- Uplinq, a company that offers advanced bookkeeping solutions to SMEs, has raised $5.6 million in funding.

- Headquartered in Arizona, Uplinq will use the capital to scale its marketing efforts to better serve fintech’s “underserved bookkeeping” market.

- The funding was led by Arizona-based AZ-VC, and included a strategic investment from Live Oak Ventures.

Uplinq, a technology company that leverages automation and machine learning to provide businesses with advanced bookkeeping solutions, has secured an investment of $5.6 million. The funding, announced in early December, was led by Arizona venture capital fund AZ-VC and included a strategic investment from Live Oak Ventures. Live Oak Ventures is the fintech-oriented venture capital arm of Live Oak Bank. Also participating in the funding were Merus Capital and members of the Kuwaiti Royal Family.

“With continued economic uncertainty, new automated fintech like Uplinq helps businesses take advantage by keeping track of changing costs and financials more efficiently than ever before to make smart business decisions fast,” Uplinq CEO Alex Glenn said. “This funding round will accelerate the next phase of Uplinq’s growth plans and expand our reach across this lucrative $15 billion industry.”

The capital will be used to help scale Uplinq’s marketing efforts, sales power, engineering capabilities, and customer delivery departments in order to better serve what the company calls fintech’s “underserved bookkeeping” market.

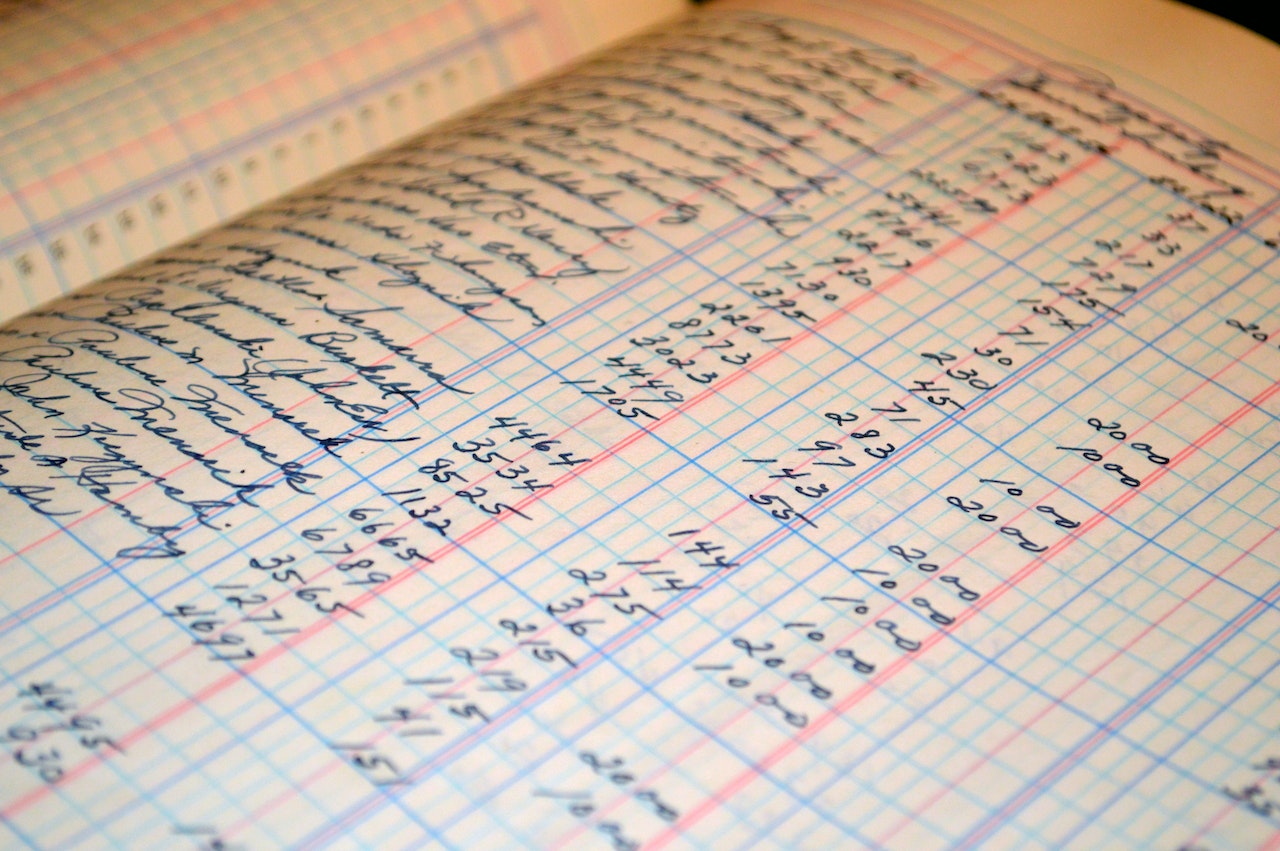

Uplinq leverages its proprietary technology to gather, organize, and categorize business transactions to provide small businesses with review-ready, real-time analysis “at the touch of a button.” With seamless integrations with more than 10,000 financial institutions, Uplinq provides its customers with weekly updated financial data – instead of monthly or quarterly – and said that more solutions for SMEs are planned to go live in 2023.

“We offer businesses a better way to get professional help through our proprietary technology, that not only makes bookkeeping worry-free for the business owner, but also provides them with powerful data automation and machine learning to better understand their finances and how their business can improve,” Glenn said.

Founded in 2020, Uplinq is headquartered in Tempe, Arizona.