This October, Finovate reunites with HK Invest to headline Hong Kong Fintech Week.

The celebration kicks off with the third annual FinovateAsia over the first two days, merging live product demos and insights on the latest regional trends and macro issues affecting financial technology. Fintech Week continues days three and four, hosting speakers to examine key themes in fintech, then crosses the border to Shenzhen, China’s Silicon Valley, for the first time, to continue its fintech exploration.

Each year, Hong Kong Fintech Week highlights the individuals and companies shaping the future of financial services. Trends and themes this year include AI, blockchain, payments, lending, open APIs, and open banking. All of these are areas in which Finovate’s presenters are innovating.

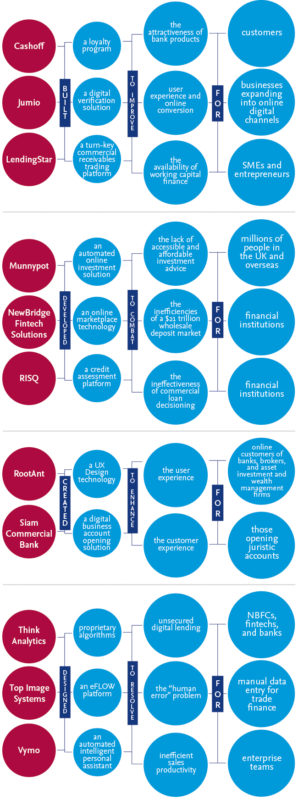

The first wave of demoing companies for FinovateAsia 2018 are problem solvers. Here are some of the issues they are tackling:

Remember, tickets to FinovateAsia are available online. Save $400 when you book before this Friday, August 3.

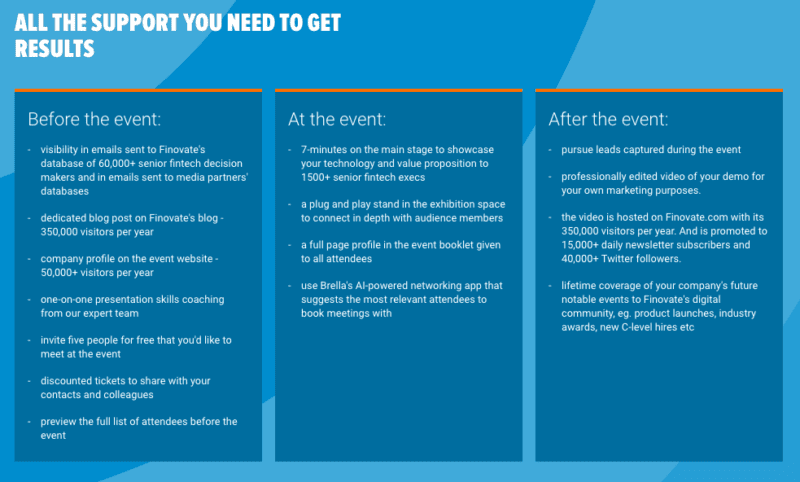

If you’re interested in demoing at the event, visit the demo page or email us at [email protected]. And if you’d like to get involved as a demoer, speaker, or sponsor with our launch event in Cape Town, South Africa this November, let us know at [email protected].