FinovateFall is going beyond the demos again this year to bring you more content. In addition to two days of live demos from 80 fintech companies, we’ll have an extra discussion day to help you break down and digest some of the new technologies. You’ll also have a chance to present your own thoughts and questions to fintech thought leaders.

The discussion day will take place on September 26, following two days of demos on September 24 and 25, at the Marriott Marquis Times Square in New York. These are the conversations that will shape your bank’s 2019 strategy, so be sure to register.

Here is just a handful of topics we’ll cover:

The future of payments

Payments have changed since the dawn of fintech. However, many old habits, such as writing checks and swiping magstripe credit cards, have not changed. Other ideas, such as mobile wallets and tap-to-pay technologies have struggled to gain ground. We’ll discuss these thoughts, as well as voice-driven payments, new technologies, and how millennials are determining the future of digital payments.

Digital transformation

Is digital transformation simply a buzzword or is it a requirement for success and survival in 2019? Digital Transformation involves a broad scope of banks’ operations and we’ll have a chance to hear the experts break down what it means to them and why they think it’s worth paying attention to.

Cybersecurity and risk management

In order to stay one step ahead of hackers, techniques in cybersecurity are constantly advancing by leveraging technologies such as AI and the blockchain. We’ll host a team of analysts, bankers, and hackers as they discuss the threats and opportunities in this space.

Voice banking

AI, natural language processing, conversational banking, and chatbots have bubbled to the top as some of the hottest new fintech trends this year. Voice has been called the next user interface and there’s been plenty of discussion on how consumers will usher in the new era of conversational banking. We’ll hear from banks, analysts, and successful startups on developments they’ve seen in this space and advice they have on where to invest for the future.

Blockchain uses and crypto exchanges

It wouldn’t be a fintech conference without a blockchain discussion– and for good reason. The enabling technology has opened up new possibilities for old banking ideas such as currency, payments, contracts, audit compliance, and more. If you’re feeling behind on leveraging blockchain opportunities, be sure to tune into one of these sessions. And don’t miss discussions on crypto exchanges– because the blockchain and cryptocurrencies are way more than just bitcoin.

Building partnerships

While we can’t settle the build vs. buy dilemma for you, we will offer up our thoughts on the importance of partnerships in banking and fintech. Most fintechs need banks to survive, and many banks thrive off the new ideas and capabilities that fintech companies open up for their institutions. These sessions will capture ideas on how to create a win-win partnership that focuses on utility and efficiency.

Data

From its role in alternative credit scoring technologies to the latest robo advisory tools, data has a place across the fintech sector. As evidenced by the title of our data session, Data as Oxygen, we think it’s a pretty important resource. We’ll hear from top-tier banks, startups, and other financial services companies as they discuss how they use data and where they see the data revolution headed next.

Financing

As a staple banking activity, lending will take one of the starring roles in our discussion day. While lending basics have remained the same, new enabling technologies have recently opened up new opportunities in the space. Artificial intelligence and machine learning have changed the way underwriters look at risk and credit scoring, while point of sale financing technologies have advanced far beyond layaway thanks to real-time risk analyses. These are just some of the topics that will be featured on the Digital Lending Stage at FinovateFall next month.

We’ll also feature highlights such as:

- Analyst all-stars

- Debates on the future of digital financial services

- Accelerator showcase

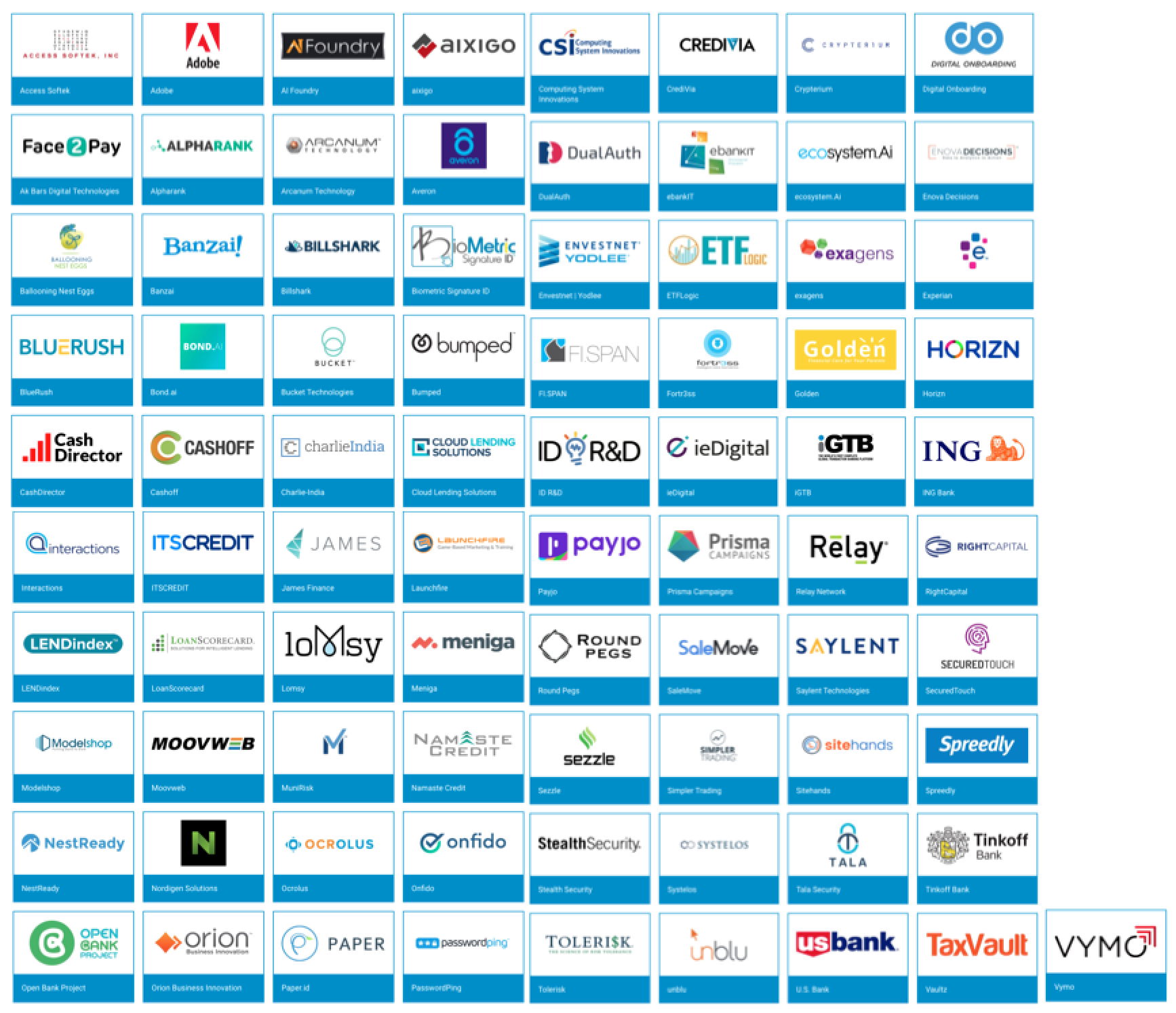

And be sure to check out our loaded list of 80 demoing companies that will take the stage on September 24 and 25. On the Finovate blog, we’re highlighting select companies in our Sneak Peek series to give you an advanced look at what to expect on stage.

A look at the companies demoing live at FinovateFall on September 24 through 26, 2018 in New York. Register today and save your spot.

Presenters

Presenters Ana Ines Echavarren, CEO, Infocorp

Ana Ines Echavarren, CEO, Infocorp

Presenters

Presenters Clayton Weir, Co-Founder, Chief Strategy Officer

Clayton Weir, Co-Founder, Chief Strategy Officer

Presenters

Presenters Damir Galiev, MBA, Business Development

Damir Galiev, MBA, Business Development Yaroslav Shuvaev, Head of R&D

Yaroslav Shuvaev, Head of R&D

Presenters

Presenters Daniel Wideman, VP of Product

Daniel Wideman, VP of Product

Presenters

Presenters Austin Kimm, COO

Austin Kimm, COO

Presenter

Presenter

Presenters

Presenters Vitor Barros, Pre-Sales Director

Vitor Barros, Pre-Sales Director

Jacob Jegher

Jacob Jegher Alyson Clarke

Alyson Clarke Daniel Latimore

Daniel Latimore Thad Peterson

Thad Peterson

Presenters

Presenters Sara Martins, Business Developer

Sara Martins, Business Developer