A look at the companies demoing live at FinovateFall on September 24 through 26, 2018 in New York. Register today and save your spot.

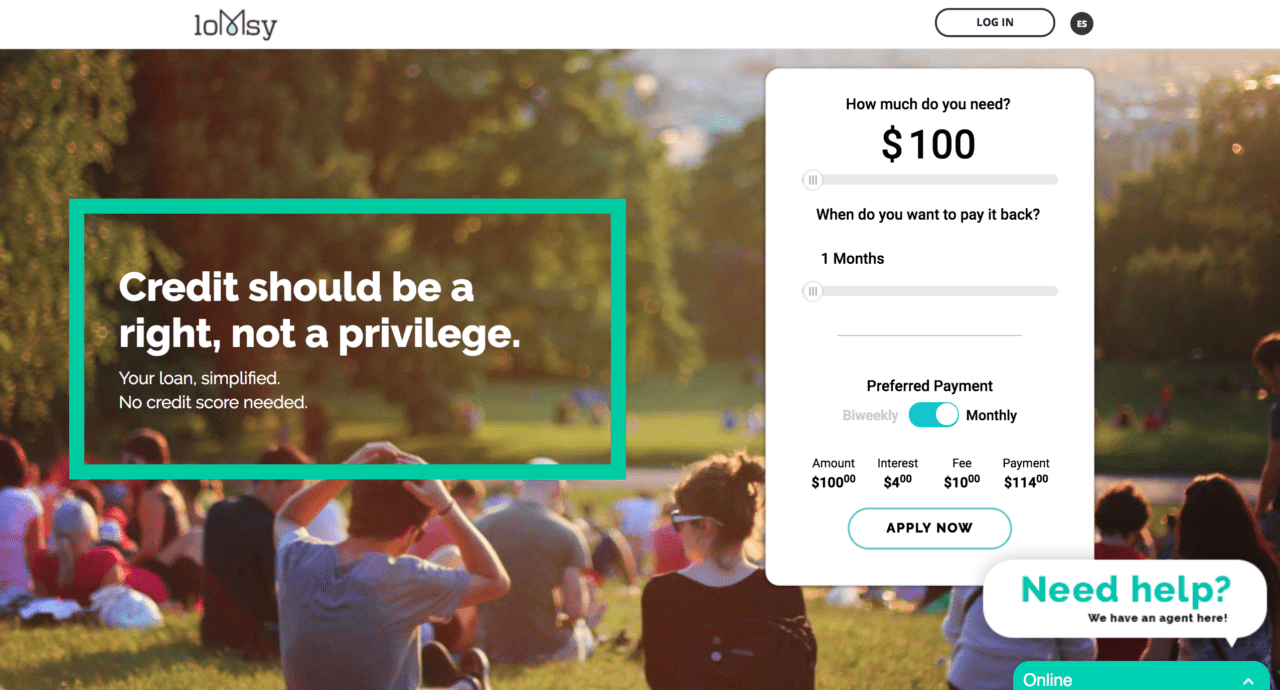

Lomsy brings credit closer to underbanked people with a low score, promoting their financial and social inclusion with personal loans and financial education.

Features

- Fair: assesses creditworthiness with a multi-dimensional methodology

- Easy: built by and for the Hispanic community

- Fast: offers a 5-minute application process

Why it’s great

Lomsy works by the motto you are not a score by leveraging technology to empower underbanked people with credit and financial education.

Presenters

Presenters

Enrique Huesca, CEO

Huesca is passionate about financial inclusion for Hispanics and holds more than 10 years of experience in high-level cabinet positions in the Mexican government.

LinkedIn

Jose Ramon Pardinas, CMO

Jose Ramon Pardinas, CMO

With more than 10 years of experience in marketing, Pardinas’ career has taken him to work in both the creative and executive areas with an international perspective.

LinkedIn

Enrique Castro, CFO

With more than five years of experience in economics and a background in applied math, Enrique enjoys working with data to understand the underbanked, develop underwriting strategies, and improve processes.

LinkedIn

Presenters

Presenters Billy Leung, Business Development Director

Billy Leung, Business Development Director

Presenters

Presenters Gaurav Anand, CFA, FRM, COO & Co-Founder

Gaurav Anand, CFA, FRM, COO & Co-Founder

Presenters

Presenters Maciej Bukowiec, Product Owner – Corporate Clients Business Line

Maciej Bukowiec, Product Owner – Corporate Clients Business Line

Presenter

Presenter

Presenters

Presenters Chad Steen, Chief Technical Architect

Chad Steen, Chief Technical Architect

Presenters

Presenters Jason Heil, Head of Credit Risk Solutions, ID Analytics

Jason Heil, Head of Credit Risk Solutions, ID Analytics

Presenter

Presenter

Presenters

Presenters Yoela Palkin, VP Engineering – Technical Team Lead

Yoela Palkin, VP Engineering – Technical Team Lead

Presenter

Presenter

Presenters

Presenters