Total fundings in second quarter hit $8 billion as 30 more companies raised $390 million the second week of May. Nearly half of that ($188 million) was debt earmarked for Avant’s U.K. subsidiary.

Total fundings in second quarter hit $8 billion as 30 more companies raised $390 million the second week of May. Nearly half of that ($188 million) was debt earmarked for Avant’s U.K. subsidiary.

The deals were widely dispersed around the world, with only 4 of the 30 headquartered in California. London beat that this week with 5, followed by 3 in NYC, and 2 each from Chicago, Florida and Germany.

The total number of deals YTD stands at 494, nearly double last year’s 266. Total dollars raised YTD is now $14.7 billion, more than twice the $6.7 billion raised during the same period a year ago.

Notable raises included Finovate alum Tagit which brought in nearly $9 million to supercharge its mobile application development platform.

——-

Fintech deals by size from 7 May to 13 May, 2016:

Avant (AvantCredit U.K.)

Consumer alt-lender

Latest round: $188 million Debt (for AvantCredit U.K.)

Total raised: $1.92 billion ($654 million Equity, $1.26 billion Debt)

HQ: Chicago, Illinois

Tags: Consumer, credit, loans, underwriting, lending

Source: Crunchbase

Bridge2Solutions

Incentive & rewards systems for financial institutions

Latest round: $35 million Series A

Total raised: $35 million

HQ: Daytona Beach, Florida

Tags: Consumer, enterprise, rewards, payments gamification, employees, human resources, loyalty, retention

Source: Crunchbase

Capital Float

Working capital financing

Latest round: $25 million Series B

Total raised: $41 million

HQ: Bangalore, India

Tags: SMB, lending, financing, commercial loans, invoice financing, factoring

Source: Crunchbase

Wincor Nixdorf (AEVI subsidiary)

Payments technology

Latest round: $23 million Post-IPO Equity

Total raised: Unknown

HQ: Germany

Tags: Enterprise, cashless payments

Source: FT Partners

orderbird

iPad POS system for the hospitality industry

Latest round: $22.8 million Series C

Total raised: $37 million

HQ: Berlin, Germany

Tags: SMB, payments, mobile, merchants, acquiring, security, credit/debit cards

Source: Crunchbase

Simplee

Healthcare finance platform

Latest round: $20 million

Total raised: $37.8 million

HQ: Palo Alto, California

Tags: SMB, patient finance, billing, payments, insurance, credit, underwriting, B2B2C

Source: Crunchbase

AutoFi

Auto financing platform

Latest round: $17 million

Total raised: $17 million

HQ: San Francisco, California

Tags: B2B2C, SMB, consumer, lending, auto loan, vehicle credit, underwriting, secured, captive financing, lead gen

Source: FT Partners

EuroCCP

Equities clearing

Latest round: $16 million (from Euronext)

Total raised: Unknown

HQ: Amsterdam, The Netherlands

Tags: B2B, enterprise, trading software, investing services, back office

Source: FT Partners

Tagit

Mobile financial applications

Latest round: $8.75 million

Total raised: $8.75 million

HQ: Singapore

Tags: Enterprise, banking, mobile application development, developers, Finovate alum

Source: Finovate

TechBureau

Blockchain technology

Latest round: $6.2 million

Total raised: $6.2 million

HQ: Osaka, Japan

Tags: SMB, blockchain, distributed database, payments, crypto-currency, bitcoin

Source: FT Partners

WealthBar

Online financial adviser

Latest round: $5.5 million

Total raised: $5.5 million

HQ: Vancouver, British Columbia, Canada

Tags: Consumer, investing, robo-adviser, ETF, wealth management

Source: Crunchbase

Healthcare Interactive

Healthcare & insurance technology

Latest round: $3.4 million Series A

Total raised: $11.8 million

HQ: Glenwood, Maryland

Tags: Enterprise, healthcare, payments, insurance

Source: FT Partners

Tandem

Digital bank

Latest round: $3.4 million Equity Crowdfunding ($95 million valuation)

Total raised: $34.8 million

HQ: London, England, United Kingdom

Tags: Consumer, banking, payments, deposits, loans, debit card

Source: Crunchbase

AppZen

Expense report automation

Latest round: $2.9 million

Total raised: $3.0 million

HQ: Sunnyvale, California

Tags: SMB, accounting, bookkeeping, expense reporting, compliance, fraud protection

Source: Crunchbase

Sure

Mobile on-demand insurance

Latest round: $2.6 million Seed

Total raised: $2.6 million

HQ: New York City, New York

Tags: Consumer, travel insurance, mobile

Source: Crunchbase

Inkassogram

Debt collection platform

Latest round: $2.45 million

Total raised: $2.45 million

HQ: Sweden

Tags: SMB, accounting, payroll, bookkeeping, billing, payments, invoicing

Source: Crunchbase

Fluent

Blockchain B2B network

Latest round: $1.65 million Seed

Total raised: $2.5 million

HQ: New York City, New York

Tags: SMB, payments, blockchain, crypto-currency, bitcoin, payments

Source: Crunchbase

AccessPay

Online payments & cash management for small businesses

Latest round: $1.45 million Debt

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: SMB, payments, accounting, treasury management, commercial banking

Source: Crunchbase

FattMerchant

Payment processor

Latest round: $1.4 million

Total raised: $2.25 million

HQ: Orlando, Florida

Tags: SMB, payments, mobile, merchants, acquiring, security, credit/debit cards

Source: Crunchbase

StoreHub

Mobile point-of-sale solution

Latest round: $850,000 Seed

Total raised: $850,000

HQ: Petaling, Malaysia

Tags: SMB, payments, mobile, merchants, acquiring, credit/debit cards, mobile, POS

Source: Crunchbase

Bridge Financial Technology

Back-office platform for financial advisers

Latest round: $722,000

Total raised: $722,000

HQ: Chicago, Illinois

Tags: Advisors, B2B2C, investing, trading, wealth management

Source: Crunchbase

Selequity

Online commercial real estate investing platform

Latest round: $590,000 Seed

Total raised: $590,000

HQ: St. Louis, Missouri

Tags: SMB, investors, commercial mortgage, P2P lending, credit, underwriting, real estate

Source: Crunchbase

Cushion

Financial & time management service for freelancers

Latest round: $500,000

Total raised: $500,000

HQ: Brooklyn, New York

Tags: SMB, accounting, payroll, bookkeeping, billing, payments, invoicing, PFM

Source: Crunchbase

Olivia

AI-powered financial assistant

Latest round: $500,000 Seed

Total raised: $500,000

HQ: San Francisco, California

Tags: Consumer, personal finance, mobile, artificial intelligence, customer service, chatbot

Source: Crunchbase

Shares.com

Asset crowdfunding platform

Latest round: $300,000 Angel

Total raised: $300,000

HQ: London, England, United Kingdom

Tags: Consumer, collectibiles, investing, asset-based lending, artwork

Source: Crunchbase

PaySur

Bitcoin exchange

Latest round: $275,000

Total raised: $275,000

HQ: Leon, Mexico

Tags: Consumer, payments, cryptocurrency, bitcoin, blockchain, remittances

Source: Crunchbase

DebitShield

Online debit card security

Latest round: Not disclosed

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: Consumer, security, payments, direct debit, online billpay

Source: Crunchbase

FairCent

Marketplace lender

Latest round: Undisclosed Series A

Total raised: $4.25 million (before the Series A)

HQ: Haryana, India

Tags: Consumer, lending, P2P, person-to-person, credit, lending, investing

Source: Crunchbase

iBondis

Marketplace lender to small businesses

Latest round: Not disclosed

Total raised: Unkown

HQ: London, England, United Kingdom

Tags: SMB, P2P lending, crowdfunding, commercial loans, person-to-person, credit, underwriting, investing

Source: Crunchbase

Savesta

Stealth personal finance

Latest round: Not disclosed

Total raised: Unknown

HQ: Bellevue, Washington

Tags: Consumer, personal finance, PFM

Source: Crunchbase

—–

Image licensed from Shutterstock

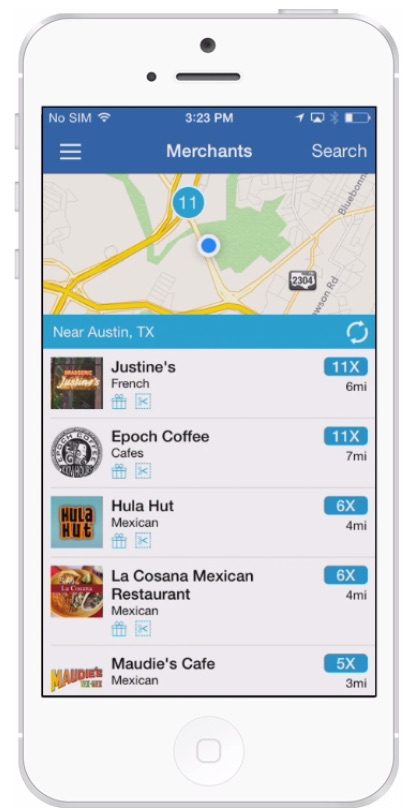

The company counts 1.5 million active users each month, 60% of whom are under the age of 44.

The company counts 1.5 million active users each month, 60% of whom are under the age of 44.

Community-focused rewards program

Community-focused rewards program