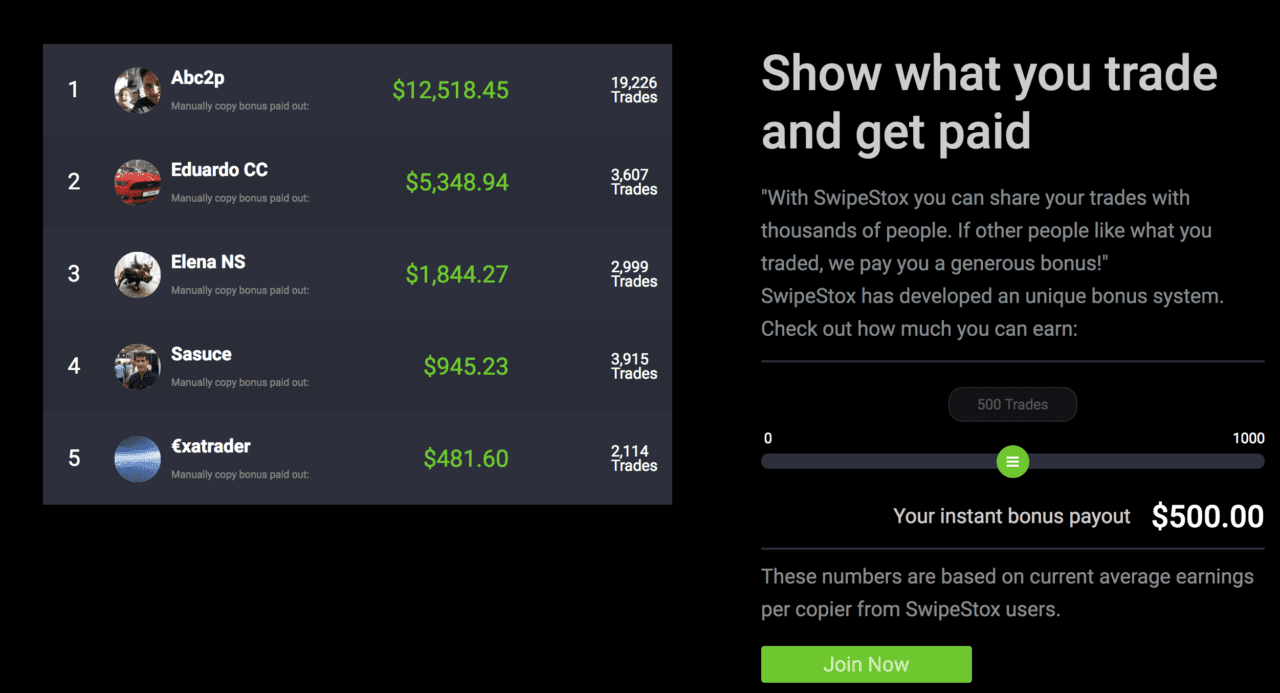

SwipeStox, the Tinder for stock trading startup announced this week that its parent company The NAGA Group has landed $13 million in financing. This boosts the company’s total funding to $15 million.

The backing comes from Chinese investment group FOSUN. Guo Guangchang, FOSUN Group’s founder and chairman, said he was compelled to invest in Germany-based NAGA Group because of the company’s “vision to disrupt the trading space” and its “experienced team and strong technology focus.”

Benjamin Bilski, Founder and CEO of SwipeStox added, “Together with FOSUN we will accelerate our product development for SwipeStox and expand into more areas in the trading ecosystem. We are aiming to become the largest social network for stock traders worldwide.” Hamburg, Germany-based SwipeStox also has offices in London and Sarajevo, Bosnia. The company’s app is open to users in the U.K., Spain, and Germany, and may soon expand to Asia. According to the press release, NAGA Group’s CEO Yasin Sebastian Qureshi mentioned the new relationship offers NAGA “a solid bridge into China mainland.”

SwipeStox launched in 2016 and nine months after going live the startup’s global user base had already traded more than $21 billion over the platform. Benjamin Bilski, along with Managing Director & Co-Founder, Wladimir Huber, showed off the SwipeStox platform at FinovateSpring 2016. At FinovateEurope 2016 in London, SwipeStox took home Best of Show honors for the debut of its platform. Also last year, the company won Wolves Summit 2016 and most recently launched a web trading platform to expand on its mobile services.