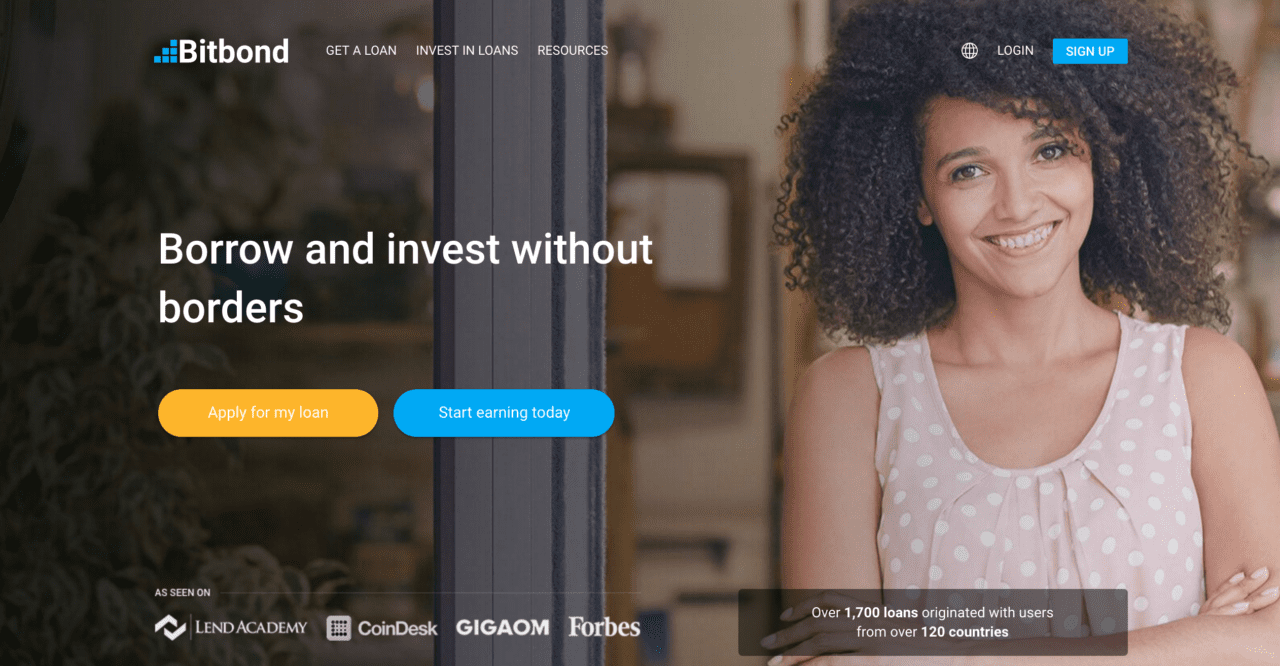

Peer-to-peer small business financing platform Bitbond announced today it has received a debt commitment from Obotritia Capital, which has agreed to fund $5.4 million worth of loans on its platform. Obotritia has also invested an undisclosed amount of equity in Bitbond, whose current funding now totals more than $2.14 million.

Headquartered in Germany, Bitbond offers small businesses across the globe fast access to working capital. It does so by connecting small business owners with individual and institutional investors. Because it leverages the blockchain, Bitbond sends cross-border payments to merchants quickly and inexpensively. Since it was founded in 2013, Bitbond has originated 1,700 loans to small businesses in 120 countries.

Above: Bitbond’s Radko Albrecht (CEO & Founder) and Jarek Nowotka (CTO) debut the company’s automated SME scoring engine at FinovateFall 2016

At FinovateFall 2016, the company launched an automated SME scoring engine. “The main challenge about creating an international lending platform is credit scoring because data is different from one country to another,” said Bitbond CEO and founder Radko Albrecht in his recent FinovateFall demo. He added, “At Bitbond we have solved this and created the most international and most scalable SME scoring mechanism.” The tool offers a universal, automated scoring method that offers borrowers instant funding after their application is accepted. Because Bitbond requires less manual involvement than traditional underwriting methods, it also has the advantage of scalability.

Earlier this year, Bitbond partnered with blockchain remittance service Bitpesa to improve access to working capital for small businesses in Africa. Last fall, the company received its BaFin license, a certification that allows it to conduct asset brokerage on its platform independent of banks.