banks alike.

Meniga is Europe’s leading white-label PFM provider. The company helps banks improve their businesses through data-mining, cross-sales, and improved retention.

Mobino enables mobile payments for 5 billion people, from any phone, no credit card required.

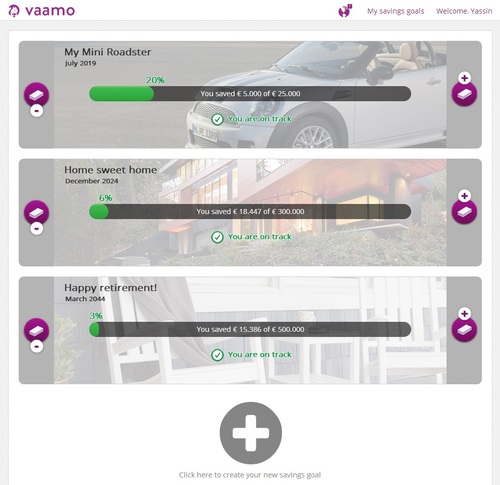

The Moneyer is the future of online Personal Finance Management.

Money on Toast delivers independent and whole of the market, FCA-regulated financial advice online via its algorithm-powered adviser.

MyOrder provides a m-commerce mobile app that serves businesses in parking, catering, and entertainment.

myWishBoard is the first crowdfunding platform for personal dreams and wishes.

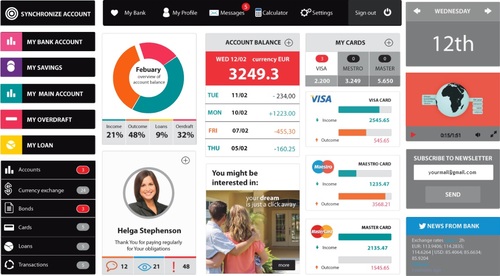

NF Innova’s Personal Experience Module, a part of iBanking product suite, enables banks to offer their customers a truly unique and tailored user experience.

Nostrum Group has built a virtual collection product that automates and optimizes the delinquency management process.

Nous.net’s Spark Feed is a real-time financial data service that helps you understand and predict the markets.

payworks is the provider of a mobile POS, Software-as-a-Service platform that lets developers quickly build payment functionality into their shopper and merchant apps.

PhotoPay’s technology allows users to extract data from any document, paper or electronic, enabling billpay on mobile devices.

Pixeliris’s CopSonic is the first universal contactless mobile payment system powered by our unique technology based on sonic communication.

Plutus Software’s KreditAja credit scoring system is designed to better serve the unbanked and underbanked in Asia.

SaaS Markets is an enterprise cloud marketplace company whose

MarketMaker platform helps FIs deploy their own branded, cloud-based business app store.

SmartEngine stands for personalization and target marketing. As pioneers in the field of customer loyalty, Smart Engine is a driver of innovation and a leader in personalized target marketing.

SoftWear Finance’s HACU PLATFORM enables banks to provide customers with the best possible user experience on any platform or device.

SQLI’s Augmented Banking is a new take at Online Banking. It is aimed at positioning a bank at the very center of people’s digital lives.

Temenos’s Treasury Management Dashboard tablet app has been developed for Microsoft Windows 8 and enables the transformation of treasury operations.

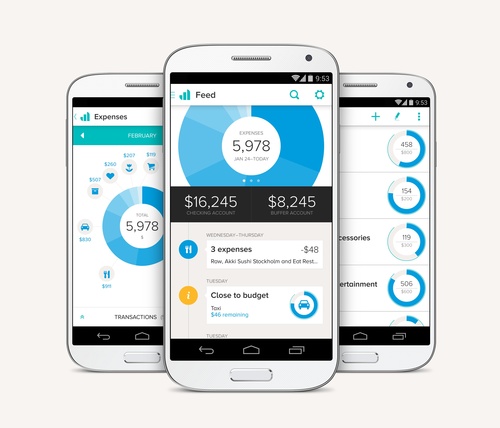

Tink is a free personal finance service that allows you to follow your money, where ever you are.

Tootpay’s solution is a mobile financial solution for payments, banking, telecommunications, and remittance industries.

Top Image Systems has leveraged its deep recognition and imaging expertise to develop a powerful suite of image processing applications for mobile devices.

Topicus Finan is a software vendor specializing in enterprise-level financial analysis. Its solution enables banks to provide self-service business lending processes for SMEs.

Toshl Finance is a personal finance manager made fun. Find out where your money is going, keep on top of bills and spending, and set up budgets.

Truphone, the innovative mobile operator, introduces the only global network-based recording solution for the Financial Industry.

Trustev provides a new approach to fraud prevention through a real-time, online identity verification platform, which ensures that merchants know exactly who they are selling to.

Yseop Sales Force Productivity Suite and its email writing application (YseMail) support financial advisors through the entire sales cycle.

A look at the companies demoing live at FinovateEurope on the 6 through 9 of March 2018 in London. Pick up your tickets today and save your spot.

Presenters

Presenters Vladimir Stojić, Technical PreSales Consultant

Vladimir Stojić, Technical PreSales Consultant