- Finance ERP provider Sage has acquired Delaware-based expense management platform Fyle. Terms of the transaction were not disclosed.

- Fyle’s technology will enable Sage to offer additional tools that leverage AI to automate workflows in accounting, finance, human resources, and payroll operations.

- Founded in 2016, Fyle made its Finovate debut at FinovateFall 2023 in New York.

Expense management platform Fyle has agreed to be acquired by finance ERP provider Sage. Terms of the transaction were not disclosed.

“Our mission has always been to make expense management intuitive—so that our users never have to actively think about the task in any meaningful way, and so that their finance departments have the data transparency and assurance they need during close,” Fyle CEO and Co-Founder Yashwanth Madhusudan said. “As a longtime partner of Sage, we know the company shares our focus on delivering great software experiences, and we are excited about the collective impact we can have.”

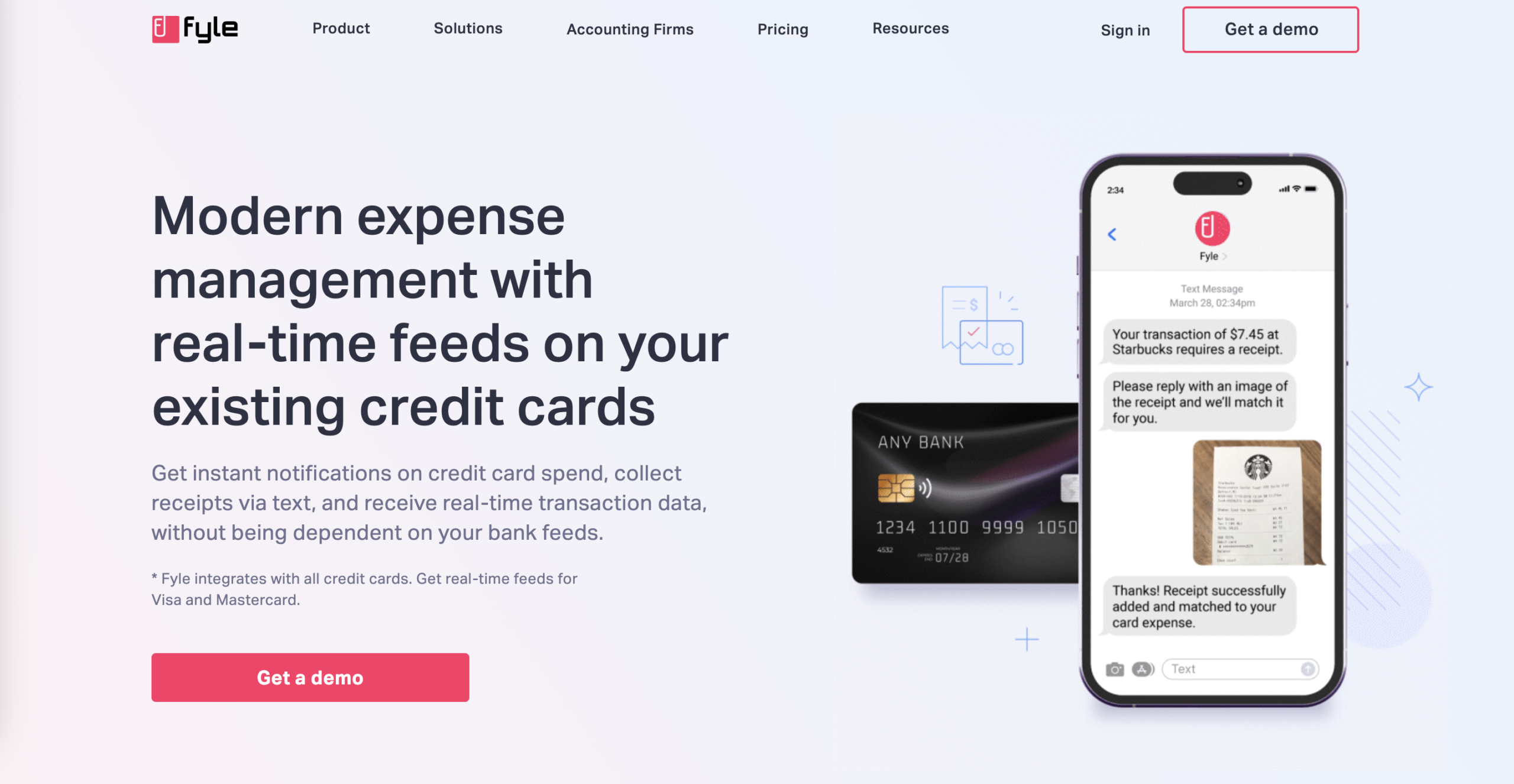

The acquisition will enable Sage to add further AI-powered tools to simplify and automate financial workflows in accounting, finance, HR, and payroll operations. Fyle provides accounting and finance teams with real-time notifications on transaction data and enables end users to submit and reconcile expenses with a simple text. With more than 150 employees, the Delaware-based company has 1,600 direct customers in the US and thousands more via white-label agreements.

Post-acquisition, Fyle will continue to integrate with third-party accounting and financial systems. The technology is already integrated with Sage Intacct and Sage 300 Construction and Real Estate, with a broader rollout throughout North America “and beyond” to follow.

“In 2025, financial leaders are expected to play much more strategic roles than ever before and are looking for every way to get a high-performance edge. We know expense management is a key workflow for finance. Fyle streamlines and automates the entire process, further simplifying SMB finances with AI. I look forward to working as one team to create real and immediate impact for our customers,” Sage EVP Financials and ERP, Dan Miller said.

UK-based Sage provides software and services to help small and medium-sized companies conduct and enhance their payroll, human resources, and financial operations. Among the company’s flagship solutions, its Sage Intacct solution provides cloud accounting and financial software management for medium-sized businesses, while the company’s Sage 50 Accounts provides similar accounting, inventory, and payments management for smaller firms.

Founded in 2016, Fyle made its Finovate debut at FinovateFall 2023. At the conference, the company demonstrated how its technology integrates with text messaging, email (including Gmail and Outlook), and meeting platforms like Slack and MS Teams to give companies and employees a unique and user-friendly way to submit and manage expenses. The technology instantly codes and categorizes expense data and syncs the data with commonly used ERPs such as Sage Intacct, NetSuite, QuickBooks Online, and Xero.

Photo by Paulina S. on Unsplash