Mobile financial services company Vipera has agreed to be acquired by Italy-based Sella Open Fintech Platform (SOFP), the fintech arm of Gruppo Banca Sella, a family-owned banking and financial services group.

Talk of the acquisition first began on March 22. This week, SOFP’s board of directors and Vipera Directors Luciano Martucci and Martin Perrin have agreed upon a cash offer. The offer price of $0.11 per share values Vipera at just over $34 million, a premium of 20%. Commenting on the offer, which is subject to approvals, Vipera Director and Chairman Luciano Martucci said, “Gruppo Banca Sella has been a valued customer of Vipera for some time and a shareholder since July 2017. I am pleased that our increasingly close relationship has led to our shareholders being offered a fair price and to Vipera’s businesses being able to develop as part of the SOFP Group.”

Vipera was founded in 2015 and went public in 2010. The company is listed on the London Stock Exchange under the ticker VIP. Headquartered in London, Vipera has 125 employees and three million registered users. Last July, Vipera acquired SoftTelecom for $1.5 million.

The company offers a range of personal and corporate banking systems, along with customer engagement analytics and marketing tools. At FinovateEurope 2016, Vipera demonstrated MOTIF, a system that offers mobile banking, mobile payments, and mobile card control. The access to consumer data offers banks actionable insights that generate location and context-based mobile offers. The personalized offers are sent to the user’s phone at an appropriate time to enhance the shopping experience and build user engagement with their bank.

Most recently, Vipera teamed up with Mastercard at FinovateEurope 2018 to debut SME-pay, a mobile payment solution tailored for small and medium sized businesses. During the demo, Vipera Chief Commercial Officer Simon Pearce, along with Mastercard’s VP of Small Business Products Dick Paul, demoed how SME-pay allows business owners to decide when, where, and how employees can use their business payment cards.

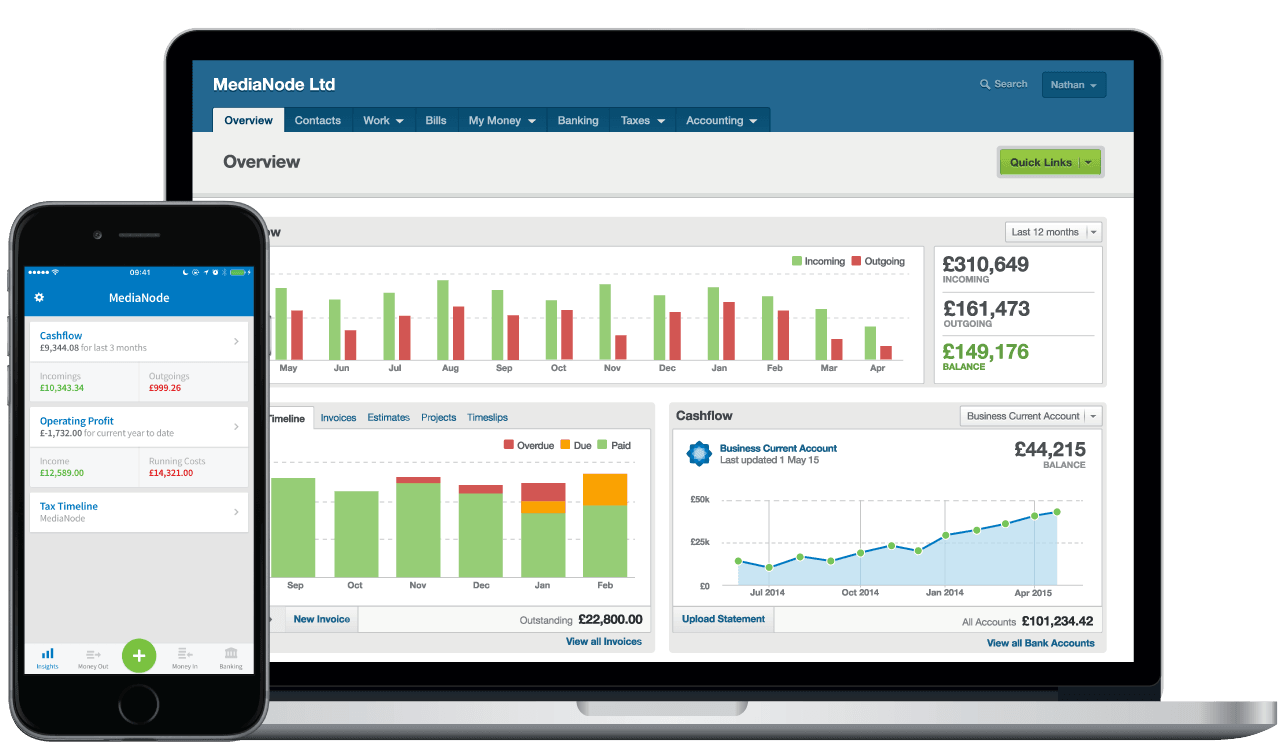

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”