When CashEdge demo’d its new person-to-person (P2P) payment solution, POPmoney, at Finovate in September (video here), they said they expected four clients to be live by year-end. It looks like the first one is there, or almost there.

When CashEdge demo’d its new person-to-person (P2P) payment solution, POPmoney, at Finovate in September (video here), they said they expected four clients to be live by year-end. It looks like the first one is there, or almost there.

First Hawaiian Bank has a lengthy POPmoney FAQ posted on its website (see screenshot below). Pertinent details on the new POPmoney service include (refer to full text below):

First Hawaiian Bank has a lengthy POPmoney FAQ posted on its website (see screenshot below). Pertinent details on the new POPmoney service include (refer to full text below):

- Cost is $1 per transaction

- Users can send money via email address, mobile phone number, or directly into the recipient’s bank account (if known)

- Online banking customers will find it in the Transfers section under a tab entitled Send Money

- P2P payments are limited to $5,000 per month subject to a daily maximum of $1,000 via email/mobile or $2,000 transferred directly to another bank account

- Payments can be scheduled up to one year in advance

For more on the P2P payments market, see our latest Online Banking Report, published 15 minutes ago: Making the Case for Person-to-Person Payments.

First Hawaiian Bank’s POPmoney FAQ (link; 8 Dec. 2009)

FAQ text:

What is “POPmoney”?

“POPmoney” is a feature of the FHB Online® banking service that lets you send money to someone electronically via their email address, mobile phone number, or directly to their bank account. Payments to someone’s email address or mobile phone number are accompanied with a personalized message letting them know that the funds are available for electronic deposit to wherever they choose, while payments to someone’s bank account are deposited automatically.

How much does POPmoney cost?

Sending money via POPmoney costs only $1.00 per transaction.

How do I sign up for POPmoney?

POPmoney is available to customers through the FHB Online service and can be accessed via the “Send Money” tab within the “Transfers” section. If you are not currently enrolled for FHB Online, visit www.fhb.com and click on the Online Banking “Enroll” button in the upper left-hand corner of the screen. If you are already enrolled for FHB Online, sign onto FHB Online, go to the Transfers section, and then click on the Send Money (Personal Only) link. Follow the three-step sign-up process:

- Step 1 POPmoney Agreement – Accept the FHB Online POPmoney amendment.

- Step 2 Contact Information – Your email address and mobile phone number are required as part of the sign-up process. You will need to verify the email address we have on file is correct. If it is incorrect, please close the window and click “Update Email Address” within the Customer Service tab to update your email address. After confirming your email address, return to the “Transfers – Send Money (Personal Only)” link and you will also be asked to provide a mobile phone number as part of the sign-up process.

- Step 3 Email/Mobile Phone Validation – We will send verification codes to your email address and mobile phone. Please check your email and your mobile phone for these codes and enter them in the boxes shown on-screen to complete the sign-up process.

Once you’ve completed the steps above, you will receive a confirmation message indicating that you have successfully signed up for POPmoney. Click “Continue to POPmoney” to start using the service.

Who can I send money to?

You can send money to someone just by knowing their mobile phone number or email address. The person receiving the notification will be able to deposit the money to any personal checking, savings, money market checking, or money market savings account at FHB or nearly any other U.S. bank. You can also send money directly to someone else’s bank account if you have their bank routing and account number information.

How does the recipient receive and deposit funds?

If you are sending money to a mobile phone or email address, the recipient will receive a notification with a personalized message indicating that you have sent them a payment. The recipient has two ways of depositing the funds:

- If the recipient is a First Hawaiian Bank customer, they can deposit the funds into their account via the FHB Online service. Upon enrolling, or if the recipient is already enrolled for FHB Online, they can click on the “Send Money (Personal Only)” to access the POPmoney feature. Any payments that have been sent to them will be listed under the “Incoming Payments & Alerts” tab. They can then select an account to which to deposit the funds. They can also designate whether future payments should be automatically deposited to this account.

- If the recipient is a not a First Hawaiian Bank customer, or would like to deposit the funds into a non-FHB account, they can visit www.popmoney.com/FHB. They will be prompted to provide their mobile phone or email address along with their bank account information for the payment to be deposited.

Can I send money internationally?

No, you can only send money to individuals via their accounts within the U.S.

What is the maximum transaction amount I can make via POPmoney?

The maximum daily amount allowed for POPmoney transactions is the current available balance in the source account (plus any available credit in an associated Yes-CheckSM account if applicable) up to the daily limit mentioned below, whichever is less. This includes any single transaction or the total amount outstanding or “in process.” For additional information, see below:

Sending Money to Bank Account

Maximum Amount

Daily

$2,000.00

Monthly

$5,000.00

Sending Money to Mobile or Email

Maximum Amount

Dail

y

$1,000.00

Monthly

$5,000.00

Can I set up recurring or future-dated transactions?

Yes, POPmoney transactions may be scheduled up to 365 days in advance of the date the transaction is to be made. Automatic recurring transactions may also be scheduled for substantially regular intervals (e.g., monthly) in the same amount between the same two accounts. You can schedule recurring transactions to be made weekly, every other week, twice a month, monthly, every four weeks, every other month, quarterly, twice a year, and annually.

How far in advance can I schedule a transaction?

You can schedule a POPmoney transaction up to one year in advance.

When are POPmoney transactions processed?

Transactions will be processed on the date you specify up to a year in advance. Transactions will take approximately three business days to process. Transactions scheduled to process on a weekend or holiday will be processed the previous Business Day.

What is the cut-off time to submit a transaction?

The cut-off time for submitting transactions is 7:00 p.m. HT each Business Day. Transactions submitted after 7:00 p.m. HT or on weekends or holidays will be processed the next Business Day. A Business Day is every calendar day except for Saturdays, Sundays, and bank holidays.

What is the cut-off time to change or delete upcoming transactions?

The cut-off time to change or delete an upcoming transaction is 7:00 p.m. Hawaii Standard Time the previous Business Day prior to the send date.

When does the transaction get debited from my account?

The transaction debit request is initiated on the “send date” but will not post against your account for one to two days.

What happens if I set up a transaction but do not have sufficient funds in my account on the “send date?”

If, on the “send date,” there is insufficient balance in your account to make a transaction you authorized, we will delay the transaction and try again on the next Business Day. If there is still insufficient balance to make the transaction, we may either refuse to pay the item, or we may make the transaction and overdraw your account. In either event, you will be responsible for any non-sufficient funds (“NSF”) or overdraft charges that may result.

How many people can I add to my list of contacts?

You may add up to a total of 50 contacts.

I used to send money to third parties via the External Transfers function. What will happen to this information?

As part of introducing POPmoney, we have migrated your third-party information and activity from External Transfers to POPmoney. This includes contacts or accounts, as well as upcoming and previous transactions. Categories for previous transactions will not be migrated and will need to be re-defined.

How do I disable POPmoney?

You may disable POPmoney by calling us at 643-4343 (1-888-643-4343 from the Continental U.S., Guam, and CNMI). Please note that disabling POPmoney will also disable your access to External Transfers.

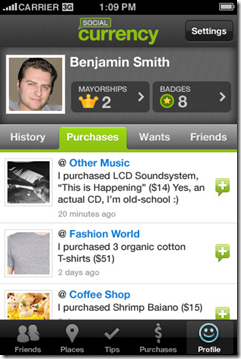

Today, I found out that American Express has blown that record away. With the release this week of a youth-oriented Foursqure-powered app, Social Currency (app link), the card issuer now has seven apps available for the iPhone alone (but still none for the iPad).

Today, I found out that American Express has blown that record away. With the release this week of a youth-oriented Foursqure-powered app, Social Currency (app link), the card issuer now has seven apps available for the iPhone alone (but still none for the iPad).