Germany consumer finance innovator Kreditech has just picked up a $10.4 million (€10 million) investment from Japan’s Rakuten. The new funds, which will be used to develop Kreditech’s partnership business, take the company’s total capital to more than $160 million. According to TechCrunch, the investment gives Kreditech a valuation of $313 million (€300 million).

In a statement accompanying the announcement, Kreditech founder and CEO Alexander Grabner-Müller emphasized how the capital will help drive the company’s partnership business. He also praised Rakuten’s investment in his company’s “mission to improve financial freedom for the underbanked through technology.” Kreditech CFO Rene Griemens added that Rakuten’s “strong market position in Asia” could be a “door opener” for the company which already has a presence in Russia, Poland, Romania, Spain, and Mexico, as well as its home country of Germany.

Kreditech is not the only fintech, nor the only Finovate alum, that Rakuten has invested in. The firm invested $15 million in Azimo this spring, and contributed to Currency Cloud’s $18 million Series C round last summer. Speaking of Kreditech, Rakuten Fintech Fund managing partner Oskar Mielczarek de la Miel highlighted the company’s “distinctive big-data-driven credit model and tech expertise” and complimented Kreditech’s “unique model of individual empowerment through access to credit.”

Founded in 2012, Kreditech demonstrated its technology at FinovateSpring 2014. The company’s solutions leverage non-traditional data and machine learning to provide financing options such as loans, PFM, and digital wallets to underbanked communities. In October, Kreditech was named to the 2016 Fintech 100 sponsored by H2 Ventures and KPMG—the same month the company announced that former mBank veteran Michal Panowicz was joining it as chief product and information officer. Kreditech launched its online POS financing solution, Monedo Now, in June, providing online consumers with instant financing of as much as $5,500.

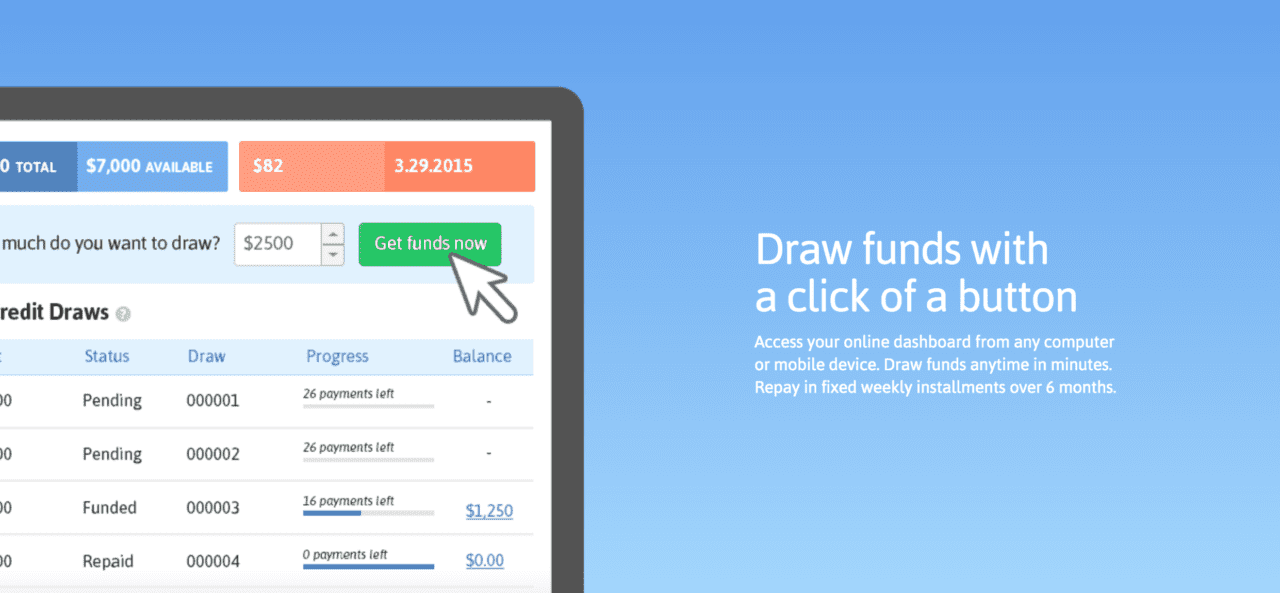

BlueVine offers a straightforward line of credit to help small businesses get the working capital they need. The company is best known for Invoice Factoring, in which it issues cash to small businesses who sell their unpaid invoices at a discount, then receive working capital in a matter of days to help manage operations. Unlike BlueVine’s traditional line-of-credit offering, the term of the financing is short, usually 60 to 90 days.

BlueVine offers a straightforward line of credit to help small businesses get the working capital they need. The company is best known for Invoice Factoring, in which it issues cash to small businesses who sell their unpaid invoices at a discount, then receive working capital in a matter of days to help manage operations. Unlike BlueVine’s traditional line-of-credit offering, the term of the financing is short, usually 60 to 90 days.

Founded in 2012 and headquartered in Germany, figo

Founded in 2012 and headquartered in Germany, figo